Crypto Markets Turn Green: CPI Report Sparks Bitcoin Rally

According to the Consumer Price Index (CPI) report published by the US Bureau of Labor Statistics (BLS), there was a small increase in inflation in September. Following the event, cryptocurrency markets responded, and the price of Bitcoin increased. Moreover, the CPI data was issued on a Friday during a US government shutdown for the first time since 2018.

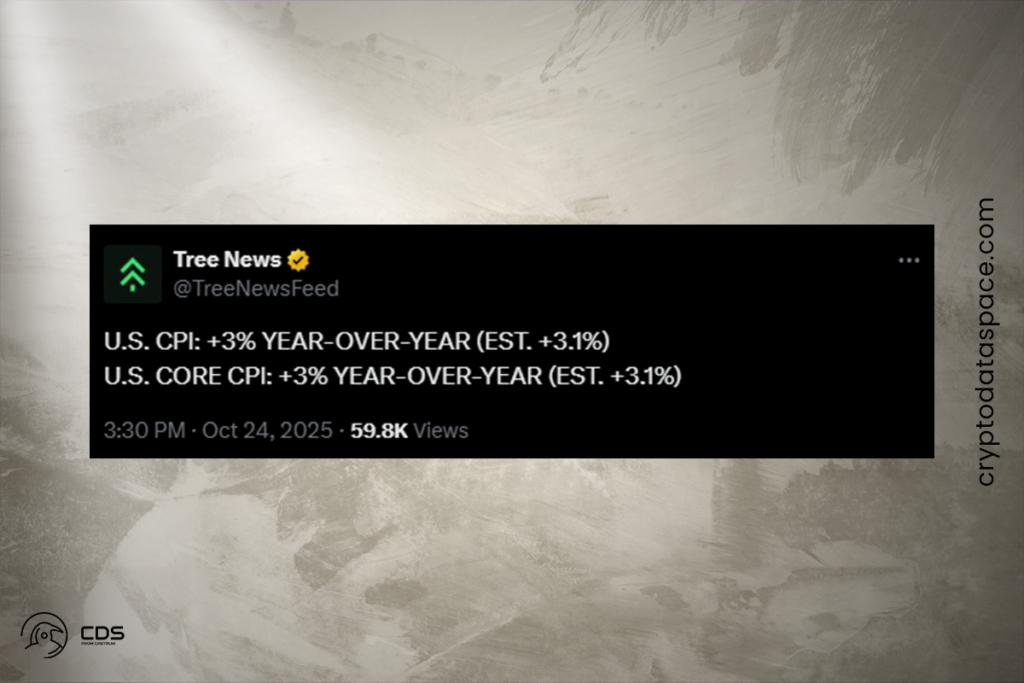

According to the most recent data, the US CPI for September 2025 was 3% year over year, which was just less than the 3.1% forecast. The headline CPI was expected to rise by 0.4% each month, according to economists. However, it only increased by 0.3%. This follows a 2.9% CPI reading in August.

U.S. CPI: +3% YEAR-OVER-YEAR (EST. +3.1%). U.S. CORE CPI: +3% YEAR-OVER-YEAR (EST. +3.1%),

US CPI Report Becomes Key Market Indicator Ahead of Fed Meeting

The CPI calculates the rate of inflation by tracking changes in the costs of common goods and services over time. It shows how the total cost of life changes by tracking the price of things like food, housing, and transportation. CPI data is frequently used by policymakers to assess inflationary pressures and inform choices about interest rates and economic policies. Notably, the data is particularly important at this time and comes just five days before the Federal Reserve’s next policy meeting.

Most other important data releases have been halted by the US government shutdown. Therefore, the only significant signal the Fed will take into account before its crucial policy meeting on October 29 is CPI data.

This was easily the most impactful inflation report of the year, simply because we haven’t seen any other economic data come out of the US government this month. Investors have been in limbo for weeks, forced to rely on private data releases and surveys. This report finally dispels some of this uncertainty,

Nic Puckrin, co-founder of The Coin Bureau

Markets Expect Fed to Cut Rates as Inflation Cools

Reduced inflation indicates that the economy is cooling down in a manageable manner, which allows the Fed to lower interest rates sooner. A 25-basis-point rate decrease is priced in at 98.9% by the market, while the odds of a 50-basis-point cut are still modest at 1.1%, according to the CME FedWatch tool.

This is a good news for the FED before next week FOMC. The FED will cut rate for sure and also should end QT,

analyst Darkfost

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.