Featured News Headlines

Ethereum ETF Inflows Hit $287.6M Thursday, Ending Four-Day $924M Outflow Streak

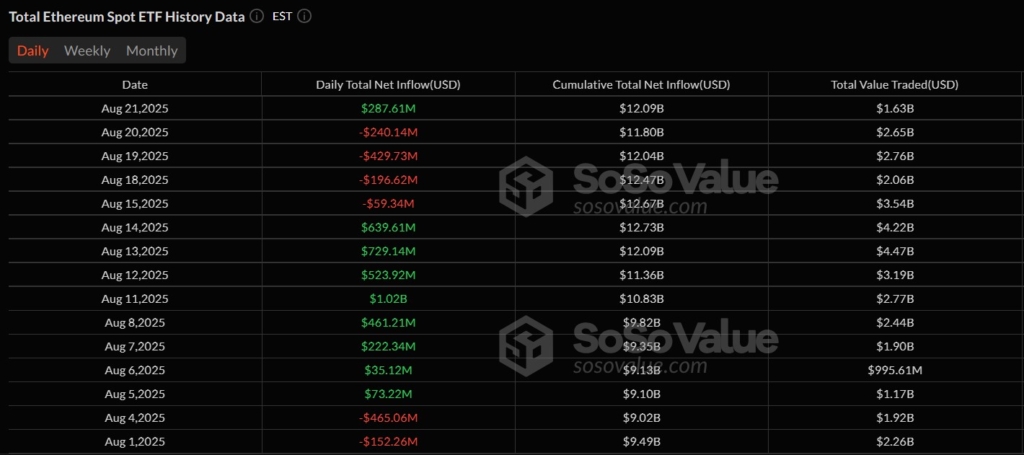

Ethereum ETFs Surge – US spot Ethereum exchange-traded funds (ETFs) bounced back dramatically on Thursday, attracting $287.6 million in net inflows and ending a concerning four-day outflow period that had investors worried about institutional demand.

BlackRock Leads Recovery After $924M Exodus

The Thursday recovery marks a significant turnaround following a brutal stretch where Ethereum ETFs shed over $924 million between August 15 and Wednesday. According to SoSoValue data, the worst single day occurred on Tuesday when spot Ether ETFs experienced $429 million in outflows, representing the second-largest daily exodus this month after the massive $465 million withdrawal recorded on August 4.

BlackRock’s iShares Ethereum Trust (ETHA) spearheaded Thursday’s recovery with an impressive $233.5 million in inflows, while Fidelity Ethereum Fund (FETH) contributed $28.5 million. Other ETF products averaged approximately $6 million in net inflows throughout the trading session.

ETF Holdings Reach Record Territory

The fresh capital injection pushed cumulative net inflows above $12 billion, signaling renewed institutional confidence after a week of sustained withdrawals. Total ETF reserves now stand at $27.66 billion, representing substantial institutional commitment to Ethereum exposure.

According to the Strategic ETH Reserve (SER) tracker, spot Ethereum ETFs collectively hold 6.42 million ETH valued at the current $27.66 billion. The investment vehicles recorded a daily net inflow of 66,350 ETH, bringing their combined holdings to 5.31% of Ether’s circulating supply.

Corporate Treasury Holdings Spark Debate

Beyond ETF activity, corporate treasury reserves and institutional long-term holdings have accumulated 4.10 million ETH worth $17.66 billion, representing 3.39% of Ether’s total supply. SharpLink Gaming maintained its aggressive accumulation strategy with a $667 million Ether purchase at near-record prices, lifting its holdings to over 740,000 ETH valued at $3.2 billion.

SharpLink currently ranks as the second-largest ETH treasury holder behind Bitmine Immersion Tech, which maintains 1.5 million ETH in reserves.

Community Questions Institutional Impact

The concentration of ETH among major institutions has sparked heated Reddit discussions about whether corporate “hoarding” genuinely benefits the decentralized finance (DeFi) ecosystem. Community members remain divided on whether institutional accumulation strengthens or undermines Ethereum’s decentralized principles.

Some argue that institutional staking reduces circulating supply and supports network security, while others contend that excessive centralization contradicts Ethereum’s core values.

Comments are closed.