Featured News Headlines

Ethereum Whales Trigger Accumulation Phase

Ethereum [ETH] may be gearing up for its next major move as on-chain and market data point to tightening supply and renewed demand from large holders.

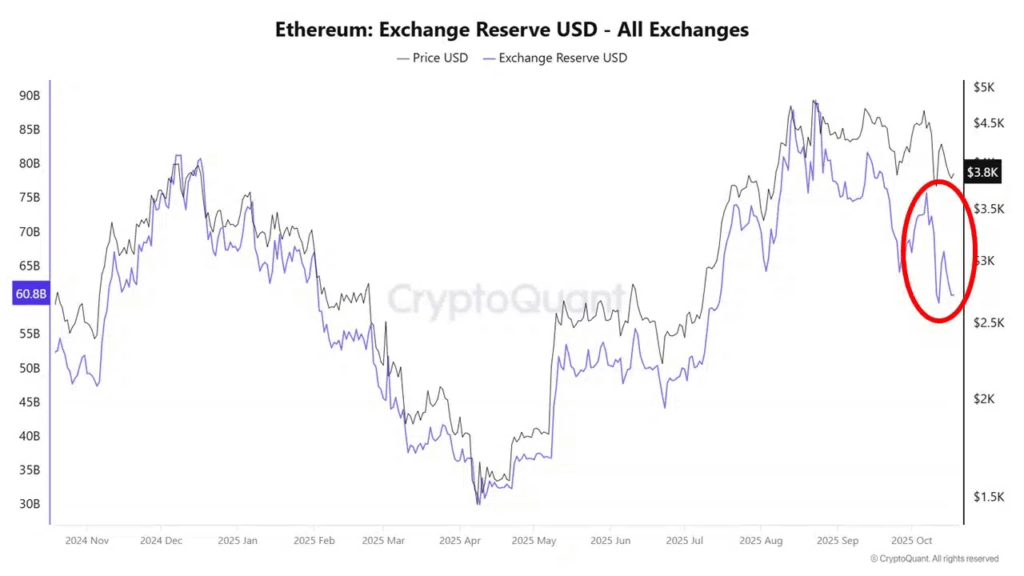

Shrinking Exchange Reserves Signal Supply Squeeze

Ethereum’s exchange reserves have dropped to new yearly lows, reducing the amount of ETH readily available for sale. This suggests that holders are increasingly moving coins off exchanges, potentially into cold storage — a pattern often associated with long-term accumulation.

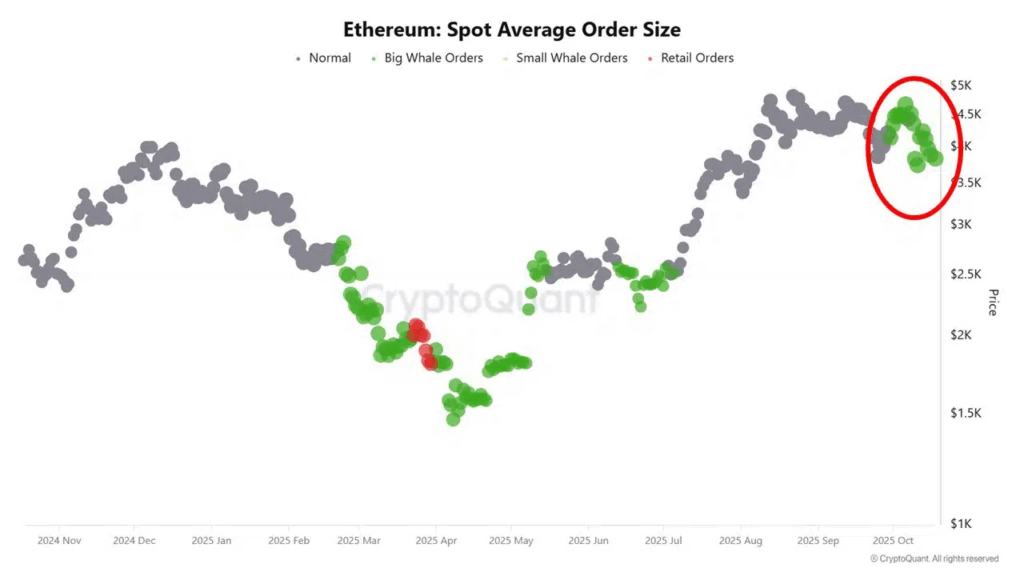

At the same time, spot markets are seeing a rise in large buy orders from whales. This is especially notable in a low-liquidity environment, where even moderate buying pressure can lead to outsized price moves.

As one analyst noted, “This setup resembles the early accumulation stages of Ethereum’s 2020 rally.” While history doesn’t repeat exactly, similar supply-demand dynamics could be forming again.

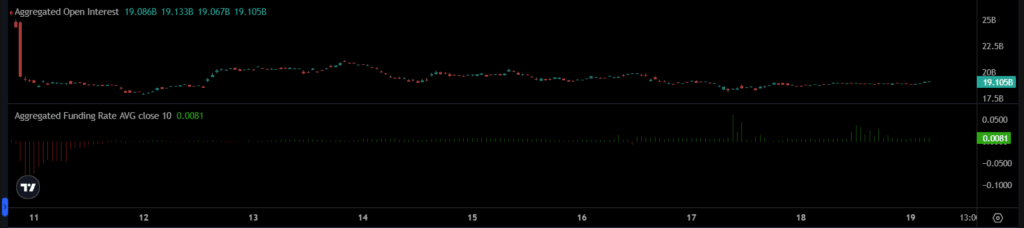

Open Interest Stabilizes, Funding Rate Turns Positive

After a sharp decline earlier in the week, Ethereum’s aggregated open interest has found footing around $19.1 billion. This indicates that traders are cautiously returning to the derivatives market following recent liquidations.

In parallel, the aggregated funding rate turned slightly positive at 0.008%. Though marginal, this shift suggests improving sentiment among leveraged traders.

Together, these metrics highlight a potential recovery in speculative interest, complementing the ongoing spot accumulation.

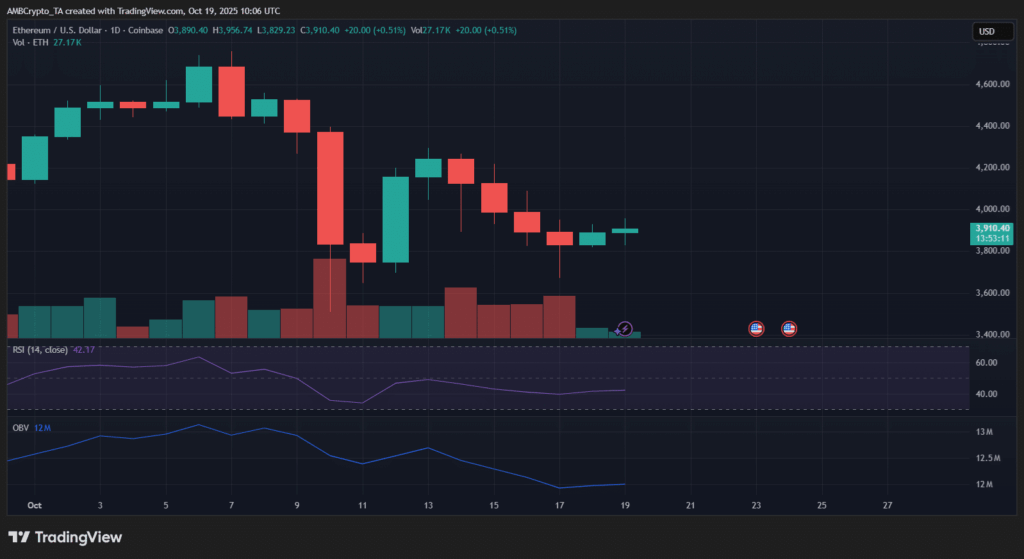

Consolidation Continues as ETH Holds Key Support

At press time, ETH was trading just above $3,900, with mild gains following last week’s sell-off. The Relative Strength Index (RSI) hovered around 42, reflecting neutral-to-weak momentum, while the On-Balance Volume (OBV) remains subdued — indicating that current accumulation is steady but not aggressive.

Ethereum appears to be consolidating between $3,800 and $4,000. This range could prove pivotal in determining whether the next move is a breakout toward $4,200 or a further test of lower support.

Comments are closed.