Featured News Headlines

Why Crypto Prices Are Dropping Rapidly

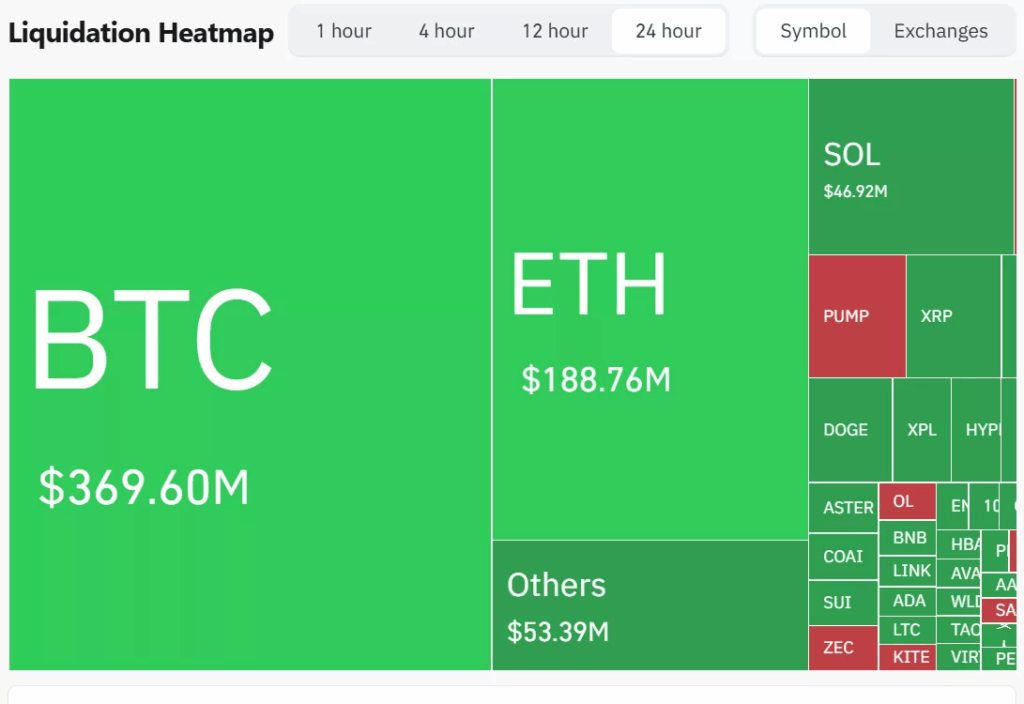

On October 30, the cryptocurrency market has experienced total liquidations of $825.4 million, edging closer to a potential $1 billion wipeout. Long positions accounted for the majority, totaling $656.7 million, while short positions reached $168.9 million.

Bitcoin Leads in Liquidations

Among all cryptocurrencies, Bitcoin long positions have faced the highest liquidations, amounting to $310.3 million, far surpassing Bitcoin short positions at $59.2 million.

Over the past hour alone, nearly $10 million in liquidations occurred, with Bitcoin dominating the heatmap at $2.88 million, followed closely by Ethereum at $2.41 million. Other altcoins collectively accounted for $815,650, while Solana saw $481,430 in liquidations.

The widespread sell-offs have impacted the overall crypto market cap, which fell 1.6%, sliding further below the $4 trillion mark to $3.8 trillion. Daily trading volume stands at $192 billion.

Price Movements of Major Cryptos

The sell-off was triggered as major tokens turned red in recent hours. Bitcoin is trading near $110,000, down 2.4% over the past 24 hours. Ethereum, meanwhile, dropped 2.5% to $3,899, retreating from its $4,000 high.

Despite the launch of two Solana ETFs, Solana briefly reached $201 but has since dipped below $200, currently trading near $190. XRP fell 3.5% to $2.56. Smaller altcoins, including Pi Network (-2.1%) and Aster (-5%), also experienced notable declines. Dogecoin lost 2.1%, trading around $0.189.

Understanding the Crash

The current market downturn is attributed to a combination of macroeconomic pressures, structural vulnerabilities, and leveraged trading dynamics. Heightened uncertainty around monetary policy has made non-yielding assets like cryptocurrencies less appealing.

Following the Fed’s interest rate cut of 0.25%, investors engaged in the common strategy of “buy the rumor, sell the news,” where anticipation pushes prices higher before cooling off after the announcement. As a result, the initial momentum surrounding the rate cut has weakened.

Moreover, the market’s reliance on high leverage and thin liquidity has exacerbated the decline. A large portion of trading volume stems from derivatives, enabling large exposures with minimal capital. As prices fell, liquidation cascades triggered forced closures of leveraged long positions, pushing prices down further and creating additional liquidations.

Comments are closed.