Featured News Headlines

ETH Price Stability Faces Pressure from Increasing Leverage

Ethereum [ETH] is attracting attention again, not only due to its price movements but also because of the growing activity among companies holding ETH treasuries. Despite the token stabilizing around $4,100, firms are accumulating Ethereum at record rates. However, rising market leverage casts uncertainty over what lies ahead for the leading altcoin.

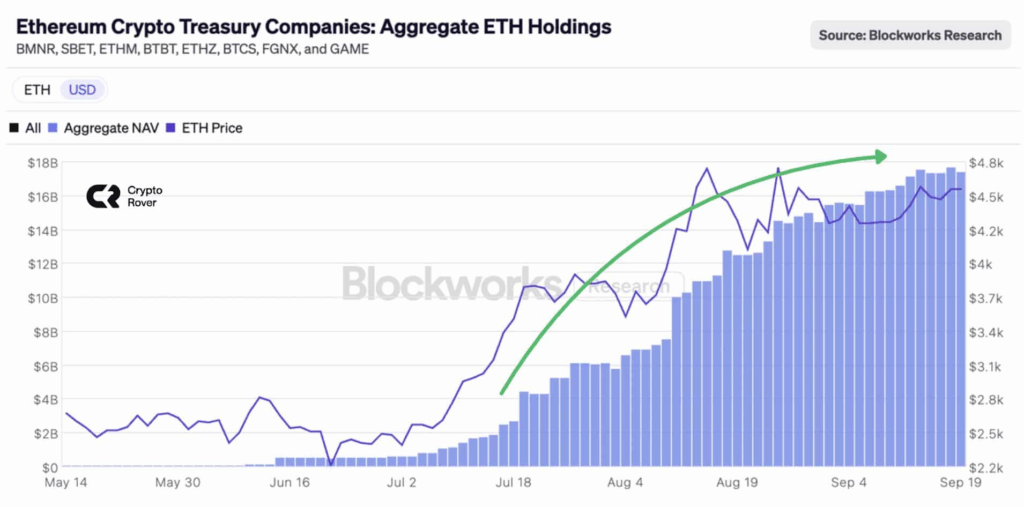

Corporate Treasuries Boost Ethereum Holdings

According to Blockworks Research, corporate Ethereum treasuries have been acquiring ETH aggressively. Aggregate holdings now approach $18 billion, showing a significant increase since mid-July. This rise has paralleled ETH’s rally toward $4,800 before settling near the current levels. Corporate confidence appears resilient even as broader market volatility persists.

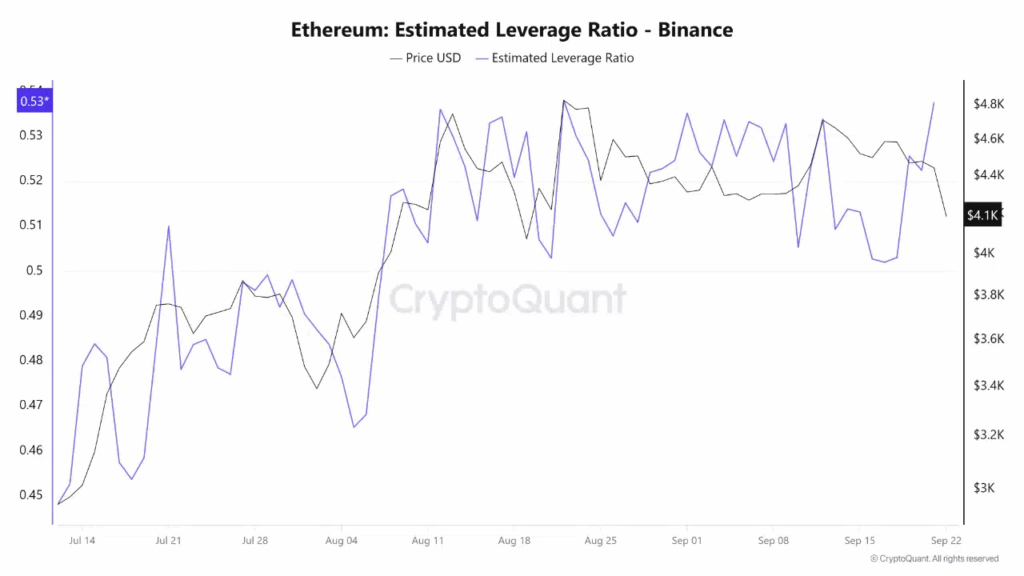

Leverage in the Market Surges

While treasuries build positions in Ethereum, derivatives data indicates growing fragility. The Estimated Leverage Ratio (ELR) has jumped from 0.50 to nearly 0.54 within three days—one of the highest marks this month.

Despite this, ETH’s price has remained relatively stable around $4,100, suggesting traders prefer leveraged bets over direct spot purchases. Historically, spikes in ELR near these levels have preceded periods of high volatility, either through a strong breakout or a rapid decline below key price points like $4,000.

Increased Risk of Market Shakeouts

The recent surge in leverage has already led to notable market corrections. Liquidations totaled nearly $3 billion recently, with ETH accounting for approximately $900 million in a single day—the largest since 2021.

Most forced sell-offs impacted smaller altcoins ranked between the top 10 and top 700 by market capitalization. This suggests that highly leveraged positions remain vulnerable as the market adjusts.

Comments are closed.