ETH Price Alert: Correction or Major Decline Ahead?

As the price of Ethereum retraces from the $4,400 resistance zone, the bullish structure has begun to exhibit early indications of weariness. Short-term momentum has decreased following a recent shift in market structure and a local negative divergence, even if the market is still on a solid mid-term upswing. To ascertain if this is really a normal correction or the beginning of a more significant decline, the coming days will be crucial.

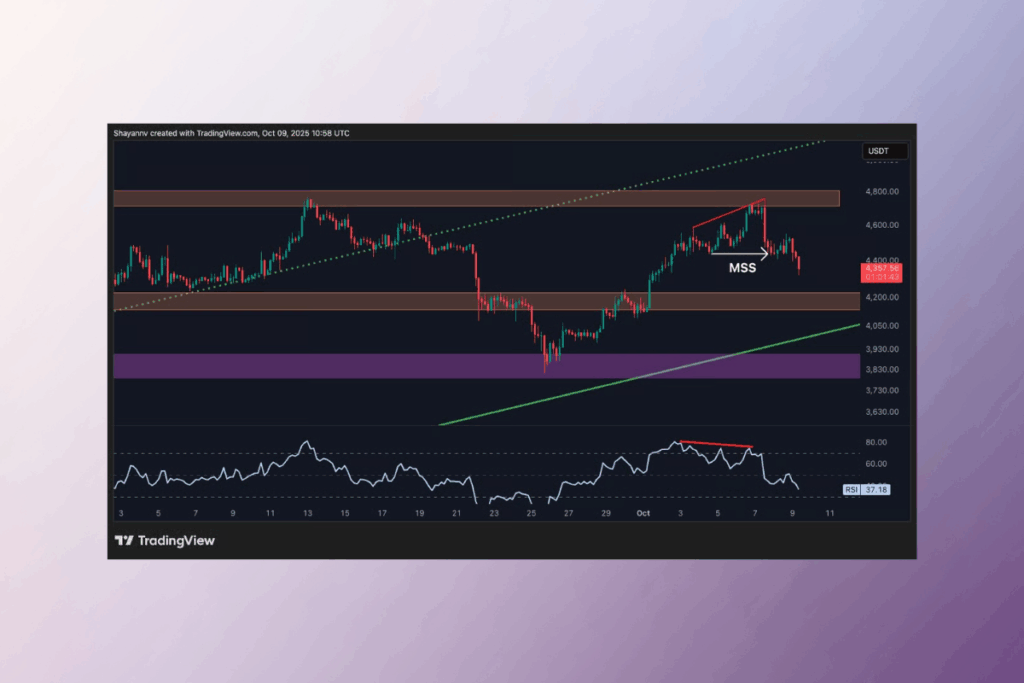

ETH Price Analysis: Bullish Channel Holds but Momentum Slows

On the daily timescale, ETH has once again failed to break over the $4,800 resistance area, although it is still inside a long-term climbing channel. At $4,000, the asset is currently declining toward the lower trendline of the channel and the 100-day moving average. Indicating that bullish momentum has temporarily subsided but hasn’t yet turned bearish, the RSI has likewise cooled to 49. The overall trend is unaffected as long as the structure stays above $4,000. Losing that level, meanwhile, would pave the way for a more substantial rise toward $3,400, the location of the next important demand zone.

Bearish Divergence Signals Short-Term Correction

After failing to maintain higher highs near $4,800, ETH has confirmed a Market Structure Shift (MSS) in the 4-hour view. This move was reinforced by a pronounced bearish divergence on the RSI, which indicated a loss of momentum prior to the decline. Now that the price has entered a brief corrective phase, it may return to the $4,200–$4,100 range, which corresponds with earlier demand. ETH must recover $4,500 and nullify the most recent lower-high formation in order for buyers to restore control. Short-term bias is still a little pessimistic in the context of the bullish channel until then.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.