Ethereum Holds $3.4K as Whales Strengthen Positions

Ethereum (ETH) has struggled to regain upward momentum since being rejected at $3,900 last week. Over the past seven days, ETH traded in a narrow range between $3,200 and $3,600, reflecting limited market volatility. At press time, Ethereum was priced at $3,446, down 2.98% on the daily chart.

Whales Use Dips to Accumulate

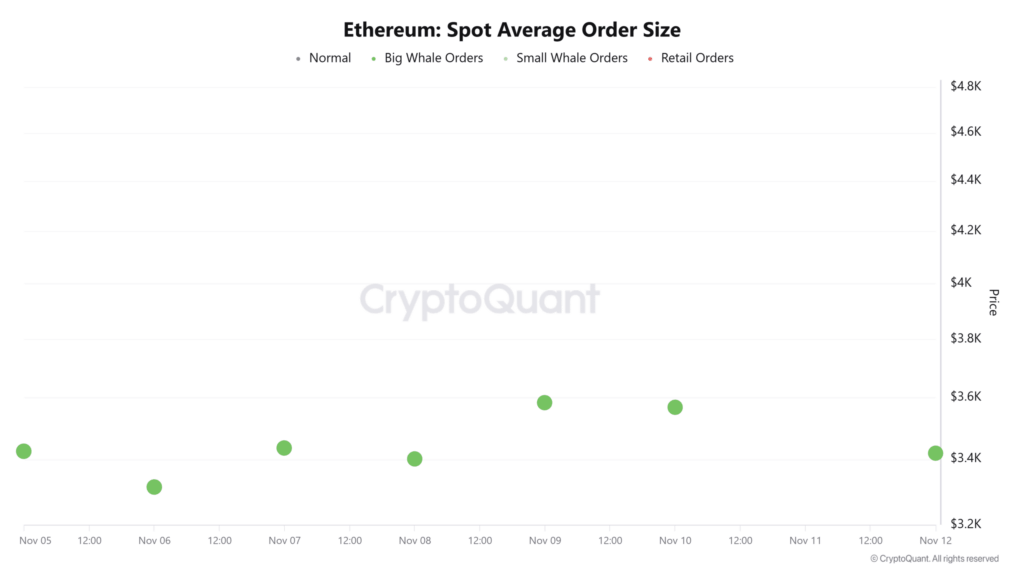

Despite short-term weakness, large holders have been steadily increasing their positions. CryptoQuant’s Spot Average Order Size metric showed consistent whale orders for seven consecutive days, indicating continued activity from major investors.

Onchain Lens reported multiple notable movements:

- One whale withdrew 60,000 ETH ($213.7 million) from Binance and deposited it into Aave V3.

- Another created a new wallet and purchased 24,007 ETH ($82.04 million).

- A third acquired 28,262 ETH, bringing its total holdings to 355,164 ETH.

“In total, these three whales accumulated 112,269 ETH, valued at approximately $394.3 million — a clear signal of confidence amid short-term weakness,” the report noted.

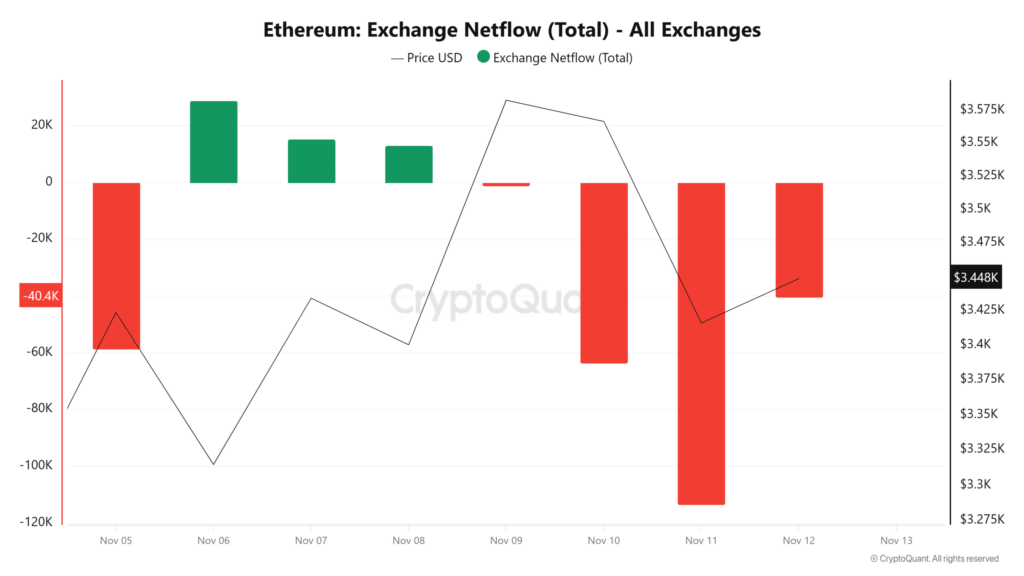

Exchange activity also reflects this accumulation trend. Ethereum experienced negative Exchange Netflows for four consecutive days, with a current reading of -40.4K, suggesting withdrawals outpaced deposits and buyers dominated exchange activity.

Retail Demand Remains Muted

While whales continue buying the dip, retail participation remains low. ETH’s Sequential Pattern Strength indicator has stayed positive for three days, showing buyer dominance, but prices have not moved significantly.

Currently, ETH hovers near the middle Bollinger Band at $3,697. Analysts note that a close above this level could open a potential move toward $3,900, the resistance that previously rejected the price. A further breakthrough might expose the upper band near $4,240.

On the downside, if momentum fades, support around $3,154, the lower Bollinger Band, could come into play.

For now, Ethereum sits in a state of balance. Whales are accumulating during dips, but retail demand has yet to confirm a broader trend reversal. “Whether the next major swing turns bullish depends on which side regains dominance,” the market overview concludes.

Comments are closed.