Ethereum Whale Holdings Reach Highest Since 2020

Ethereum Whale – Ethereum (ETH) mega whales have significantly increased their holdings, with a 9.31% jump—nearly double the accumulation pace seen before the massive 2022 rally, data from Glassnode reveals. This surge in whale activity points to a possible strong price move ahead, as Ethereum continues to consolidate inside a classic bull pennant pattern.

Mega Whales Rebuild Holdings to Highest Level Since 2020

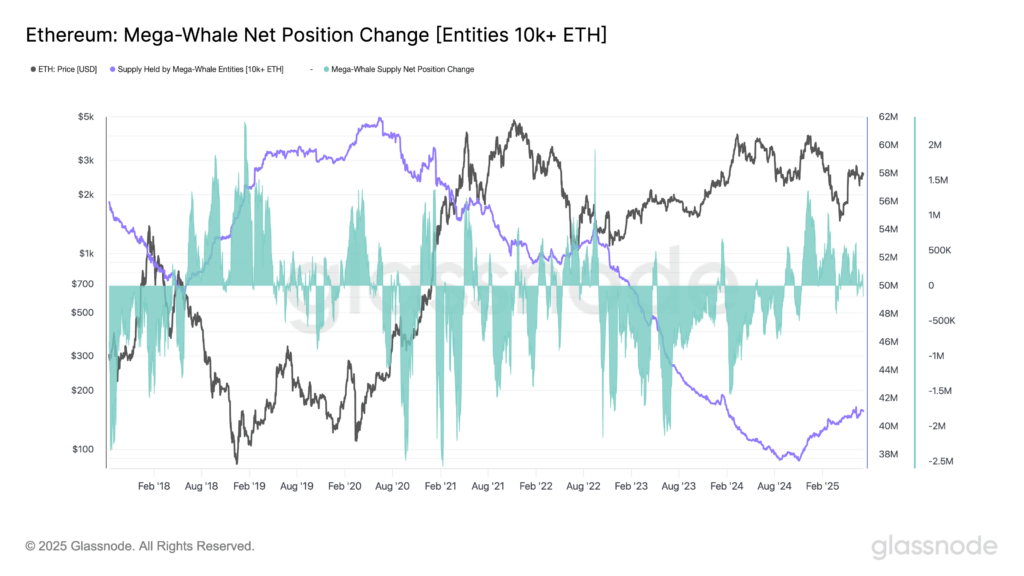

Ethereum wallets holding 10,000 ETH or more have boosted their stash from a record low of 37.56 million ETH in October 2024 to over 41.06 million ETH as of Monday. This 9.31% increase is a clear sign that large holders are quietly accumulating, a trend similar to past periods before major price surges, such as the 95% rally from ~$1,000 to nearly $1,950 in 2022.

Historically, such whale accumulation has preceded significant price jumps. Between November 2020 and January 2021, whale holdings increased 4%, followed by Ethereum’s price rising from $460 to $1,220. The current quiet build-up suggests investors are preparing for another potential bullish phase, although the broader market has yet to fully respond.

Bull Pennant Pattern Points to $3,400 Target by August

On Ethereum’s daily chart, a textbook bull pennant pattern is taking shape, signaling a likely continuation of the upward trend. Despite some consolidation and minor false breakouts, a decisive move above the pennant’s resistance could drive ETH towards $3,400 by August. Some analysts even speculate about a surge to $5,000 by year-end.

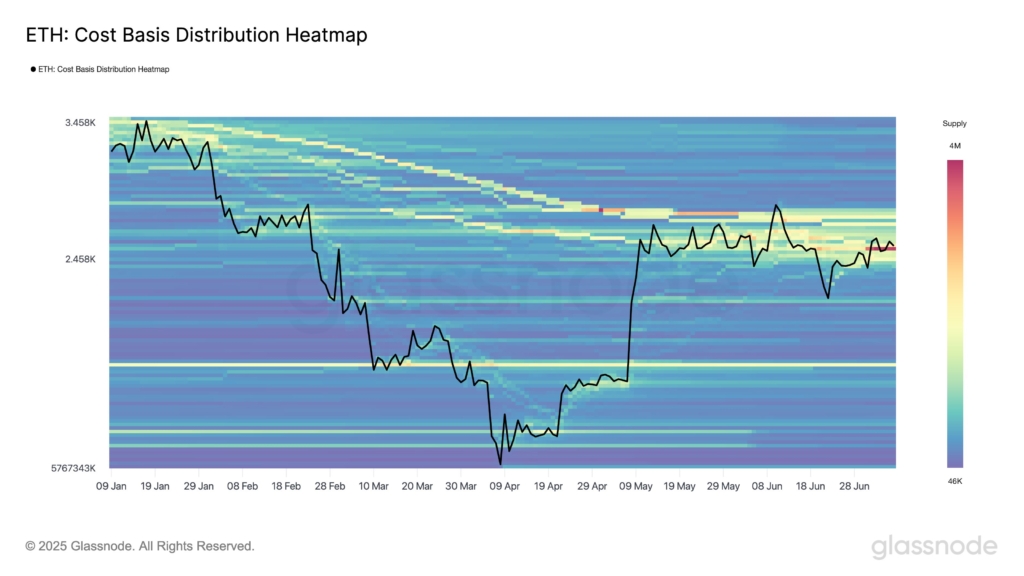

Glassnode’s cost basis heatmap highlights the $2,500–$2,536 range as a critical accumulation zone, with over 3.45 million ETH held at this price level. This heavy concentration of long-term holders provides a solid support foundation, suggesting that Ethereum’s ongoing consolidation phase may set the stage for the next major price advance.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.