Featured News Headlines

ETH Rally Fueled by Institutional Buys and ETF Hype

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has recently broken above the $4,400 level, marking a notable milestone in its price journey. According to data from Brave New Coin (BNC), this puts Ethereum’s market value at approximately $520 billion, a figure that now surpasses Mastercard’s market capitalization. This surge reflects growing institutional interest, increasing on-chain activity, and positive developments in the Ethereum ETF space, all contributing to a shift in market sentiment around the globe.

Technical Strength and Price Stability

After a consolidation phase lasting 18 days just above the critical $4,080 support level, Ethereum has demonstrated impressive technical resilience. Analyst CryptoKoon pointed out that Ethereum’s charts reveal a “steady defense of key levels,” suggesting that if this trend continues, it could pave the way for a “renewed bullish leg.” Supporting this outlook, a recent study published in the Journal of Risk and Financial Management found that approximately 65% of price consolidations lasting over two weeks lead to bullish breakouts when accompanied by sufficient trading volume—a condition Ethereum has met with a 1.45% daily gain recently.

Additionally, Ethereum’s hourly chart shows a rounded channel formation, a pattern historically linked with upward momentum and boasting a 70% success rate, according to Strike.money research. These technical signals highlight Ethereum’s potential to sustain upward movement in the near term.

Institutional Demand and Large-Scale Purchases

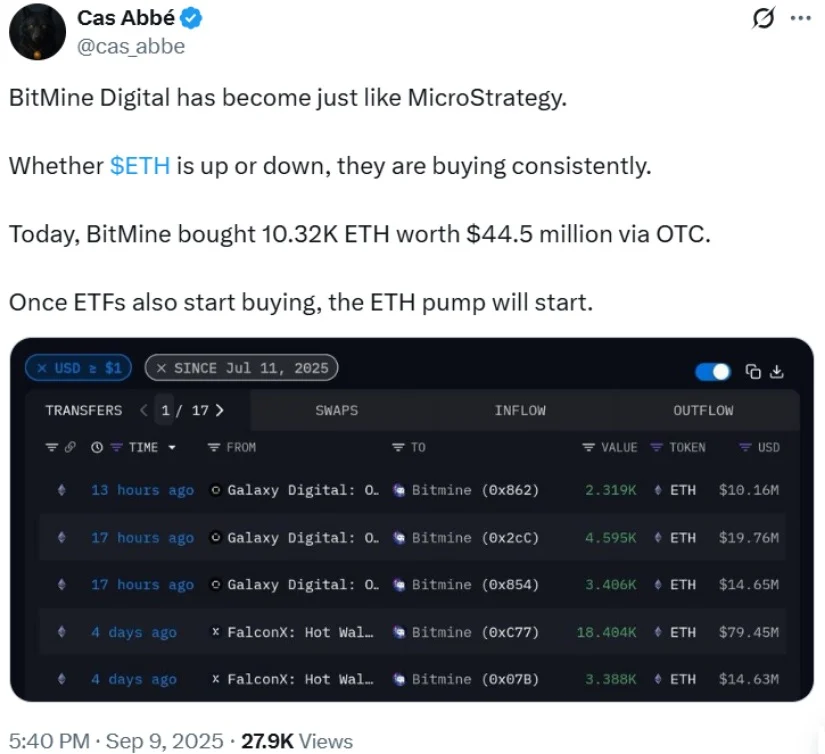

Institutional adoption continues to play a significant role in driving Ethereum’s demand. BitMine Digital, often referred to as the “MicroStrategy of Ethereum,” recently executed a sizable $44.5 million over-the-counter purchase of 10,320 ETH. This acquisition increased BitMine’s holdings to over 2 million ETH, valued at nearly $8.9 billion. Market observers compare this consistent treasury accumulation to Michael Saylor’s approach with Bitcoin, lending further credibility and confidence to Ethereum’s long-term prospects.

Adding to this sentiment, Ethereum co-founder Vitalik Buterin made headlines with a $1.01 billion on-chain investment in August 2025—one of the largest insider moves of the year. This strategic allocation hints at strong internal confidence in Ethereum’s future and potential upcoming network enhancements.

Expert Price Targets and Market Outlook

Market analysts are increasingly optimistic about Ethereum’s price trajectory. Donald Dean identified three key price targets—$5,766, $6,658, and $9,547—based on Fibonacci retracement levels and a bullish pennant formation. He emphasized the presence of a “volume shelf,” a strong accumulation zone that could support the next upward move.

Similarly, CryptoElites described Ethereum’s recent breakout above long-term resistance as a “classic breakout and retest scenario,” which could facilitate price discovery beyond $5,000 and possibly toward $9,000 by 2025.

Other analysts, including @AltcoinGordon and @Karman_1s, have highlighted $6,000 and $8,000 as significant interim milestones, referencing the historical strength of the $4,000 support zone.

Wider Implications for the Cryptocurrency Market

Should Ethereum reach the $9,000 mark, its market capitalization would expand by roughly $500 billion. This would not only solidify Ethereum’s leadership within the altcoin sector but also potentially increase investor confidence in smaller projects that stand to benefit from a broader market uplift.

Stablecoin inflows, which recently hit a record $9 billion in a single day, further suggest sustained capital rotation into Ethereum and other major crypto assets, reinforcing the bullish market dynamics.

Risks and Market Challenges

Despite the optimistic outlook, certain risks and uncertainties persist. A 2024 report from the Crypto Research Institute revealed that 40% of traders remain cautious about sustained Ethereum breakouts, citing historical volatility and ongoing concerns about gas fees. Although Layer 2 solutions have successfully reduced transaction costs by up to 90%, regulatory uncertainties and broader market fluctuations continue to pose potential challenges.

Comments are closed.