Featured News Headlines

ETH ETFs- Corporate Ethereum Holdings Surge

ETH ETFs– A new wave of corporate treasuries is reshaping the crypto landscape, bridging the gap between traditional finance and digital assets. Companies like Strategy, Metaplanet, and SharpLink have collectively accumulated nearly $100 billion in cryptocurrencies, according to a new report from Galaxy Research.

Bitcoin Still Dominates, But Ethereum Is Gaining Fast

Bitcoin continues to lead as the primary asset, with over 791,000 BTC—worth approximately $93 billion—held by corporate treasuries. This represents nearly 4% of Bitcoin’s circulating supply. However, Ethereum is catching up quickly.

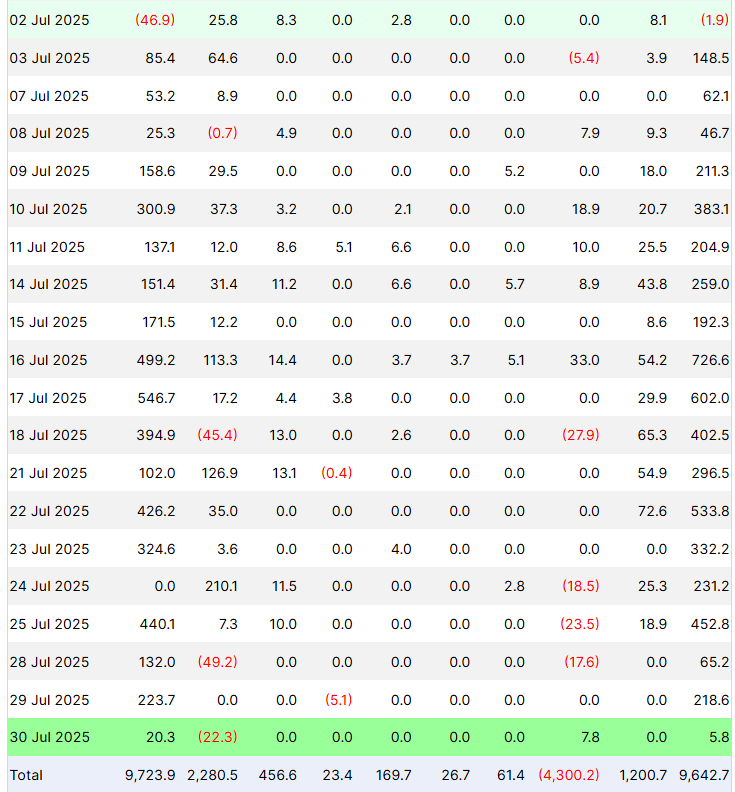

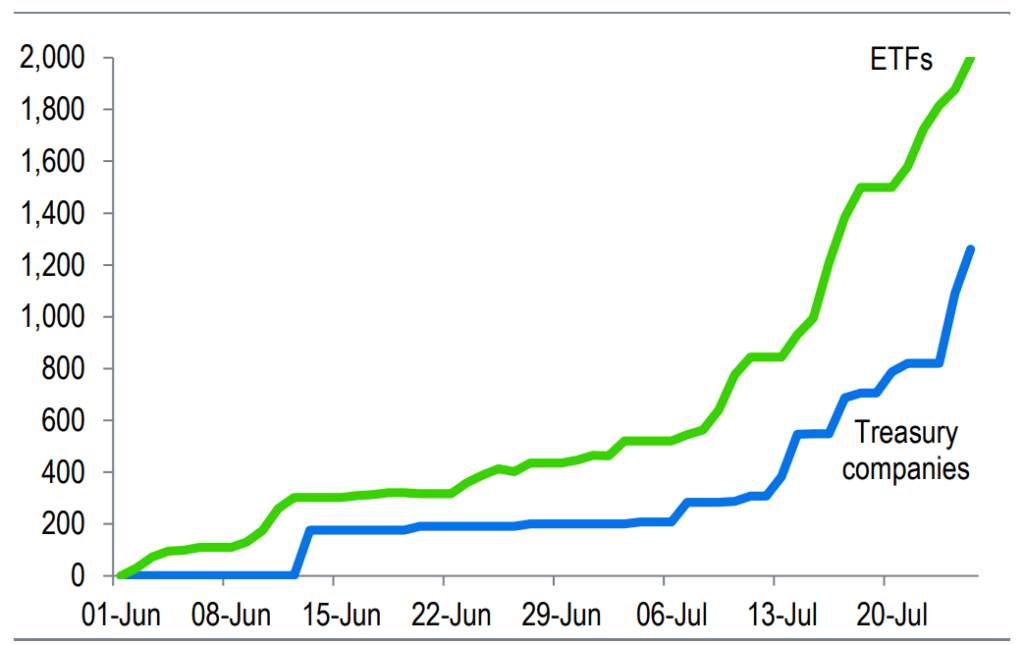

Corporate treasuries now hold 1.3 million ETH, valued at over $4 billion, making up 1.09% of Ethereum’s total supply. This institutional accumulation comes alongside a record-breaking 19 straight days of net inflows into U.S. spot ETH ETFs, which have brought in $5.3 billion in ETH since July 3.

Ethereum Is Emerging as a Treasury Asset

This growing demand for ETH marks a strategic shift in how corporations view Ethereum. Unlike Bitcoin’s early treasury phase, Ethereum’s ecosystem allows companies to stake assets, earn yield, and actively integrate ETH into financial operations.

“These firms aren’t just holding ETH—they’re using it to generate value,” said Enmanuel Cardozo, a market analyst at Brickken.

He adds that Ethereum’s adoption is advancing faster than Bitcoin’s early days, as staking introduces an entirely new layer of financial utility.

What’s Next for ETH?

While reclaiming its all-time high by summer’s end may require near-perfect market conditions, sustained corporate buying and ETF momentum are laying the groundwork for a long-term ETH revaluation—potentially pushing the price past $4,000 by year-end, according to Standard Chartered.

Comments are closed.