Controversial Wealth Tax Amendment: French Parliament Votes to Expand Tax

French lawmakers have decided to move forward with a tax law reform that targets unproductive wealth. Levies would be applied to specific kinds of property and cryptocurrency holdings under the idea. Jean-Paul Matteï, a centrist MP, submitted the amendment on October 22. It was approved late Friday by members of France’s lower chamber, the National Assembly, by a vote of 163-150, with the backing of both far-right and socialist MPs. In order to become law, the legislation must still make it through the Senate and the rest of the parliamentary process as MPs attempt to establish a budget for 2026.

Unproductive Wealth Exemptions in France May Soon End

According to Matteï’s explanation of the proposal, the existing real estate wealth tax law is illogical from an economic standpoint. Unproductive items like gold, coins, vintage cars, yachts, and artwork are exempt from taxes. According to him, the new tax will promote profitable investment. He maintained that assets that would have added to the French economy‘s vibrancy were not taken into consideration by the current structure.

Crypto and Luxury Assets Now in France’s Wealth Tax Crosshairs

Targeting unproductive wealth, France’s planned tax reform broadens its purview to encompass luxury real estate, high-value collectibles, and digital assets. As per the recently proposed amendment:

- Expanded Taxable Assets: This now includes digital assets like cryptocurrency, planes, valuable collectibles, and non-productive real estate. Many of these assets were exempt in the past.

- Higher Threshold: The tax will only apply to those whose unproductive wealth exceeds €2 million ($2.3 million), up from the present threshold of €1.3 million ($1.5 million).

- Flat Tax Rate: The progressive real estate wealth tax will be replaced with a flat 1% tax on assets over €2 million. The rate is 0% for assets under €800,000 ($922,660) and 1.5% for assets over €10 million ($11.5 million) under current law.

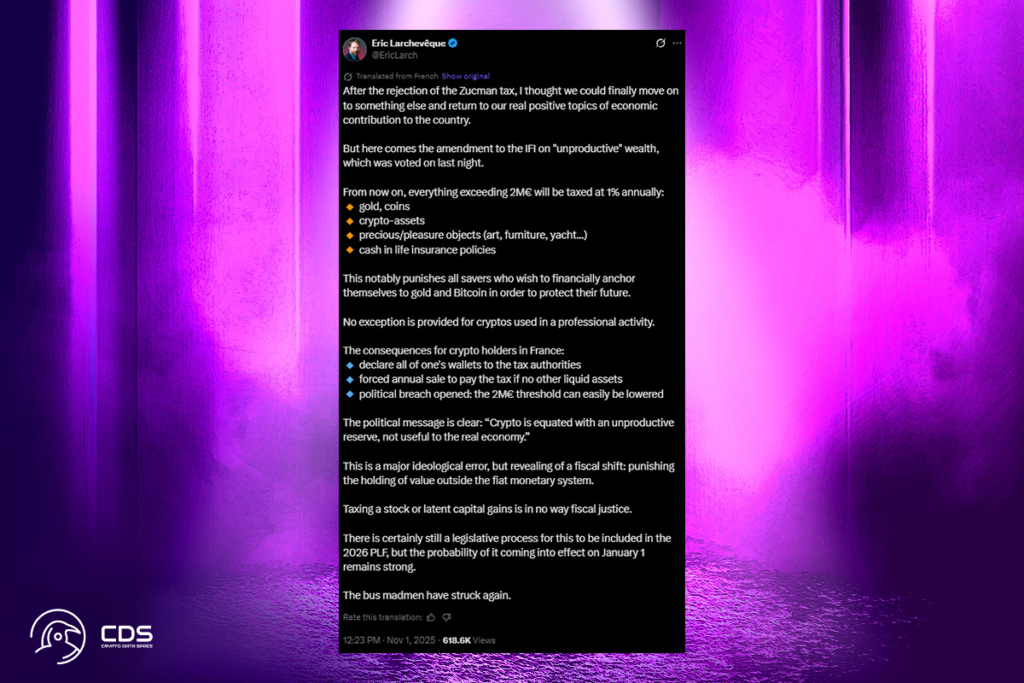

Some local cryptocurrency fans are disappointed by the conflicting responses to the inclusion of cryptocurrencies and digital assets.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.