Featured News Headlines

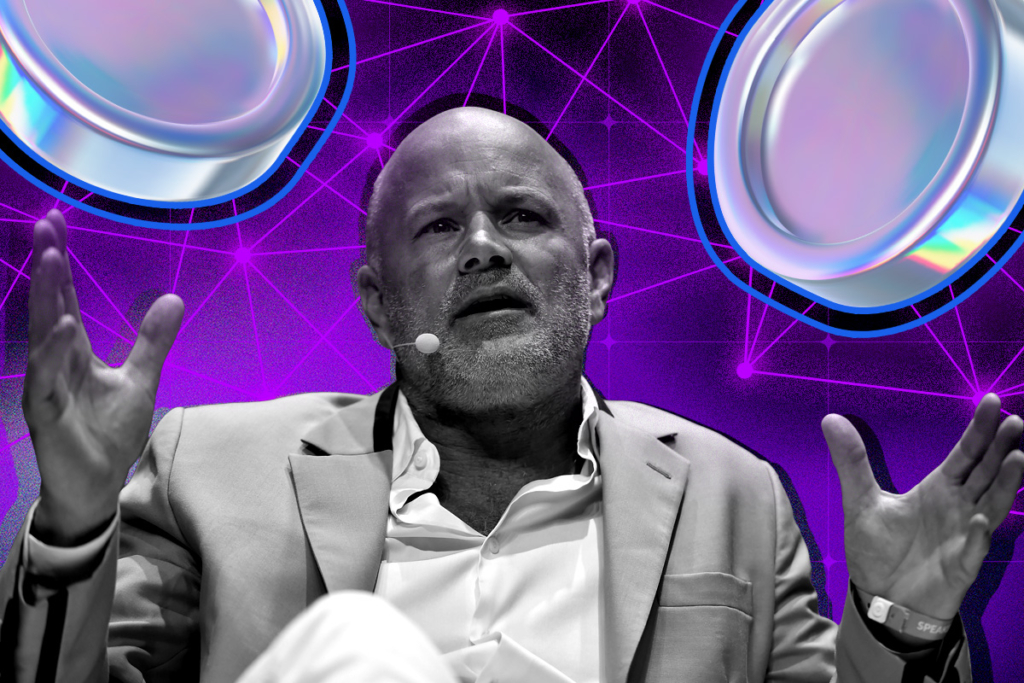

Galaxy Digital’s Novogratz Bullish on Crypto After Landmark U.S. Legislation

Galaxy Digital CEO Mike Novogratz believes the passage of two landmark crypto bills in the U.S. will transform digital asset markets and potentially disrupt the long-standing four-year Bitcoin cycle.

Speaking to Bloomberg on Tuesday, Novogratz pointed to the GENIUS Act, signed into law in July to regulate stablecoins, and the CLARITY Act, which establishes clear jurisdiction for regulatory agencies over crypto. Together, he said, these measures could trigger a “tremendous amount of new participation in crypto.”

Breaking the Bitcoin Cycle

Historically, crypto investors have linked market cycles to the Bitcoin halving, which occurs every four years. The latest halving took place in April 2024, leading many to anticipate a peak followed by a downturn later this year. But Novogratz argued this time could be different.

“People couldn’t previously use stablecoins on their iPhones or social media apps because they weren’t necessarily legal, but now they are,” he said. With this new accessibility, Novogratz suggested investors may not exit the market at peak levels as they did in 2017 and 2021.

Political Momentum Behind CLARITY Act

Novogratz’s optimism was echoed by Coinbase CEO Brian Armstrong, who described the CLARITY Act as a “freight train leaving the station.” Representative French Hill also noted that the House Financial Services Committee hopes to move on the bill by October or November.

Still, Novogratz acknowledged potential Democratic pushback, particularly over concerns about the Trump family’s ties to crypto. Even so, he said enough Democrats now support the industry to get the bill passed.

Market Volatility Amid Optimism

Despite legislative progress, Novogratz addressed recent turbulence that wiped out nearly $200 billion from crypto markets. He attributed the slump to heavy selling from Chinese miners and bearish commentary from Arthur Hayes, who recently sold his HYPE holdings.

Calling the drop “just a pullback,” Novogratz maintained his bullish stance: “With those two bookends of legislation, it’s going to unleash a tremendous amount of new participation in crypto.”

Comments are closed.