CNB Buys Coinbase Shares: What’s Behind the Move?

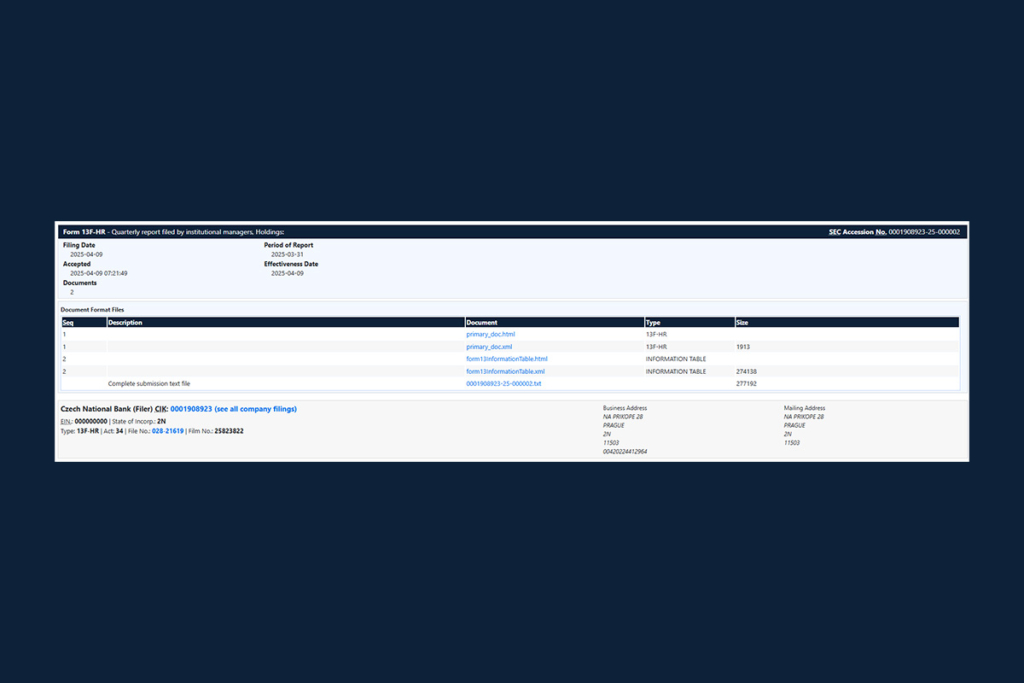

In the second quarter of this year, the Czech National Bank (CNB) purchased $18.1 million worth of Coinbase shares, increasing its exposure to companies linked to cryptocurrencies. The bank revealed that it acquired 51,732 shares of Coinbase Global in the second quarter in a recent Form 13F submission to the U.S. Securities and Exchange Commission. At the end of June, the shares were worth $18.1 million, but Friday’s closing price puts their current value at over $20 million.

CNB Makes First-Ever Coinbase Purchase, Signaling Crypto Reserve Plans

Since its prior disclosure indicated no ownership in the first quarter, this is the central bank’s first-ever purchase of Coinbase shares. Recently, the Czech Republic has shown a greater willingness to investigate cryptocurrency. The CNB accepted a plan in January to consider allocating its reserves to other asset types, such as bitcoin.

The central bank wanted to diversify its reserve holdings, according to CNB Governor Aleš Michl at the time. Michl told the Financial Times that, with board approval, the CNB might be able to devote up to 5% of its €140 billion ($163.5 billion) reserves to Bitcoin.

Is the Czech National Bank Pioneering Crypto Adoption in Europe?

The CNB may set a standard for other European central banks with its audacious decision to purchase Coinbase stock and its willingness to accept Bitcoin as part of its reserves. Cryptocurrencies are becoming a more attractive alternative asset class as traditional monetary authorities seek diversification in the face of inflation and geopolitical threats. According to analysts, the CNB’s progressive approach would encourage comparable tactics throughout the EU, which could hasten the institutional adoption of digital assets on the continent.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.