Featured News Headlines

The 18-Month Trap: Why Crypto Can’t Build Sustainable Products

In a post on X titled “Why Crypto Can’t Build Anything Long-Term”, Rosie Sargsian, head of growth at TEN Protocol, argued that many crypto projects are locked into a cycle of chasing the next narrative rather than executing a long-term strategy. She writes:

“Now nobody stays with anything long enough to know if it works. First sign of resistance: pivot. Slow user growth: pivot. Fundraising getting hard: pivot.”

According to her, this pattern emerges because founders feel compelled to move on the moment momentum falters.

The Shortened Product Life-Cycle

Sargsian outlines that the product cycle in crypto has shrunk drastically. Whereas during the ICO era a project might have had 3–4 years to mature, today she contends:

“Now it’s 18 months if you’re lucky. … Real infrastructure takes at least 3–5 years. Real product-market fit requires iteration over years, not quarters.”

She further highlights that crypto venture funding in Q2 2025 fell by nearly 60 %, which places even more pressure on projects to deliver quickly — or pivot early.

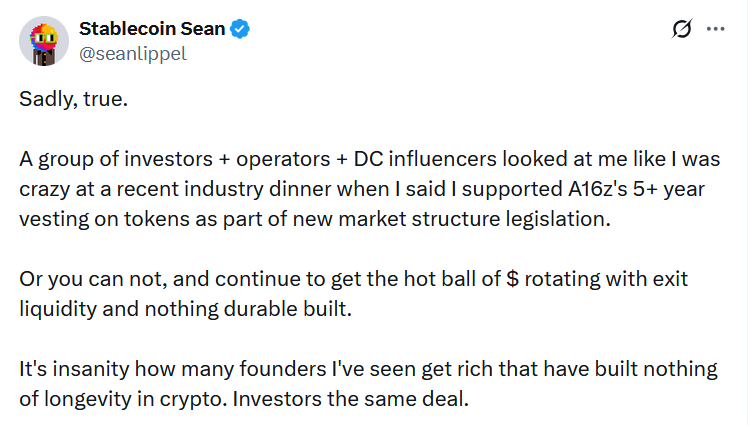

Incentive Structures That Discourage Longevity

Another challenge she identifies: the way many crypto projects incentivise early adoption tends to favour short-term gains rather than sustainable engagement. Tools like token launches and airdrops draw users in the short term, but in many cases:

“Without sufficient structuring and planning … early investors dump right after the token drops and abandon the platform.”

Game Theory: It’s Not Just Founders’ Fault

Sargsian does not squarely blame individual founders. Instead, she suggests the underlying “game” in crypto — where attention, capital and narratives rotate rapidly — makes it extremely difficult for projects to take a long-term view. She explains:

“Some investors even force you to catch the current narrative. And your team starts interviewing at whatever project just raised on this quarter’s hot narrative.”

Implications for Building Meaningfully

The upshot: if a project is constantly pivoting and chasing the next trend, it’s unlikely to invest the multi-year effort required to build real infrastructure, cultivate meaningful product-market fit, or grow a loyal user base. Sargsian’s argument implies that many projects will struggle simply because the timelines and expectations are misaligned with what true building takes.

Comments are closed.