Featured News Headlines

Crypto Market Tests Support After Sharp Volatility

The cryptocurrency market recorded a notable recovery this week, with total market capitalization climbing 10.4% after Monday’s sharp early-morning decline. Bitcoin (BTC) led the move, rising 10.55%, while several altcoins posted even stronger gains. Yet despite the rebound, broader macroeconomic developments continue to shape sentiment across digital assets.

U.S. Government Reopens as Key Economic Data Resurfaces

The U.S. government officially reopened on 13 November following a 43-day pause, an event that briefly disrupted the release of important economic data. With the government back in operation, several delayed reports resurfaced and quickly influenced market expectations.

One of the most notable updates came from payroll processor ADP. On Wednesday, the firm reported that U.S. private-sector employers shed 32,000 jobs in November, despite economists forecasting an increase of 40,000 jobs. This unexpected drop highlighted ongoing uncertainty in the labor market and added new tension to an already fragile macro environment.

Meanwhile, the Federal Reserve confirmed the end of its quantitative tightening (QT) program, bringing a moment of clarity to markets following months of speculation. U.S. equities reacted positively to the announcement, with the S&P 500 rising 0.3% on Wednesday.

Adding another layer to the broader economic conversation, the Bank of America and BlackRock both emphasized that the current AI-driven tech surge is supported by “real corporate investment,” distancing it from the speculative excess that defined the dot-com bubble. Bank of America’s head of equity and research described the current environment as “more of an air pocket than a bubble,” suggesting volatility but not irrational mania.

These developments collectively illustrate how a combination of economic ambiguity and shifting institutional narratives continues to pull the crypto market in multiple directions.

Market Support Holds Despite Breakdown of Long-Term Trendline

In the crypto market, total capitalization fell below the important $3.56 trillion support level in September, extending a downward trend into early November. The long-term trendline dating back to November 2023 was broken last month, suggesting weakening momentum.

However, the price action took an unexpected turn.

After the trendline was breached and retested from below, market observers anticipated a clear rejection. Instead, the level acted as support again. The resilience at this technical zone implies that the recent rebound may continue if momentum stabilizes.

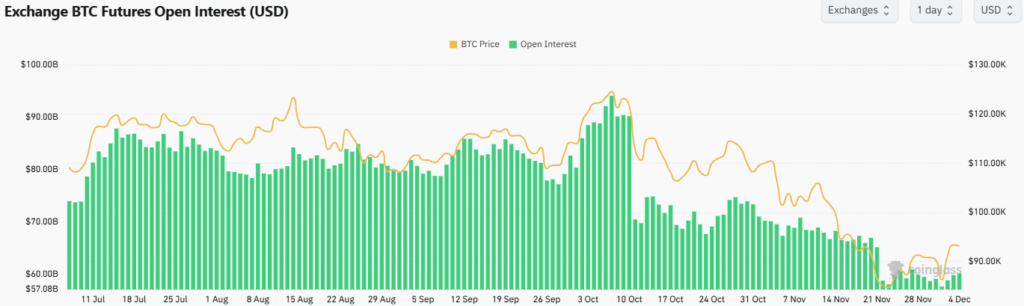

Despite the bounce, analysts note that Bitcoin’s Open Interest (OI) has only grown modestly over the past three days. Compared with levels seen in October, current OI remains shallow, indicating a lack of aggressive speculative positioning.

This limited growth in derivatives participation shows that overall market confidence remains subdued. Bullish bets have not returned to the scale witnessed during stronger market phases earlier in the year.

Capital Flow Remains Weak as Market Seeks Clear Direction

Although prices moved higher, the underlying capital flows do not yet point to a strong recovery. Sustained growth in both spot demand and Open Interest is widely considered necessary to fuel a new market-wide rally. Without these key drivers, the recent rebound appears more like a temporary reaction than the start of a full-scale trend reversal.

For now, traders and market participants are treating the rebound cautiously. A more definitive shift in macroeconomic conditions, combined with clearer evidence of accumulating capital inflows, would be needed before broader recovery expectations can solidify.

The crypto market’s recent rebound reflects improving short-term sentiment, but the broader picture remains influenced by inconsistent macro signals. From unexpected employment data to the end of the Federal Reserve’s QT program and shifting institutional perspectives on economic trends, digital assets continue to operate in an environment defined by uncertainty.

While total market capitalization has reclaimed key technical levels, weak capital flows and limited speculative activity suggest that the market is still searching for direction. Until stronger spot demand and deeper derivatives participation emerge, analysts view the rally as a temporary lift rather than the beginning of a sustained upward trend.

Comments are closed.