Crypto VC Funding Surges: Is a New Bull Cycle Starting?

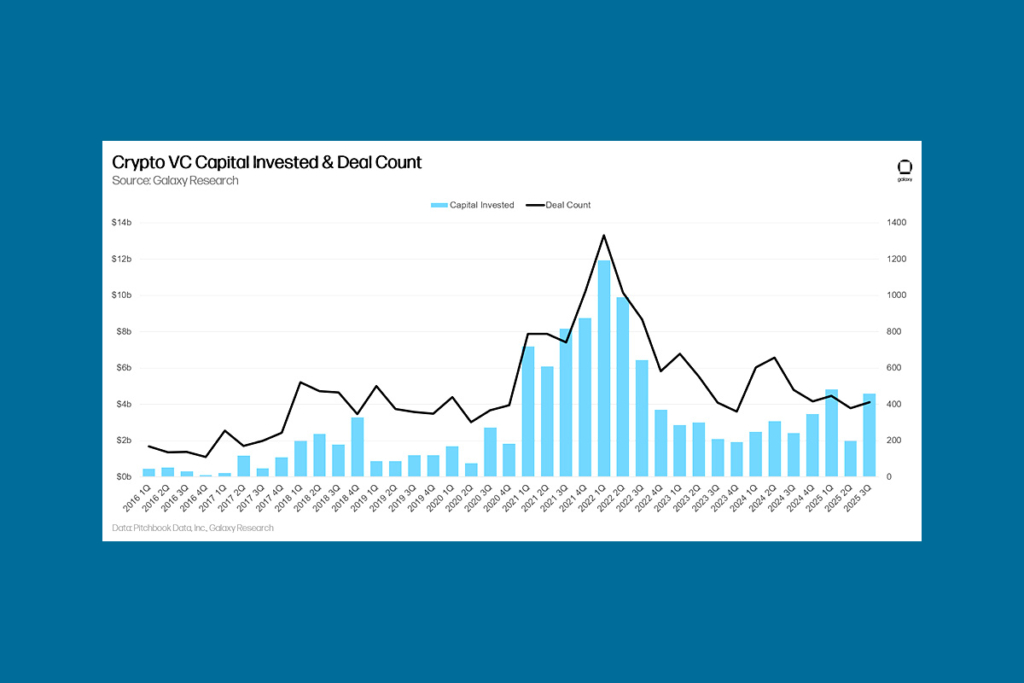

In the third quarter, venture capital investments with a cryptocurrency concentration totaled $4.65 billion. This is the second-highest number since the dramatic drop in venture capital funding for cryptocurrencies. Following the FTX exchange’s failure in late 2022, the decline started. According to a report released on Monday by Alex Thorn, head of research at Galaxy Digital, venture bets increased by 290% in the third quarter. It was the biggest quarter since Q1, when $4.8 billion in investments were made, he continued.

Despite remaining below 2021-2022 bull market levels, venture activity remains active and healthy overall. Sectors like stablecoins, AI, blockchain infrastructure, and trading continue to draw deals and dollars, and pre-seed activity remains consistent.

Thorn

A decline in cryptocurrency venture capital is accompanied by an increase in investing activity. The exchange’s bankruptcy was caused by FTX‘s significant fraud, which was discovered in November 2022. Venture capital in the cryptocurrency space mostly left the industry after this episode.

Revolut and Kraken Lead Q3 Crypto Venture Funding Boom

In the third quarter, 414 venture deals were completed. Half of the capital raised during the quarter came from seven of these. Revolut, a financial technology firm that brought in $1 billion, was one of them. Crypto-focused US bank Erebor raised $250 million, while cryptocurrency exchange Kraken raised $500 million. The majority of the funds raised came from well-established companies established in 2018. In the meantime, businesses established in 2024 had the most transactions.

Pre-seed deal count as a percentage has trended down consistently as the overall industry has matured. With crypto being adopted by established traditional players, and a large cohort of venture-backed firms having found market fit, it’s increasingly likely that the golden era of pre-seed crypto venture investing has passed.

Thorn

Crypto VC Activity Slows as Bitcoin ETPs Attract Big Investors

A strong association existed between VC activity and the values of liquid cryptocurrency assets during the previous bull runs from 2017 to 2021. But during the past two years, activity has been more muted while prices have increased, according to Thorn.

The venture stagnation is due to a number of factors, such as waning interest in previously hot crypto VC sectors like gaming, NFTs, and Web3; competition from AI startups for investment capital; and higher interest rates, which disincentivize venture allocators broadly,

Thorn

Investor interest in cryptocurrency may face competition from spot exchange-traded vehicles and digital asset treasury firms. Large investors, including hedge funds and pension funds, are increasingly making high-profile investments in spot-based Bitcoin ETPs. According to Thorn, this implies that some investors might be using these big, liquid vehicles to get exposure to the industry. Rather than investing in early-stage venture capital, they are opting for this strategy. Allocators continue to face challenges due to macro factors. Thorn, however, believes that changes in the regulatory landscape may lead to a revival of allocator interest in the market.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.