Featured News Headlines

Yield Curve Control Talks: What the Fed’s Third Mandate Means for Crypto

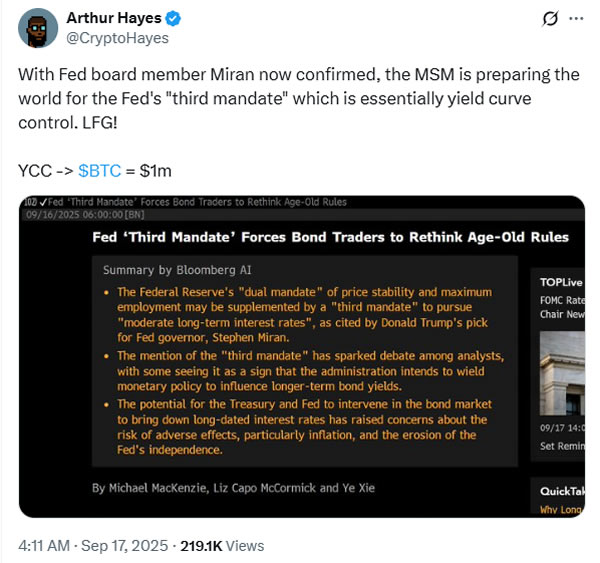

Fed’s “Third Mandate” Could Boost Bitcoin as Dollar Faces Pressure – The U.S. Federal Reserve may be on the brink of a historic policy shift after a long-forgotten clause in its founding documents resurfaced, raising the possibility of a so-called “third mandate.” While the move could spell trouble for the U.S. dollar, many analysts argue it may be a major tailwind for Bitcoin and crypto markets.

From Dual to Triple Mandate

Traditionally, the Fed has operated under two mandates: price stability and maximum employment. But earlier this month, Stephen Miran, President Donald Trump’s nominee for Fed governor, pointed to a statutory requirement that includes a third goal — maintaining moderate long-term interest rates.

This rarely discussed objective has been overlooked for decades, generally seen as a natural byproduct of achieving the first two. However, according to a report by Bloomberg, the Trump administration may now use it as legal cover to justify aggressive intervention in bond markets.

Yield Curve Control Back on the Table

By invoking the third mandate, the administration could push the Fed toward policies such as yield curve control, quantitative easing, bond buybacks, or increased Treasury issuance. The aim: suppressing long-term interest rates to ease borrowing costs as the U.S. national debt surges past $37.5 trillion.

Lowering rates could also stimulate the housing market by driving down mortgage rates, a long-standing goal of Trump, who has repeatedly criticized Fed Chair Jerome Powell for being “too slow” to cut rates.

Why Crypto Could Benefit

Critics call the strategy a form of financial repression. Christian Pusateri, founder of Mind Network, described it as “yield curve control by another name,” warning that the price of money is coming under tighter state control.

For crypto, however, the shift could be bullish. Arthur Hayes, outspoken co-founder of BitMEX, argued that such policies could send Bitcoin to $1 million, as investors seek alternatives to a manipulated bond market and weakening dollar.

Comments are closed.