Featured News Headlines

Extreme Fear Hits Crypto Markets – Could BTC Bounce Back Soon?

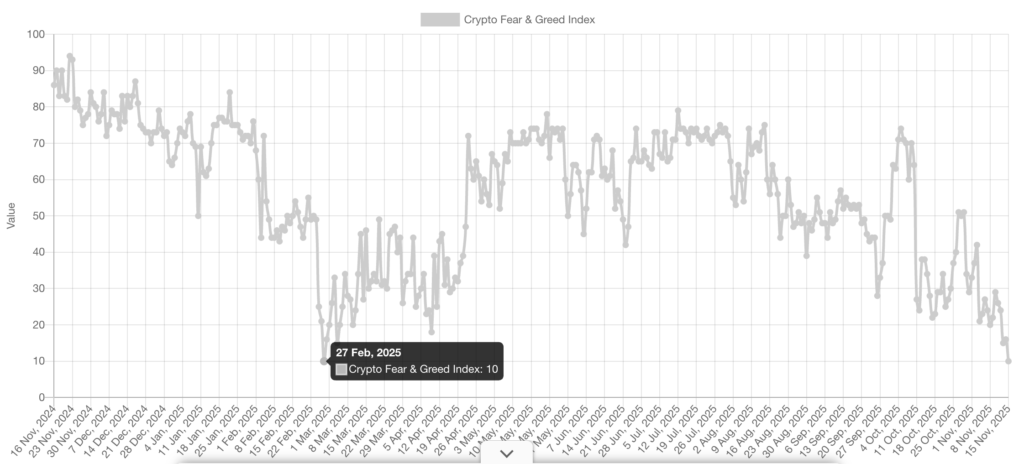

Crypto market sentiment has plunged to its lowest level in over eight months, driven by ongoing macroeconomic uncertainty that continues to rattle investors. The Crypto Fear & Greed Index, which gauges overall market sentiment, recorded an “Extreme Fear” score of 10 in its Saturday update. This marks the lowest reading since February 27, as Bitcoin (BTC) dipped below $95,000 and has yet to recover above $96,000, according to CoinMarketCap.

The February low coincided with record outflows from spot Bitcoin ETFs, totaling $1.14 billion in a single day, as BTC fell from $102,000 to $84,000 within weeks.

Analysts Predict a Short-Lived Bearish Mood

Despite the extreme reading, some crypto analysts believe the bearish sentiment may be temporary. Andre Dragosh, Bitwise’s European head of research, highlighted that while sentiment indexes appear bearish, the current market shows less pessimism than previous downturns. He pointed to Bitwise’s Cryptoasset Sentiment Index, which is displaying signs of positive divergence, suggesting a potential reversal.

Bitcoin Charts Hint at Optimism

Technical analysts are also finding silver linings for BTC bulls. NorthmanTrader founder Sven Henrich noted a falling wedge and positive divergence on Bitcoin’s price chart, calling it “potentially positive”. Meanwhile, Messari research manager DRXL emphasized the dissonance between market headlines and underlying sentiment, noting that while much of what crypto investors hoped for is happening, the market still feels cautious.

Healthy Market Dynamics Ahead?

Bitwise Chief Investment Officer Matt Hougan added that the absence of a year-end surge may be a healthy sign, preventing the market from overheating before a potential pullback. Despite short-term fears, these insights suggest that the crypto market could be positioned for stabilization and gradual recovery as macro and technical conditions evolve.

Comments are closed.