Featured News Headlines

GENIUS Act Fallout- The New Favorites in Yield-Bearing Stablecoins

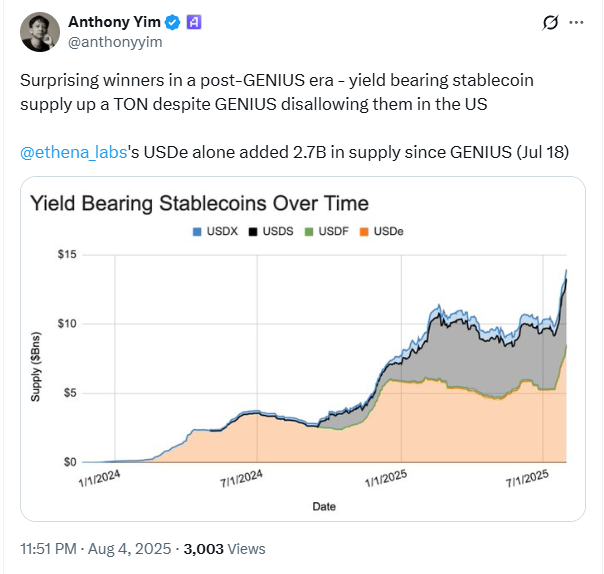

GENIUS Act Fallout– Since the US passed the GENIUS stablecoin bill in July—which bans issuers from offering direct yields on stablecoins—the market has witnessed a surprising surge in yield-bearing stablecoins. Investors are flocking to tokens like Ethena USDe and Sky’s USDS, which offer returns through staking within their own protocols.

USDe and USDS Lead the Charge

Data reveals a sharp rise in circulating supply: USDe jumped 70% to 9.49 billion tokens, making it the third-largest stablecoin by market cap. USDS grew 23% to nearly 4.81 billion, securing the fourth spot among stablecoins, per DefiLlama. This growth sparked a nearly 60% rally in Ethena’s governance token, ENA, now priced at $0.58.

Why Are Investors Choosing Yield-Bearing Stablecoins?

With the GENIUS Act blocking direct yield payments, holders are turning to staking models to earn passive income. CryptoQuant’s research head Julio Moreno explains: “Yield-bearing stablecoins pay returns natively by staking inside their protocols, providing an attractive alternative for investors seeking real yields.”

Stablecoin Market Growth Set to Continue

The stablecoin market expanded from $205 billion at the start of 2024 to $268 billion today—a 23.5% rise. Analysts predict the supply could near $300 billion by year-end if this momentum holds.

Real Yield Beats Inflation

Staked USDe (sUSDe) offers an annual percentage yield (APY) of 10.86%, while staked USDS (sUSDS) delivers 4.75%. Considering June’s US inflation rate of 2.7%, these yields represent real returns of 8.16% and 2.05%, respectively—making yield-bearing stablecoins a compelling choice amid rising inflation concerns.

Comments are closed.