JPMorgan: Institutional Liquidity Drives Change in Crypto Markets

JPMorgan manages customer assets totaling about $5 trillion. The bank claims that as institutional liquidity transforms the market, cryptocurrencies are entering a new stage. It claimed that cryptocurrency is developing into a tradable macro asset in a recent research paper. It claims that the industry is now transcending its origins in early-stage venture dynamics and retail speculation.

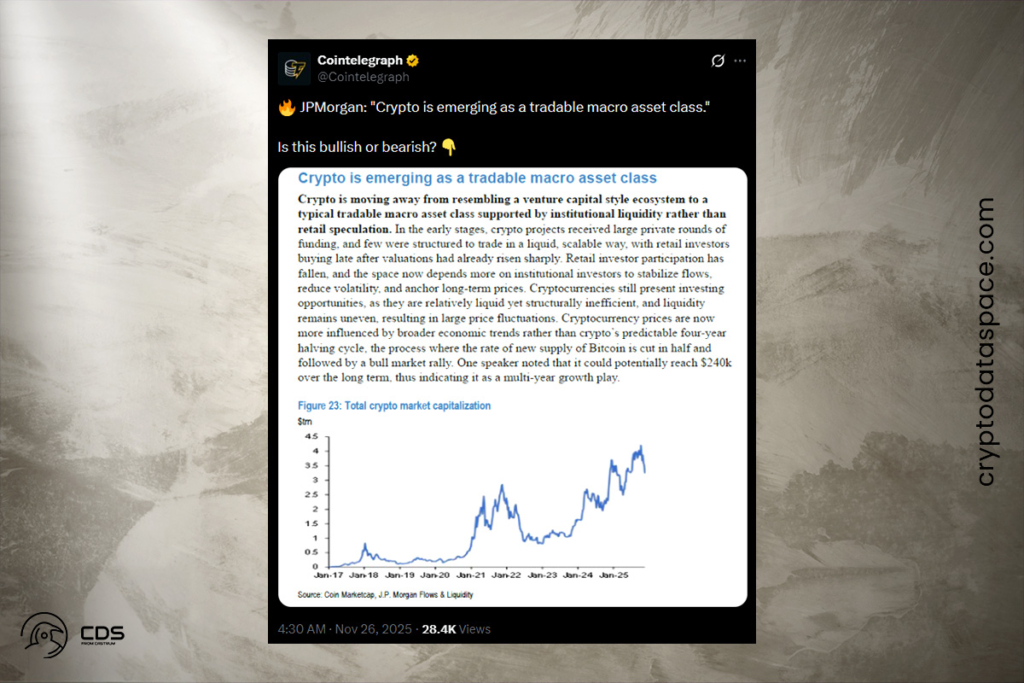

JPMorgan Highlights Shift in Crypto Market Dynamics

The cryptocurrency market has changed from its early paradigm, according to JPMorgan, in which significant private investment rounds established valuations far in advance of public trade. The majority of the risk was taken on by retail investors, who frequently joined the market late. Analysts now see both an increase in institutional participation and a decrease in retail activity.

This shift is stabilizing flows, lowering volatility, and creating more reliable long-term pricing,

the report

The bank did warn that there are still market inefficiencies, though. Price fluctuations are exacerbated by the uneven liquidity. Macroeconomic variables now influence cryptocurrency pricing more, according to analysts. They pointed out that this impact has outpaced the customary halving period of Bitcoin. As a result, JPMorgan believes that Bitcoin may eventually hit $240,000.

The Bank Highlights Risks for Firms Holding Majority Crypto Assets

Shortly after JPMorgan issued a note that Strategy would be taken out of key market indices, the research paper came to light. Citing the company’s substantial Bitcoin holdings, the note explicitly targeted the MSCI USA Index. Specifically, 649,870 BTC, or $56.91 billion, are owned by Strategy. Thus, its balance sheet is mostly reliant on one asset. Its worth is now almost equal to the value of its Bitcoin assets after its shares dropped 40% over the last month.

According to JPMorgan, the company’s capacity to raise money is constrained by its limited balance-sheet structure. The bank also pointed out that companies holding more than half of their assets in digital currencies would be excluded under a proposed MSCI rule change. JPMorgan has been increasing its own exposure to cryptocurrencies, despite its caution about Strategy.

For instance, the bank revealed that it owned 5,284,190 shares of the BlackRock Bitcoin ETF (IBIT) in a recent 13F filing. As of September 30, the value of these shares was $343 million. When compared to June, this number shows a 64% rise. Additionally, $68 million in call options and $133 million in put options associated with the ETF were disclosed in the filing. These jobs are dispersed among several corporate divisions, particularly those that cater to affluent customers.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.