Featured News Headlines

- 1 DOGE Price: Whale Moves, Oversold RSI & Double Bottom Pattern Explained

- 2 Double Bottom Formation Hints at Potential Reversal

- 3 Oversold Conditions Signal Possible Price Stabilization

- 4 Growing Network Activity Points to Sustained User Interest

- 5 What Does This Mean for Dogecoin Investors?

- 6 Patience and Vigilance Are Key

DOGE Price: Whale Moves, Oversold RSI & Double Bottom Pattern Explained

DOGE Price– Over the last 24 hours, large Dogecoin (DOGE) holders—wallets containing between 10 million and 1 billion DOGE—have quietly added an impressive 130 million DOGE to their portfolios, signaling significant accumulation amid recent market weakness. According to on-chain analyst Ali Martinez, this strategic buying occurred as Dogecoin’s price slipped below the $0.23 mark, marking a 6% daily decline and over 15% drop throughout the week.

While Dogecoin’s price was trending downward, the increasing volume in large wallets suggests whales are capitalizing on the dip, positioning themselves for what could be a major move ahead. This accumulation by whales during a price correction is often a bullish indicator, showing confidence in Dogecoin’s long-term potential despite short-term volatility.

Double Bottom Formation Hints at Potential Reversal

Prominent trader Tardigrade recently pointed out a compelling technical pattern on Dogecoin’s 4-hour chart—a potential double bottom formation. This classic reversal pattern features two distinct low points around the same price level, separated by a brief rally.

The first bottom appeared near $0.2160 on July 25, followed by a second, slightly higher low on July 29. Both bottoms face resistance at around $0.2435, a level Dogecoin has tested multiple times but has yet to break decisively. Should DOGE break above this resistance, it could set the stage for a rally toward $0.27, a key target for bullish traders.

However, the pattern would be invalidated if Dogecoin’s price drops below $0.22, which would signal further downside risk. This technical setup highlights a critical juncture for DOGE, where traders closely watch for signs of a breakout or breakdown.

Oversold Conditions Signal Possible Price Stabilization

Adding to the technical narrative, an analysis of Dogecoin (DOGE)’s 1-hour chart reveals oversold conditions after a sharp 10% price drop over 17 hours. The Relative Strength Index (RSI), a key momentum indicator, plunged from overbought levels down to below 30—an area widely considered oversold.

Historically, an RSI below 30 suggests that selling pressure may be exhausted, often preceding a pause or reversal in price decline. While this does not guarantee an immediate bounce, it implies that Dogecoin (DOGE) could be poised for stabilization or a short-term rally. Traders will be looking for confirmation from volume and price action before committing to new positions.

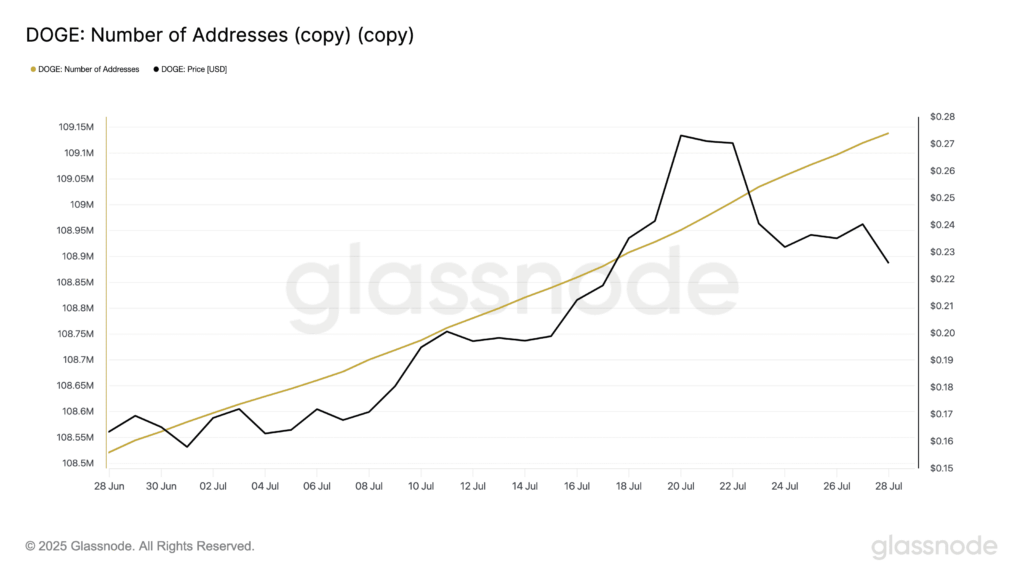

Growing Network Activity Points to Sustained User Interest

On-chain data from Glassnode further supports the bullish sentiment by showing steady growth in active Dogecoin (DOGE) addresses. At the time of reporting, there were 109.14 million active addresses—a rise from 108.5 million just one month prior.

This increase in active addresses indicates rising participation and ongoing interest among users, even as prices face downward pressure. It suggests that Dogecoin (DOGE) is maintaining its user base and possibly expanding its network effect, which is a vital factor for any cryptocurrency’s long-term health.

The combination of growing network usage amid falling prices often signals strong holder conviction and potential for future accumulation phases.

What Does This Mean for Dogecoin Investors?

The current market environment for Dogecoin (DOGE) reflects a classic correction phase where prices pull back but fundamental interest and whale activity remain robust. Large holders appear to be seizing the opportunity to accumulate DOGE at discounted prices, hinting at confidence in the coin’s future prospects.

Technical charts showing a potential double bottom, coupled with oversold conditions, suggest the sell-off might be nearing its end, possibly paving the way for a new upward movement. Meanwhile, the steady increase in active addresses underscores continued community engagement and adoption—key drivers for sustained demand.

However, investors should remain cautious, keeping an eye on critical support levels near $0.22 and resistance around $0.2435. A decisive break either way could dictate the next major trend for Dogecoin (DOGE).

Patience and Vigilance Are Key

For now, the signals suggest that Dogecoin’s recent dip has attracted significant whale buying, indicating a potential floor in price and a setup for a rebound. Still, crypto markets are known for their volatility, and traders should be prepared for rapid changes.

Monitoring on-chain data, price action, and key technical levels will be essential for navigating the next phase of DOGE’s price movement. Whether you’re a long-term holder or a short-term trader, staying informed and patient will be crucial to capitalizing on Dogecoin’s evolving market dynamics.

Comments are closed.