Featured News Headlines

Ethereum ETF Inflows Hit $2.4 Billion, Surpassing Bitcoin ETFs

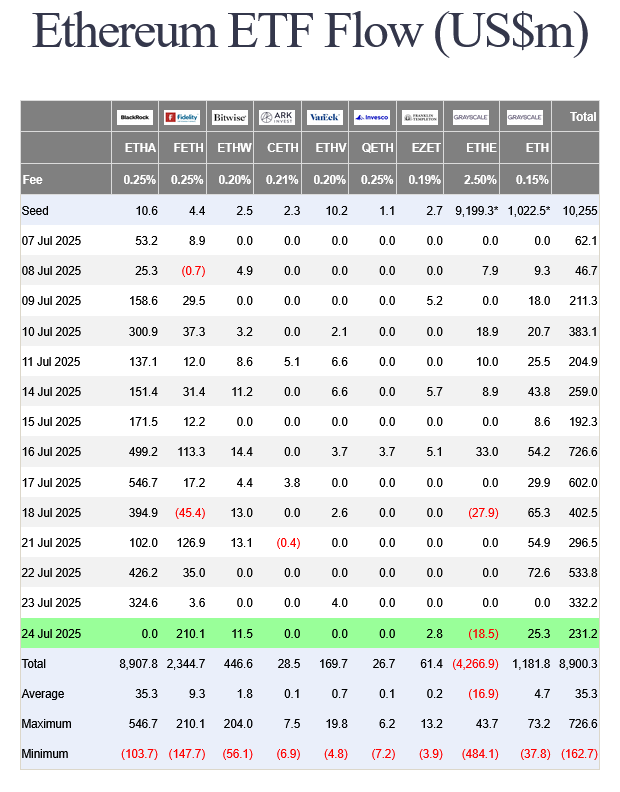

Ethereum ETF – US investors have recently shown strong preference for spot Ether (ETH) exchange-traded funds (ETFs) over Bitcoin ETFs, signaling a notable shift in institutional interest towards Ethereum. Over the past six trading days, spot Ether ETFs recorded net inflows nearing $2.4 billion, significantly surpassing the $827 million inflows seen in spot Bitcoin ETFs, according to Farside Investors.

The biggest beneficiary of this surge was BlackRock’s iShares Ethereum ETF (ETHA), which attracted a net inflow of $1.79 billion — nearly 75% of the total inflows during this period. Impressively, ETHA recently became the third-fastest ETF to reach $10 billion in assets under management, achieving this milestone in just 251 trading days.

Meanwhile, Fidelity’s Ethereum Fund (FETH) also made headlines, posting its best day ever on Thursday with a $210 million net inflow, surpassing its previous record from December 2024.

Corporate Ethereum Holdings Reach New Heights

Institutional demand is also reflected in corporate treasury activity. BitMine Immersion Technologies purchased approximately $2 billion worth of ETH in the last 16 days, becoming the largest corporate holder of Ethereum. Currently, companies collectively hold 2.31 million ETH, representing 1.91% of Ethereum’s circulating supply, according to Strategic Ether Reserves data.

Industry Experts Predict ETH Price Surge

Galaxy Digital CEO Michael Novogratz forecasts that ETH will hit $4,000 and even outperform Bitcoin (BTC) in the next six months. He noted that major purchases by companies like BitMine Immersion and SharpLink Gaming could trigger a supply shock for Ethereum, potentially driving prices higher.

Bitcoin ETF Inflows Slow Down

In contrast, spot Bitcoin ETFs experienced a net outflow of $131 million on Monday, breaking a 12-day streak of inflows totaling $6.6 billion. According to Swissblock research, this may signal a rotation in market leadership, with ETH poised to take the next leg up in the crypto cycle.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.