Ethereum Price Struggles to Sustain Reversal as Mega-Whales Remain Inactive

Ethereum price has experienced a turbulent 24 hours, falling nearly 11.5% before bouncing back approximately 2.5%, now trading above $3,230. Despite the minor recovery, the 24-hour ticker still reflects a dip of around 6%, leaving investors and traders closely watching the next moves.

Bullish Harami Forms, but Whales Stay Quiet

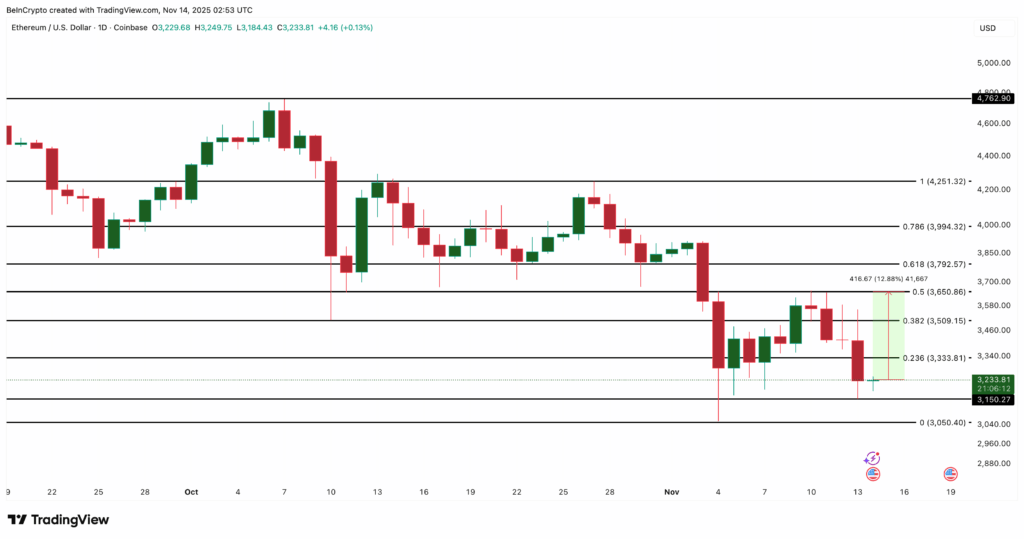

On the daily chart, Ethereum has printed a bullish harami, a reversal pattern where a small green candle sits within the body of a larger red candle from the previous day. This pattern typically signals slowing selling pressure and hints at buyers attempting to regain control. A similar setup appeared on November 5, but the rebound failed as buying strength quickly dissipated. This historical context adds weight to the current formation, raising questions about whether the bullish momentum can be sustained this time.

Complicating matters, whale activity remains subdued. The mega-whale address count—which tracks wallets holding over 10,000 ETH—has fallen again, returning to negative levels last seen on November 8. Overall, the number of large holders has been declining since November 2, with only a brief uptick during a short-lived rebound from November 6 to 11. The lack of support from whales keeps Ethereum’s potential reversal weaker than it appears on the chart.

Key Levels Determine the Strength of Recovery

If the bullish harami holds, Ethereum could test $3,333, a short-term resistance level that has limited rebounds this week. Beyond that, a stronger hurdle lies at $3,650, requiring a 12% move from recent lows. The cost-basis distribution heatmap shows that $3,638–$3,667 contains over 1.5 million ETH, representing a critical supply zone. Clearing this range would indicate stronger buyer commitment and validate the harami.

Conversely, a loss of support near $3,150 could weaken the pattern, while a sharp drop below $3,050 would invalidate it entirely, echoing the failure seen after the previous harami earlier this month.

As Ethereum navigates these levels, traders are keeping a close eye on whether bullish momentum can finally overcome whale inactivity, making the coming days crucial for the cryptocurrency’s short-term trajectory.

Comments are closed.