Ether ETFs See Record Inflows: Will This Push ETH to New Highs?

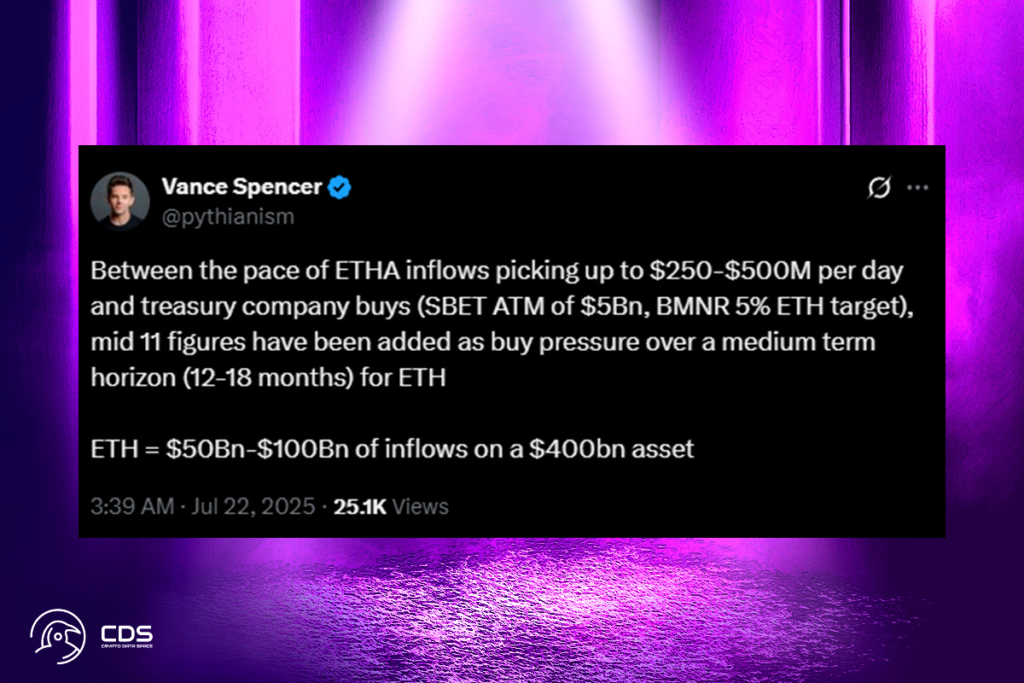

With new treasury firms revealing the storage of the asset virtually every day, the rate of Ethereum inflows to spot exchange-traded funds is accelerating. In this regard, Vance Spencer, a co-founder of Framework Ventures, stated on Tuesday that this will significantly increase Ethereum’s buying pressure over the next 12 to 18 months.

Mid-eleven figures have been added as buy pressure over a medium-term horizon (12-18 months) for ETH,

Spencer

For a $400 billion asset, he continues, this might represent inflows of $50 billion to $100 billion.

US Spot Ethereum ETFs Attract $2.2B in 5 Days Despite Grayscale Outflows

Over $2.2 billion has been invested in US spot Ethereum ETFs over the last five trading days, continuing a 12-day inflow trend. Monday saw inflows totaling nearly $300 million, with Fidelity’s FETH fund leading the way with a $127 million inflow. With BlackRock’s input exceeding $8 billion, the total inflow for Ether ETFs is currently $7.7 billion. However, because of the ongoing withdrawal from the higher-priced Grayscale ETHE fund, the overall sum is lower.

Ethereum ETFs Boosted as Ether Machine Announces Nasdaq IPO Plans

The rise in ETF inflows is accompanied by a fresh wave of Ethereum treasury firms that are appearing virtually every day. A new Ethereum-focused investment firm revealed plans on Monday to go public on the Nasdaq with more than $1.6 billion in backing. According to Reuters, the Ether Machine will be the combined company of the SPAC merger that will establish the Ether Reserve. The business plans to purchase about 400,000 Ethereum, which is presently valued at about $1.5 billion, making it the biggest Ethereum treasury corporation that is publicly traded.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.