Featured News Headlines

Digital Currencies as Tools of Financial Mobilization

A recent 2025 study frames cryptocurrencies and central bank digital currencies (CBDCs) as instruments of “financial mobilization,” essential for states to redirect liquidity amid banking crises or tightening sanctions. Blockchain networks are described as a “digital logistics front,” where economic survival intersects with national security priorities.

Crypto and CBDCs in Geopolitical Power Dynamics

The report emphasizes how finance has become a new battlefield. Cryptocurrencies provide an infrastructure for what it terms “total war,” integrating deterrence, capital mobilization, and social stability. By digitizing financial flows, countries like China can maintain liquidity, fund defense sectors, and stimulate domestic demand even when global financial systems are disrupted.

The study outlines a triad of conflict forms: “total war, hybrid war, and digital financial war,” asserting that digital ledgers underpin national resilience. Notably, the digital yuan and blockchain-based settlements are strategic tools designed to operate independently of U.S. sanctions and the SWIFT network.

“Digital currencies have become strategic assets in hybrid warfare, reshaping cross-border capital flows during wartime.”

— Study Times (2025)

The Declining Dollar and Emerging Alternatives

Economist Barry Eichengreen highlights a significant trend: the U.S. dollar’s share of global reserves declined from 71% in 2000 to 58% in 2024. He notes that governments are “moving away from the dollar… for geopolitical reasons, while firms still prefer its liquidity.”

In parallel, China’s mBridge initiative connects CBDCs from multiple countries—including Saudi Arabia, Thailand, and the UAE—aiming to bypass SWIFT and build a parallel financial network beyond U.S. influence. For Beijing, blockchain technology symbolizes economic autonomy under pressure, extending beyond mere transaction speed.

Crypto’s Dual Role in Geopolitics and Crime

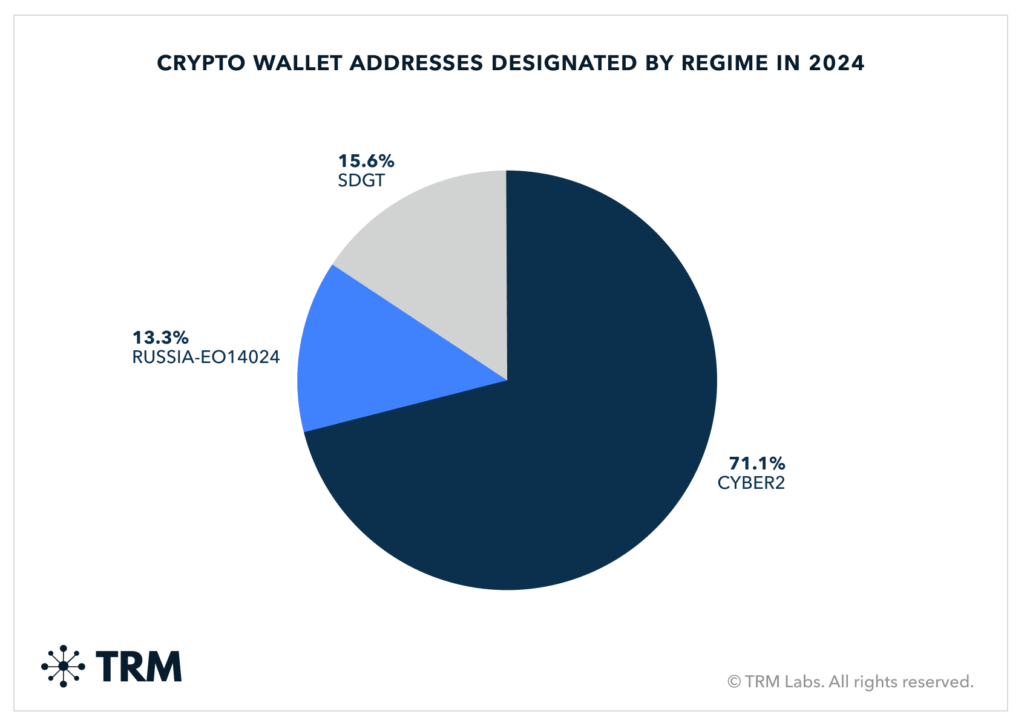

The 2025 TRM Labs Crypto Crime Report reveals digital assets’ double role on the geopolitical chessboard. Sanctioned exchanges such as Russia’s Garantex and Iran’s Nobitex processed over 85% of illicit inflows to restricted markets. Terrorist groups including Hamas, Hezbollah, and ISIS affiliates reportedly utilized stablecoins like USDT on the TRON blockchain for fundraising, prompting Israeli authorities to freeze millions of dollars in related accounts.

Thus, digital finance, initially hailed as a borderless innovation, now functions as a domain of control, surveillance, and enforcement.

Blockchain as a Military and Strategic Asset

Military theorist Jason P. Lowery argues in Softwar that Bitcoin represents “a non-lethal form of power projection—a digital defense system secured by electricity, not explosives.” This concept informs Beijing’s strategic embrace of blockchain as a foundation for resilience and deterrence.

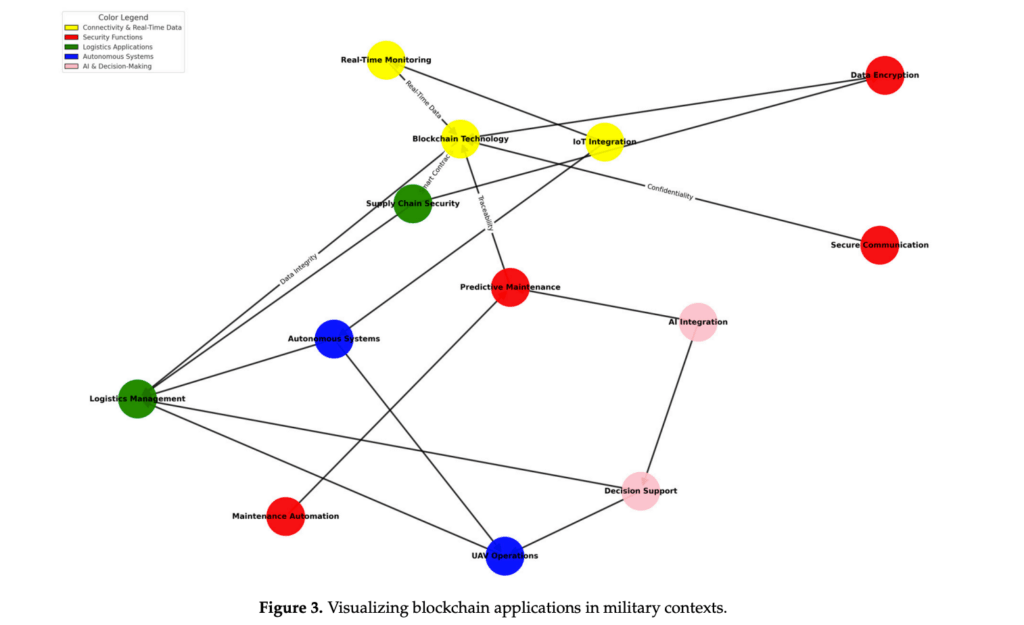

A 2025 review in Technologies highlights blockchain’s role in strengthening military operations through secure communication, immutable logistics, and quantum-resistant authentication. Distributed ledgers are seen as fortifying command systems and supply chains against cyber and physical threats, linking cryptographic integrity with operational trust and funding agility.

Geopolitical Divide Over Crypto’s Future

The geopolitical split over cryptocurrency intensifies. Western governments seek to limit its militarization, while China integrates it deeply into state policy. Economist Barry Eichengreen warns that “geopolitics cuts both ways,” suggesting crypto’s infrastructure could either weaken or bolster U.S. dollar dominance depending on its architects.

China’s hybrid model, merging economic control with technological sovereignty, signals that the next phase of global power competition will unfold in financial markets, cyberspace, and across distributed ledger networks.

Comments are closed.