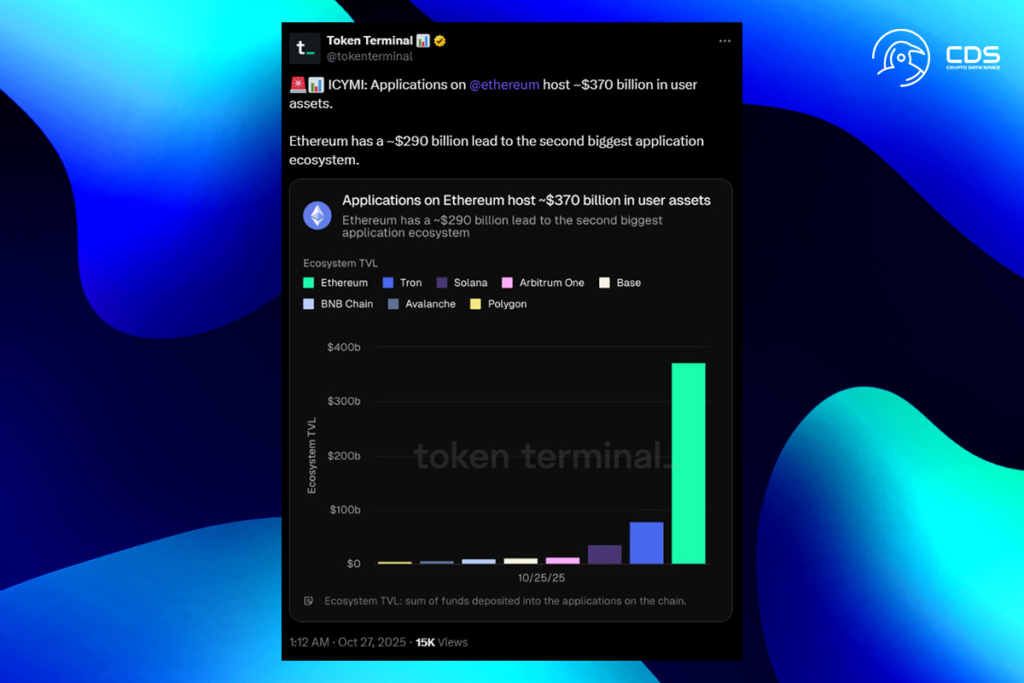

Ethereum Powers DeFi Growth: $370B in Locked Assets

Ethereum continues to dominate the DeFi market. More than $370 billion in user assets are currently secured by apps developed on its network, which is almost $290 billion more than any other blockchain. Ethereum continues to be essential to the expansion of the stablecoin and tokenized asset markets.

Ethereum Outpaces Competitors as Tokenized Assets Flourish

Ethereum’s total value locked (TVL) has increased in tandem with the expansion of stablecoins, lending protocols, and tokenized RWAs, according to data from Token Terminal. The network’s worth was 1.27 times that of its ecosystem, even though Solana, TRON, and Arbitrum were becoming more and more competitive.

According to data, the market capitalization of Ethereum’s tokenized assets, including stablecoins, frequently establishes a floor for the value of ETH as a whole. Ethereum’s market capitalization typically increases in tandem with the issuance and trading of additional assets on the blockchain. The graph also demonstrated that recoveries in ETH’s completely diluted market capitalization have closely corresponded with increases in the value of tokenized assets, which were observed in early 2022 and mid-2025.

ETH Struggles to Break Short-Term Resistance at $4,200

After momentarily reaching resistance around $4,200, ETH was trading around $4,096 at the time of writing. 52.8 was the RSI. After cooling from overbought levels earlier in the week, the momentum is neutral. The MACD, meanwhile, displayed a slight bullish crossover. But the green bars on the histogram were diminishing, which indicated that buying power was waning. Volume support for any gains may have been limited because OBV remained stable at 11.9 million. ETH is finding it difficult to sustain upward pressure close to short-term resistance, as figures suggest consolidation.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.