DOGE Price Eyes $0.34 as Dormant Coins Drop and Holders Accumulate

Dogecoin’s recent on-chain metrics suggest growing investor confidence as the meme coin trades within a bullish ascending channel.

Dormant Coins and Growing Holder Base Support Price Stability

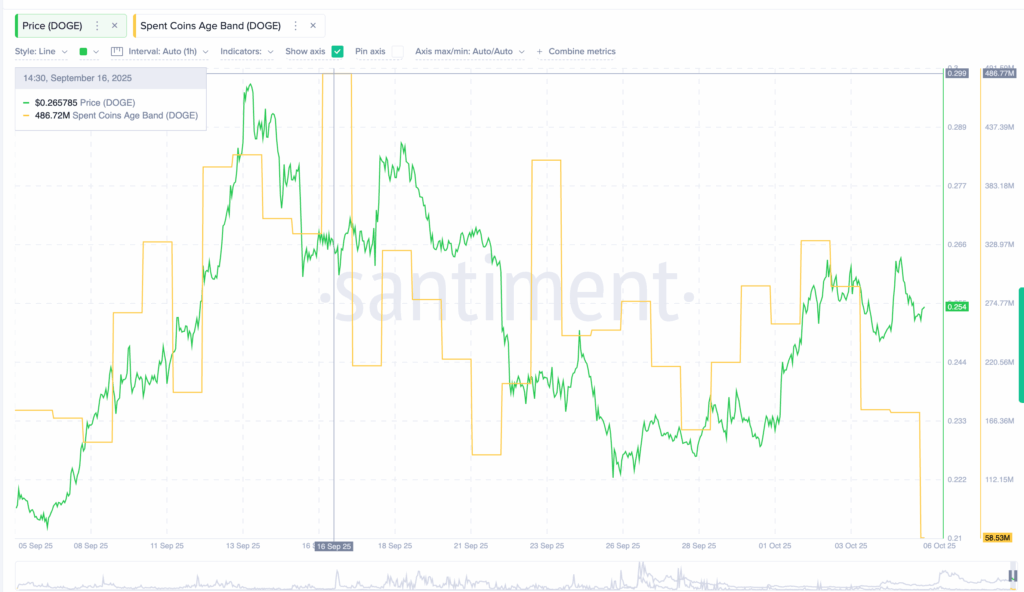

A significant decline in the Spent Coins Age Band reveals that fewer DOGE tokens are leaving wallets. The metric fell nearly 88%, from 486.7 million on September 16 to just 58.5 million by October 6. This includes coins held from a few days to several years, suggesting investors are choosing to hold rather than sell.

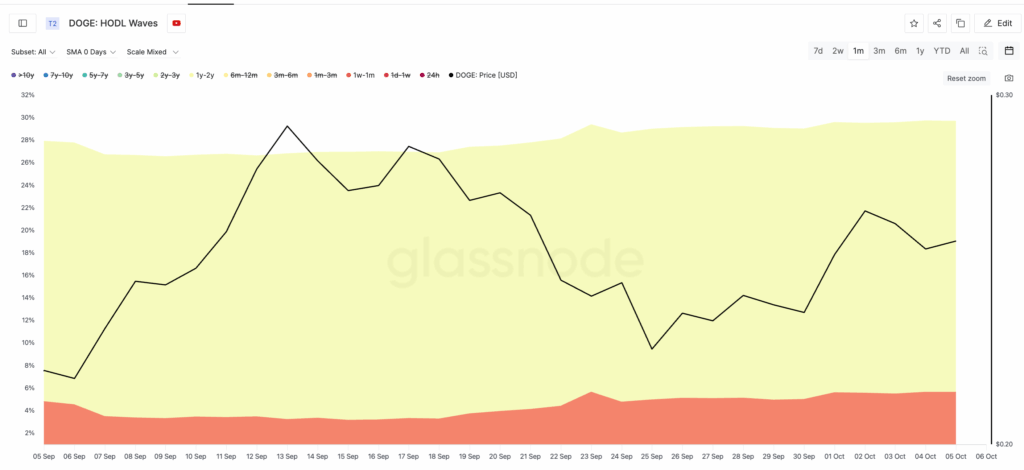

At the same time, HODL Waves indicate an increase in both short- and long-term holders. The 1-week to 1-month group has risen from 3.16% to 5.65%, while 1-year to 2-year holders increased from 23.11% to 24.05% month-over-month. This simultaneous accumulation from new and old investors builds a rare bullish alignment, reinforcing Dogecoin’s foundational strength.

Bullish Channel Signals Potential 20% Rally

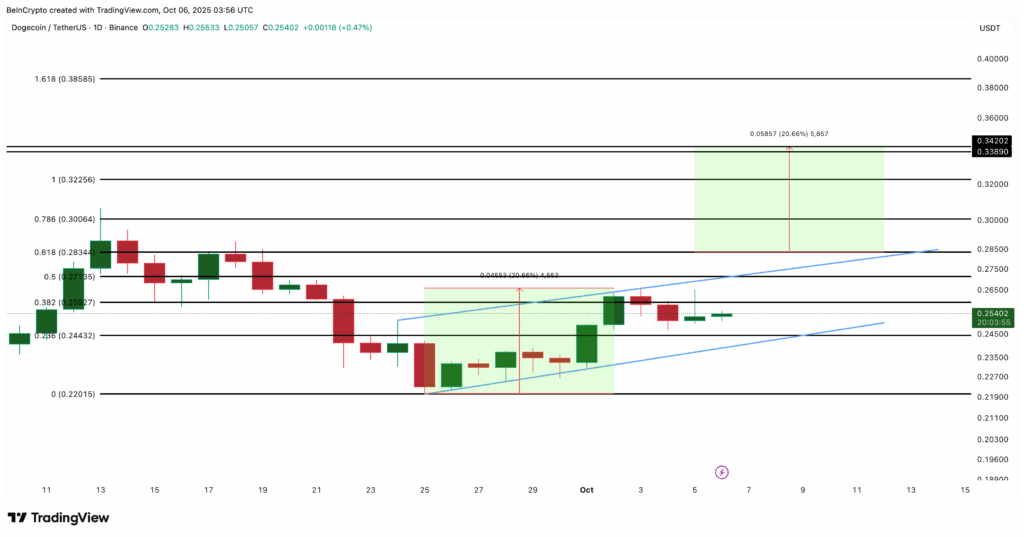

Dogecoin is currently trading within an ascending channel, a bullish technical formation characterized by rising higher lows. The upper resistance zone lies near $0.28. A confirmed breakout above this level could trigger a 20% rally, pushing DOGE toward $0.32–$0.34.

If momentum continues building, the breakout could occur sooner, as the rising trendline narrows the gap between current price and resistance. Fibonacci projections suggest that if buying pressure intensifies, the rally could extend to $0.38.

On the downside, $0.24 acts as a key support level. A breakdown below $0.22 would challenge the short-term bullish setup.

Together, the tightening chart structure, reduced coin movement, and growing investor conviction provide a quiet but firm backdrop for a potential breakout—if resistance finally gives way.

Comments are closed.