Crypto Market Slide Sparks Major Token Liquidation by Hayes

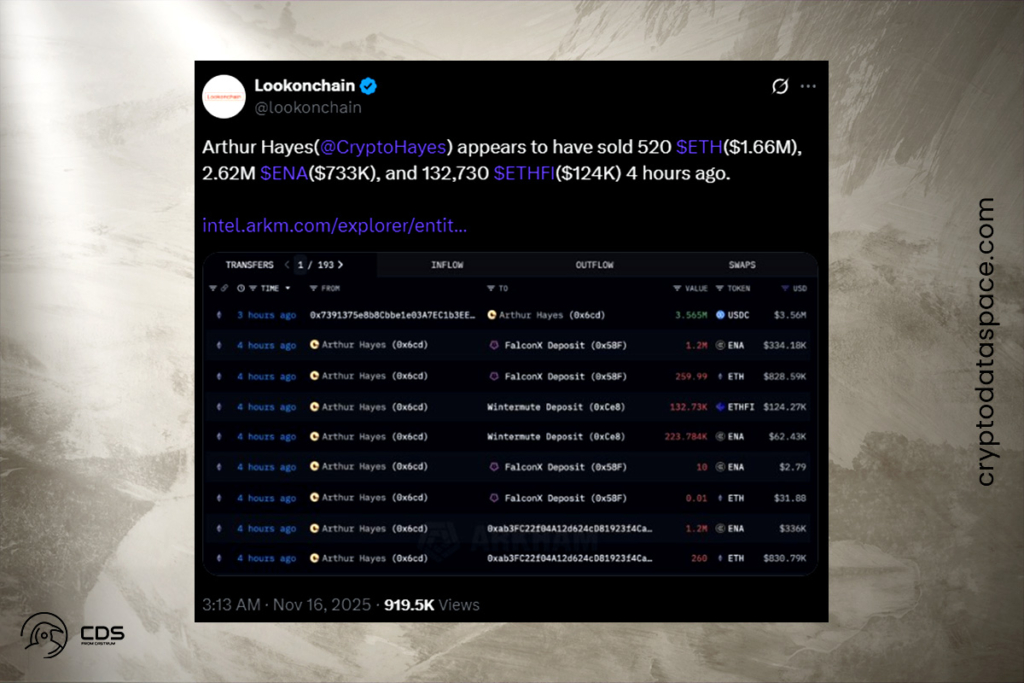

Arthur Hayes made a new move after the market took a sharp turn. In one day, the co-founder of BitMEX sold off tokens valued at about $5 million. He is also reducing his holdings in several significant cryptocurrencies. His actions added to an already unsettling week for traders as the market fell to multi-month lows. Lookonchain data revealed that he took swift action to reduce risk following the market’s decline. FalconX and Wintermute are being used by Hayes to route numerous transactions. His biggest sales were for about $2.48 million in Ethereum, $1.38 million in Ethena, and approximately $480,000 in Lido DAO.

Hayes’ Recent ETH Sales Highlight Risk Reduction Strategy

Additionally, he sent a total of several hundred thousand dollars’ worth of tokens to OTC exchanges by reducing stakes in Aave, Uniswap, and ether.fi. The transfer history demonstrates a distinct decrease in exposure in a matter of hours. Hayes sold 1,480 ETH worth $4.7 million in the last two days, according to a more current Lookonchain report. But he hasn’t had the best timing. It was the local bottom when he last sold ETH on August 1. Only nine days later, he decided to buy it back at a higher price.

Hayes Influences Market Sentiment With ZEC Purchases

Moreover, there has been discussion about Hayes perhaps switching to Zcash due to the quick departures. Furthermore, Hayes’ most recent public appeal might have contributed to ZEC’s rise. Traders noticed right away after he posted a ZEC/BTC chart and claimed to have “aped more.” The pair recently broke through 0.0068 BTC after rising gradually from about 0.0045 BTC, a distinct trend of rising highs and falling lows. Stronger volume was also displayed on the chart. Hayes’s purchases validated the shift in opinion toward ZEC due to increased interest and tighter liquidity.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.