Featured News Headlines

Ethereum Rally Explained- Ethereum’s Quiet Comeback

Ethereum Rally Explained– Ethereum is back in the spotlight. After weeks of sluggish movement, ETH has reclaimed the critical $3,000 level — and flipped it into solid support. As of this writing, it’s trading just above $3,500, marking a 16% rally since July 14.

Spot ETF Inflows and On-Chain Accumulation Drive the Rally

So, what’s behind the sudden momentum?

A mix of spot ETF inflows, strong on-chain activity, and falling exchange reserves. When investors pull ETH off centralized exchanges, it’s usually a signal of long-term accumulation. This move often precedes price strength — and that’s exactly what’s happening now.

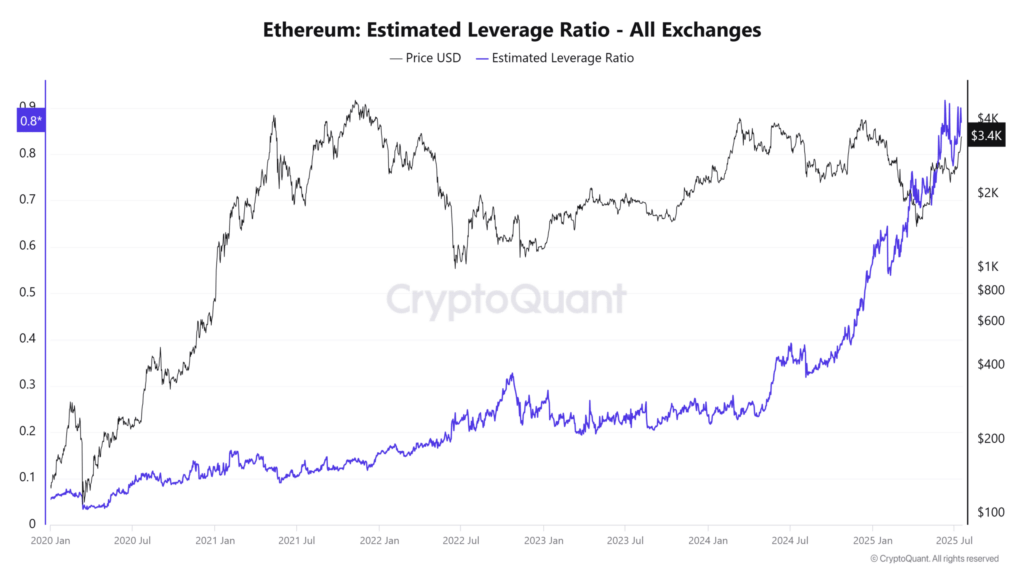

Pair that with rising Open Interest and you get a surge in the Estimated Leverage Ratio, now at cycle highs. While that might sound like a red flag, strong spot demand is keeping the rally grounded.

Short Liquidations Are Fueling the Uptrend

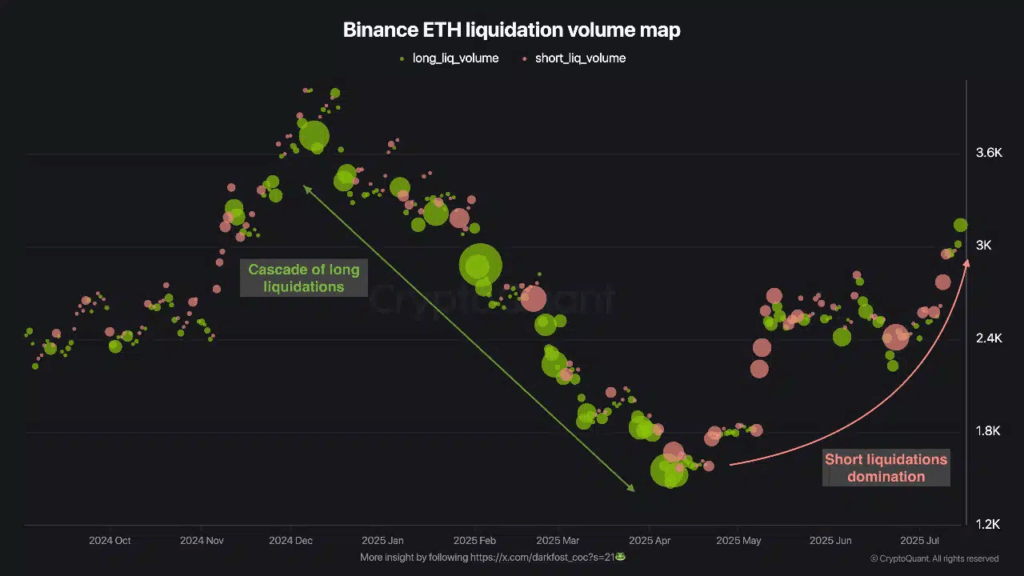

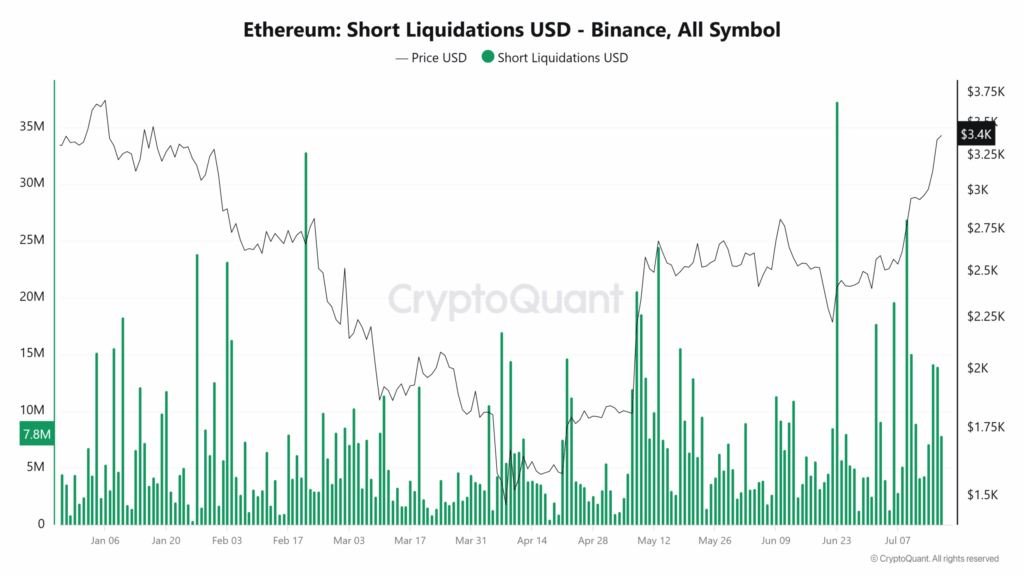

According to CryptoQuant analyst Darkfost, a wave of short liquidations — particularly on Binance — has added fuel to ETH’s rally. Traders betting against Ethereum are getting squeezed, triggering rapid price climbs.

Since May, ETH has seen multiple short squeezes, with over $20 million in short positions wiped out in a single day. And there’s more behind the scenes.

Institutional ETH Holdings Hit $5 Billion

The belief in Ethereum as a store of value is spreading fast. The top 10 companies now hold over 1.6 million ETH, worth roughly $5 billion. Leading the charge is SharpLink (SBET) with 280,600 ETH in reserves.

With more institutional ETH adoption expected, the next leg up may just be getting started.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.