Featured News Headlines

Federal Reserve- Why Powell’s Cautious Tone Could Slow Crypto’s Next Bull Run

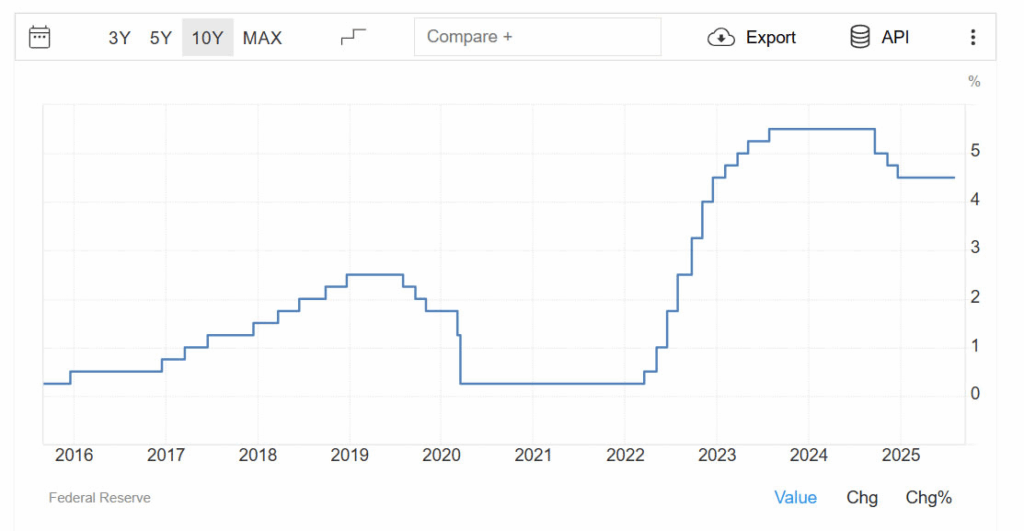

Federal Reserve– Investors lowered expectations for a September rate cut following Federal Reserve Chair Jerome Powell’s guarded remarks during Wednesday’s press conference. The Fed decided to hold interest rates steady at 4.25% to 4.5%, citing ongoing economic uncertainty that “remains elevated.”

No Clear Decision on September Rate Cut

Powell emphasized that the Fed has not made any decisions about rate changes in September, stating, “We don’t do that in advance.” He highlighted rising tariffs contributing to inflationary pressures and noted that the decision will depend heavily on economic data over the next two months. With U.S. inflation currently at 2.7% and rising for four consecutive months, a rate cut seems less likely soon.

Impact on Crypto Markets and Bull Run Outlook

The probability of a September rate cut fell sharply from 63% to 40% after Powell’s comments. Crypto analyst Nick Ruck of LVRG Research said this might slow the pace of the crypto bull run, but underlying liquidity could sustain support for a rebound. Apollo Capital’s CIO Henrik Andersson added that the market had already priced in no immediate cut, so the reaction was muted.

Crypto markets saw a slight dip after the announcement but bounced back in early Asian trading. The total market capitalization hovers around $3.94 trillion, maintaining a sideways range for the past two weeks.

What This Means for Crypto Investors

Typically, rate cuts boost crypto markets by making traditional savings less attractive and pushing investors toward higher-risk assets like cryptocurrencies. Although the Fed’s cautious stance delays the expected easing, markets still anticipate one or two rate cuts before year-end. Investors should watch upcoming economic data closely, as tariff-related inflation remains a key wildcard.

Comments are closed.