Featured News Headlines

Coinbase Q2 Earnings – Coinbase Introduces 0.1% Fee on Large USDC to USD Conversions

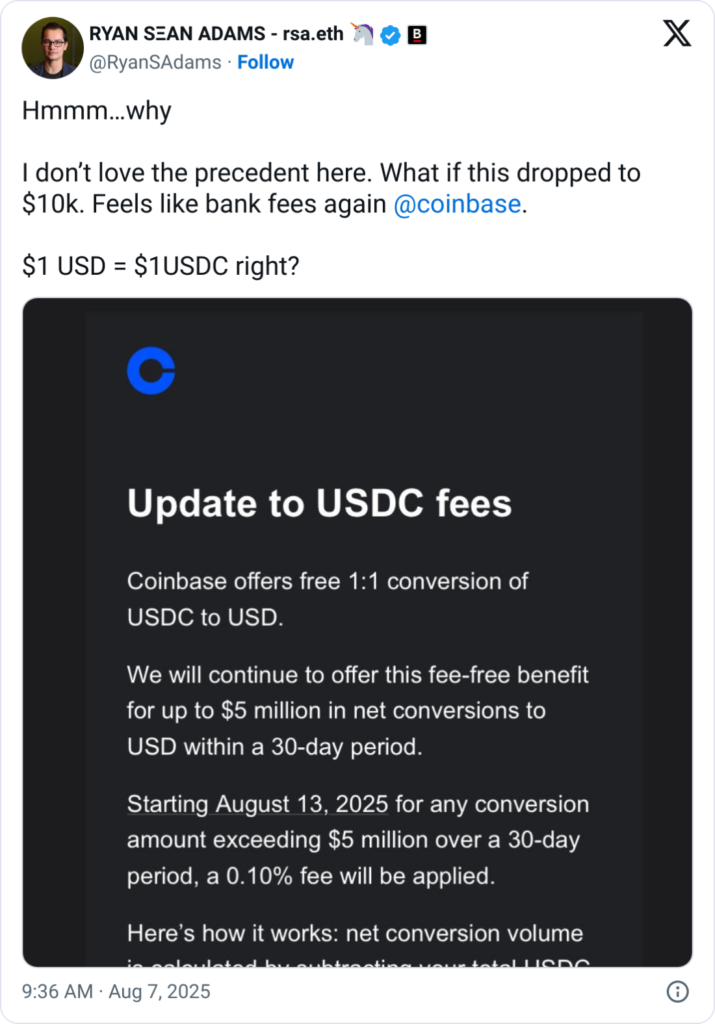

Coinbase Q2 Earnings – Crypto giant Coinbase announced it will start charging a 0.1% fee on conversions from the stablecoin USDC to US dollars for net conversions exceeding $5 million over a 30-day rolling period. This new fee kicks in starting August 13, as the exchange looks to manage its earnings challenges following recent quarterly misses.

Previously, Coinbase did not charge fees for net conversions up to $40 million within 30 days, with fees only applying beyond that amount at rates between 0.05% and 0.2% depending on volume.

Earnings Miss Spurs Fee Introduction

Coinbase reported a revenue of $1.5 billion for Q2 2025, falling short of analysts’ expectations of $1.56 billion to $1.59 billion. This marked the second consecutive quarter of missing revenue forecasts, sending its shares down by 8% after the announcement.

Stablecoin-related revenue grew 12% year-on-year to $332 million, but this was not enough to offset broader earnings pressure. The new fee on large USDC conversions is seen as an effort to cover operational costs amid this challenging backdrop.

Coinbase Calls It an Experiment Amid Mixed Reactions

The fee announcement sparked debate within the crypto community. Bankless co-founder Ryan Sean Adams criticized the move, comparing it to traditional bank fees. In response, Coinbase’s senior product manager for stablecoins, Will McComb, stated the fee is part of an experiment to understand how costs impact USDC off-ramping.

McComb emphasized that Coinbase aims to be the best platform for stablecoin users and is carefully monitoring community feedback.

Stemming Arbitrage and Managing Costs

Some analysts and influencers speculate the fee may also aim to curb arbitrage strategies exploiting free off-ramps from Tether (USDT) to USDC conversions, which impact USDC supply. Coinbase CEO Brian Armstrong confirmed this reasoning with a simple “Yep” on social media.

Tether currently charges a 0.1% fee or $1,000 minimum on large USDT redemptions, making the new Coinbase fee a move to level the playing field and manage liquidity risks.

Comments are closed.