Crypto Staking Taxes Under Fire: US House Pressures IRS Ahead of 2026

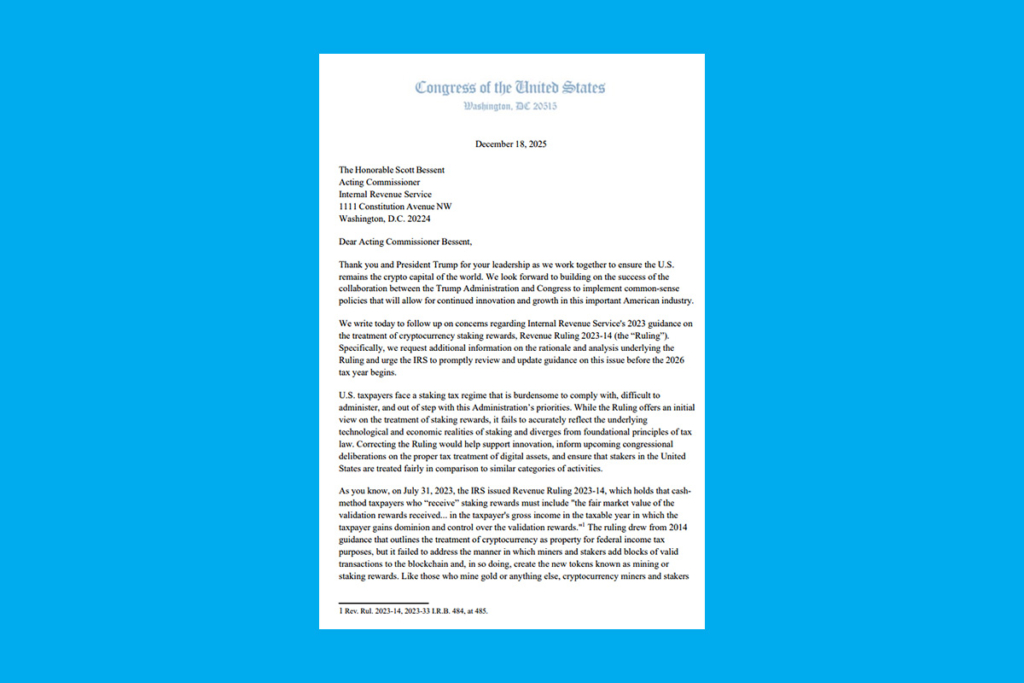

A group of 18 bipartisan members of the US House is calling on the US tax agency to reconsider the rules about crypto staking taxes. The request is submitted before the formal start of 2026. In a letter to Internal Revenue Service acting commissioner Scott Bessent on Friday, the lawmakers, led by Republican Mike Carey, requested a review. They also asked for new rules regarding what they saw as burdensome tax regulations related to cryptocurrency staking. The letter states that staking reward taxes have to be applied at the time of sale. Thus, stakers will be taxed according to the accurate declaration of their actual economic gains.

This letter is simply requesting fair tax treatment for digital assets and ending the double taxation of staking rewards is a big step in the right direction,

Carey

US Lawmakers Push to End Double Taxation on Crypto Staking

Lawmakers contended that the existing regulations tax stakers both when they earn rewards and when they sell them. Even though staking is a fundamental feature of several blockchains, they said that this double taxation is deterring people from participating in the staking market.

Millions of Americans own tokens on these networks. Network security — and American leadership — requires those taxpayers to stake those tokens, but today the administrative burden and prospect of over taxation discourages that participation,

the lawmakers

The final question in the letter is whether there are any administrative obstacles to updating the guidelines by the end of the year. It makes the case that the regulations ought to be updated quickly. The politicians claim that these adjustments would help the current administration achieve its objective of enhancing US leadership in the development of digital assets.

US Crypto Tax Rules Face Shift With New Staking Proposal

It’s hardly the only effort to alter cryptocurrency tax laws. Representatives Max Miller and Steven Horsford of the House presented a discussion draft on Saturday that aims to reduce tax requirements for cryptocurrency users. Small stablecoin transactions would not be subject to capital gains taxes under the plan. Additionally, it would include a deferral option for mining rewards and staking. By choosing a referral option over a total overhaul of the existing regulations, the representatives took a significantly different approach to staking.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.