High-Leverage Crypto Trader Qwatio Faces Massive Liquidations Amid Market Upswing

The cryptocurrency market’s recent rally caught several leveraged traders off guard — most notably Qwatio, a high-profile trader on the decentralized exchange Hyperliquid. Over the span of five chaotic hours, Qwatio suffered eight consecutive liquidations after aggressively shorting the market, resulting in cumulative losses that exceeded $15 million.

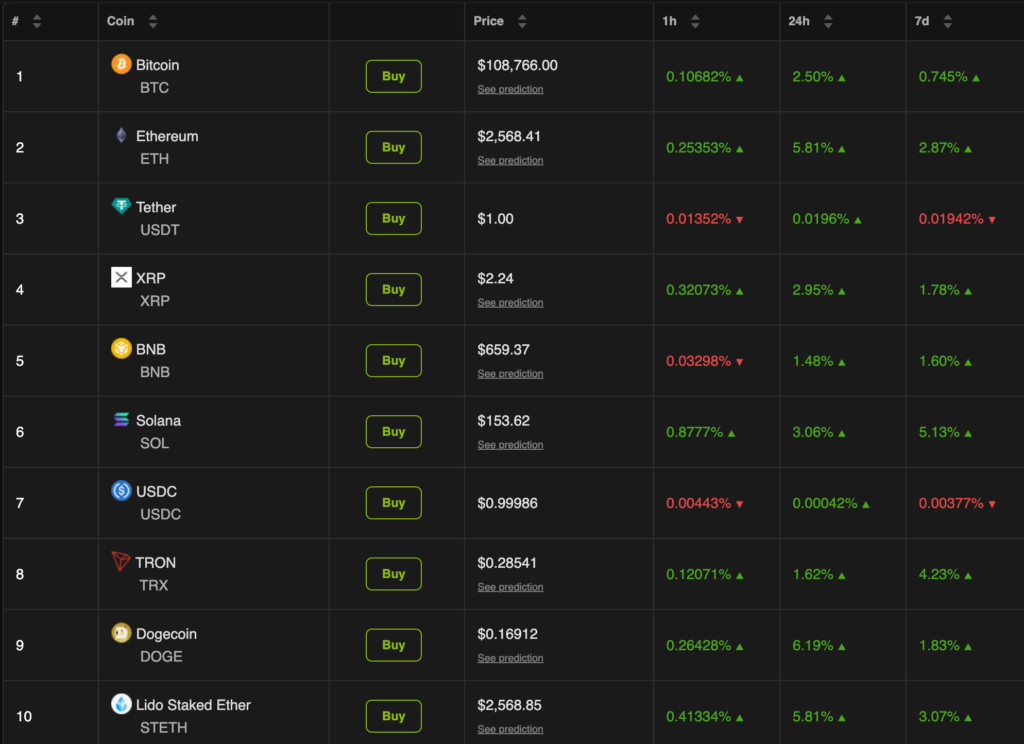

This comes as the broader crypto market surged 1.78% over the past 24 hours, buoyed by a landmark U.S.-Vietnam trade agreement that eased tariffs and boosted investor sentiment. Bitcoin (BTC) led the rally with a 2.5% gain, climbing to $108,766, while Ethereum (ETH) jumped 5.8% to hit $2,568, according to data from BeInCrypto.

Caught on the wrong side of the price action, Qwatio’s high-leverage strategy unraveled quickly. Data from Lookonchain revealed that a staggering 1,177 BTC (worth $128.3 million) and 34,466 ETH (valued at $86.82 million) were liquidated from Qwatio’s positions during the five-hour span.

The trader, known for his high-risk approach of shorting the market during price dips, failed to anticipate the swift rebound — a mistake that triggered cascading liquidations across his portfolio. This is not Qwatio’s first high-profile loss. BeInCrypto reports he has now faced a total of 23 liquidations: 15 on Bitcoin and 8 on Ethereum.

He wasn’t alone in facing the heat. Another trader, known as 0xFa5D, reportedly lost over $6.8 million after taking a long position on ETH that backfired. Following an initial $3.55 million loss, the trader returned just two hours later, this time shorting ETH with 10x leverage using 15.66 million USDC. That move proved equally disastrous, costing him an additional $3.28 million.

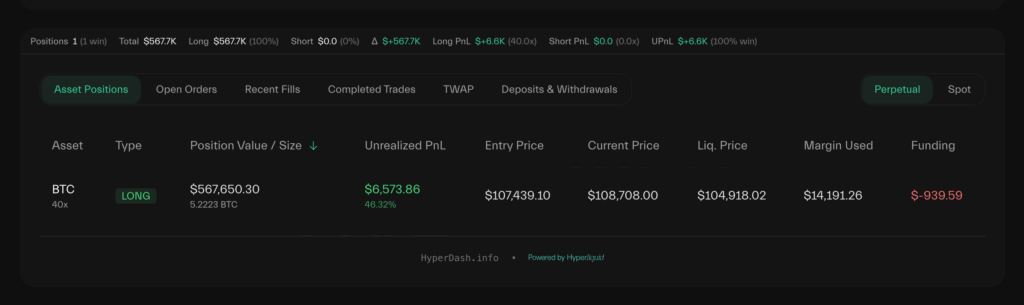

The volatile trading session also highlights the ongoing risk tolerance of large traders on Hyperliquid. James Wynn, another whale on the platform, has reportedly lost over $100 million. Yet according to Hyperdash, he remains active, recently opening a new long BTC position. At last check, it showed a modest unrealized gain of just $6,573.8 — a far cry from his previously realized $87 million profit.

Despite the carnage, not all traders were burned. BeInCrypto spotlighted one savvy participant who managed to turn a modest $6,800 into an impressive $1.5 million — all without taking a directional stance in the market.

These developments underscore both the opportunity and peril of high-leverage trading in today’s fast-moving crypto environment.

Comments are closed.