Featured News Headlines

Shiba Inu Price- Bearish Signals Point to Further Losses

Shiba Inu Price– Shiba Inu (SHIB) is facing a tough road ahead, with a 21% price drop over the past two weeks sparking fears of a deeper correction. The meme coin is struggling to hold support, as momentum fades and investor interest declines sharply.

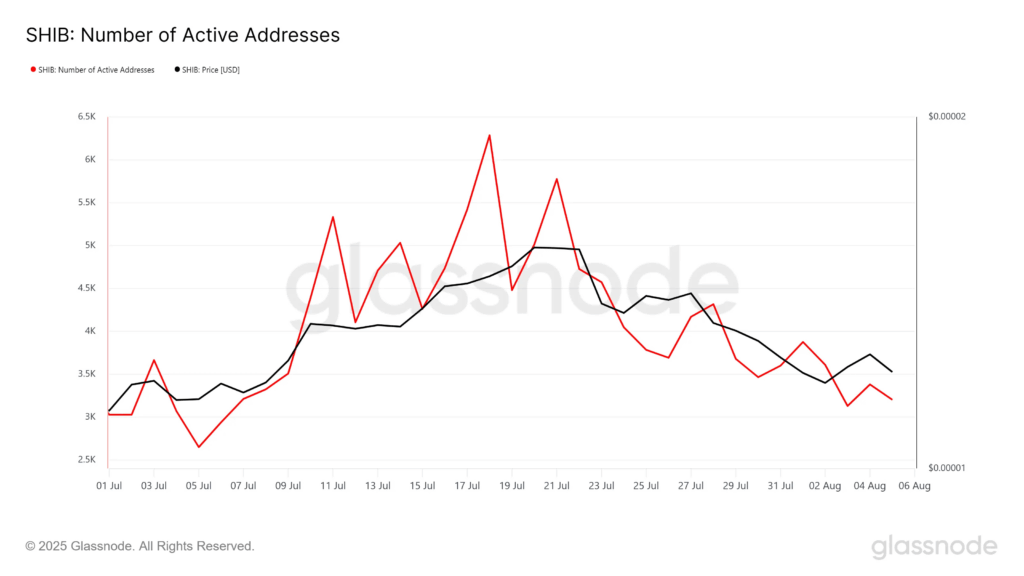

New Wallets Drop 44% – A Bearish Signal?

One of the most alarming metrics is the sharp 44% decline in new addresses, dropping from 2,059 to just 1,171. This suggests that fresh capital is no longer entering the SHIB ecosystem, weakening the foundation for any potential recovery.

Without new demand, SHIB faces an uphill battle. Investor retreat is not just a number—it’s a signal. It shows a clear loss of confidence, which is often followed by extended bearish phases.

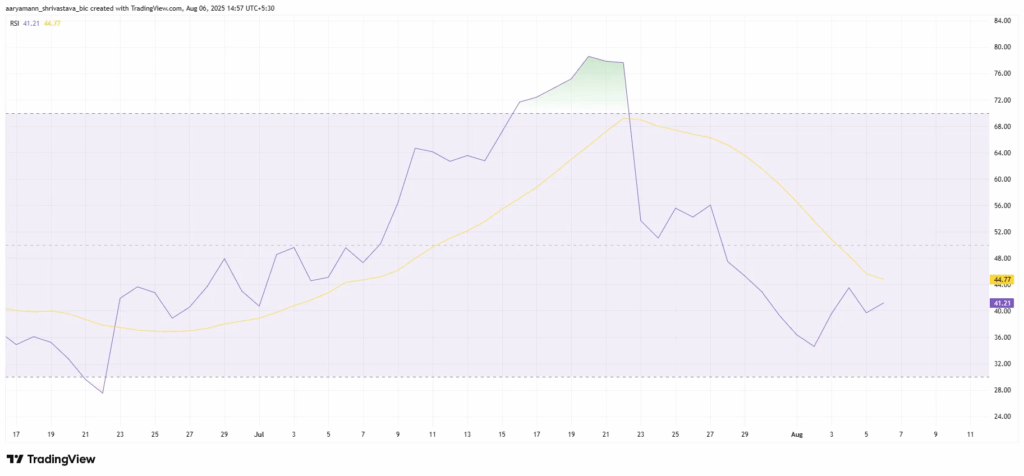

RSI in the Bearish Zone – More Pain Ahead?

The Relative Strength Index (RSI) is currently sitting below the neutral 50 mark, highlighting the lack of buying pressure. This bearish technical indicator reflects broader market pessimism and suggests that downward momentum may persist.

Can SHIB Hold the Line?

SHIB is now trading at $0.00001212, clinging to the support level at $0.00001182. If it breaks lower, the next key support sits at $0.00001141—a critical level that could trigger further losses.

However, if SHIB can reclaim $0.00001252 as support, we might see a push toward $0.00001333, signaling a potential trend reversal. But that recovery depends heavily on shifting market sentiment and renewed investor interest.