Featured News Headlines

Ethereum Price Cools Despite Surge in Accumulation

Ethereum’s on-chain dynamics are shifting dramatically as accumulation among large addresses doubles within four months — a trend that could have long-term implications for price and supply.

Long-Term Investors Accelerate ETH Accumulation

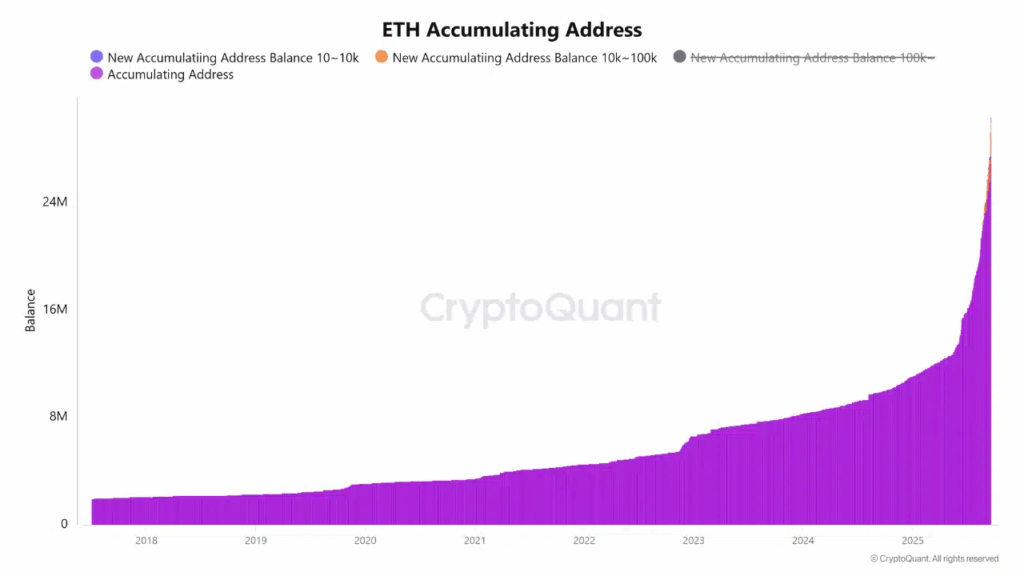

According to recent on-chain data, addresses categorized as “accumulating” have increased their ETH holdings from approximately 13 million to nearly 28 million ETH since June 2025. This sharp rise marks an aggressive shift in investor behavior, suggesting confidence in Ethereum’s long-term fundamentals.

The rapid accumulation reduces the amount of ETH available on the open market, creating potential conditions for a supply squeeze. Historically, reduced circulating supply has been a contributing factor in sustained price appreciation — particularly if demand remains steady.

Grayscale May Begin Staking Its ETH Holdings

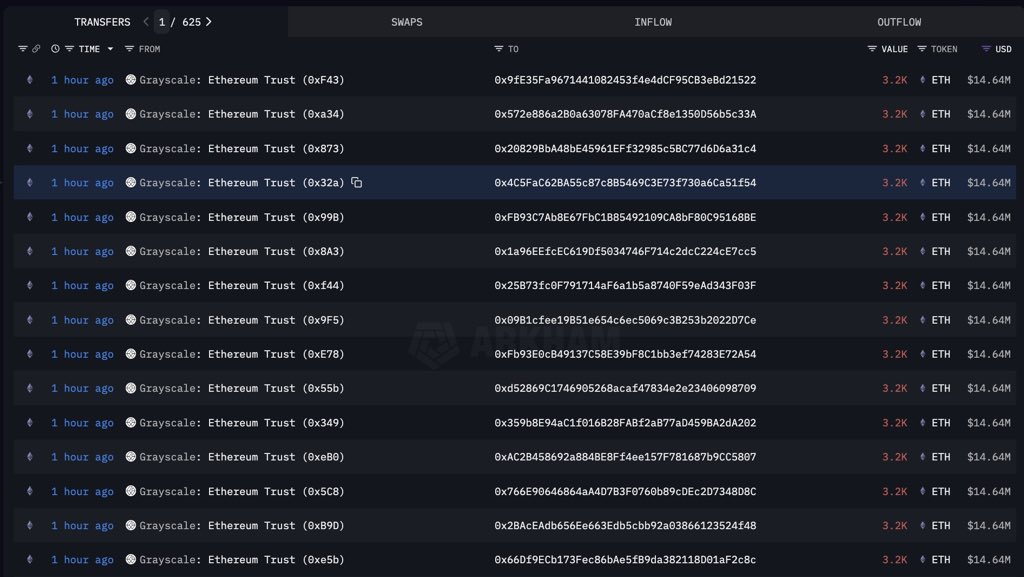

Grayscale, one of the largest institutional holders of Ethereum, has reportedly moved over 40,000 ETH in recent days. According to industry speculation, the firm is preparing to stake a portion of its 1.5 million ETH reserves.

If confirmed, this would mark the first time a U.S.-listed Ethereum ETF engages in on-chain staking, representing a significant milestone in institutional participation. Staked ETH is locked out of circulation, which could further tighten supply and reinforce the deflationary dynamics introduced by EIP-1559.

“This level of institutional engagement could change how ETFs interact with proof-of-stake assets,” analysts note.

ETH Price Momentum Stalls After Rally

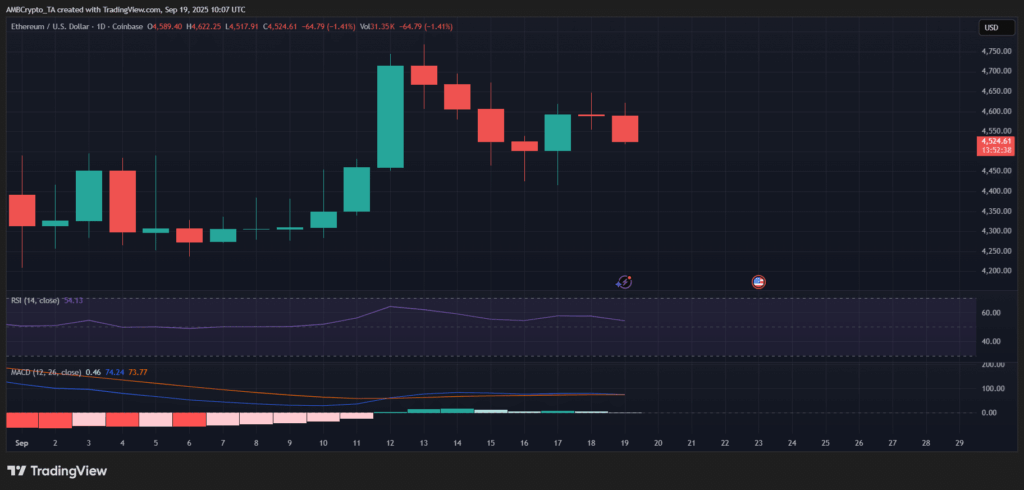

Despite bullish accumulation trends, Ethereum’s price has begun to cool. At the time of writing, ETH was trading around $4,524, down 1.41% on the day. Technical indicators like the RSI show waning buying pressure, while the MACD suggests a lack of clear momentum.

Without renewed demand, Ethereum may enter a consolidation phase in the short term, even as long-term fundamentals grow stronger.

Comments are closed.