Crypto Market Under Fire: Bitcoin’s $93K Drop Driven by Whale Moves

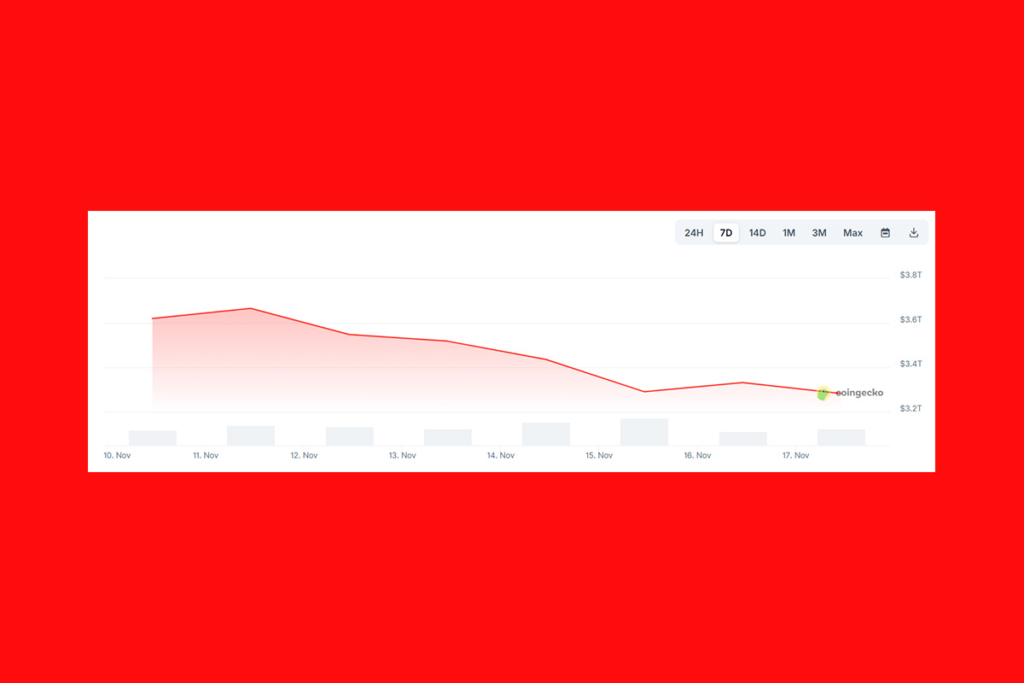

Crypto executives say that the latest market decline may be caused by long-term whale sales, outflows from cryptocurrency exchange-traded funds, and rising geopolitical tensions. On Sunday, Bitcoin momentarily dropped to its lowest point of the year at $93,029. According to CoinGecko, the total market capitalization has also decreased during the past seven days, falling from $3.7 trillion on November 11 to $3.2 trillion on Monday.

The market downturn isn’t the result of a single shock, according to Ryan McMillin, chief investment officer of Australian cryptocurrency investment company Merkle Tree Capital. One reason, according to McMillin, was on-chain data that showed long-term holders cashing in after an exceptional run. Additionally, he pointed out strong fundamentals and liquidity tailwinds that would cause the price to drop significantly.

At the same time, spot Bitcoin ETFs and other vehicles that were huge buyers earlier in the cycle have swung to net outflows just as global markets have turned more risk-off and rate-cut hopes have been pushed out. Put that together and you have old coins being distributed into a softer bid in a macro environment that’s a lot less forgiving than it was six months ago,

McMillin

Industry Leaders Point to Geopolitics and Four-Year Cycles for Crypto Dip

According to Binance Australia and New Zealand’s general manager, Matt Poblocki, the volatility serves as a reminder that the cryptocurrency market is still developing. He continued by saying that it is impacted by political and macroeconomic developments worldwide. On the other hand, the CEO of Banxa, a company that provides infrastructure for cryptocurrency payments and compliance, Holger Arians, stated that markets are operating extremely rapidly. He went on to say that this is relevant to the world’s current situation.

We’re dealing with several unresolved and in some cases escalating geopolitical tensions. At the same time, global tech valuations have kept rising on future expectations. A broader risk-off moment was almost inevitable after a year of optimism. And while crypto can sometimes move independently from traditional markets, this is one of those periods where people are simply waiting, watching, and trying to make sense of a turbulent year.

Arians

Other CEOs in the cryptocurrency industry also have suggestions on the problem. The CEO of Bitwise Asset Management, Hunter Horsley, thinks the market decline may be caused by the four-year cycle idea. Market makers who have a significant gap in their balance sheet may be at risk, according to Tom Lee, chairman of BitMine, an Ether Treasury firm. He thinks sharks might take advantage of these flaws to force liquidations and drive down the price of Bitcoin.

Experts See Consolidation, Not Crash, in Crypto Markets

Experts believe that rather than indicating a long-term decline, the cryptocurrency market is navigating a normal consolidation phase despite recent volatility and brief sell-offs. Confidence is still supported by institutional participation, ETF inflows, and solid network fundamentals, and important support levels are remaining stable. Investors may find smart entry positions at this time, with the possibility of a rebound and fresh impetus as the market processes recent changes. Overall, the outlook shows durability and the continuance of a multi-year growth trend, even though caution is still necessary.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.