U.S. Approves Leveraged Spot Crypto Trading: A Game-Changer for Investors

Leveraged spot cryptocurrency trading on federally authorized exchanges became available to U.S. traders on December 4, 2024. For the US crypto business, this was a major turning point. Spot cryptocurrency contracts will now trade on futures exchanges licensed with the Commodity Futures Trading Commission, the agency stated. Clearinghouse protection will support these trades. Market players have less counterparty risk because of this arrangement. American traders can now engage in margin-based spot cryptocurrency trading within the regulated U.S. derivatives markets due to the ruling.

Previously, only offshore platforms offered these kinds of goods. In this regard, Americans seeking leveraged spot cryptocurrency were forced to use offshore platforms, which were not as transparent or protected as US-registered exchanges. Spot cryptocurrency trading is now included in the same structure as futures and options contracts due to this new framework.

Now, for the first time ever, spot crypto can trade on CFTC-registered exchanges that have been the gold standard for nearly a hundred years, with the customer protections and market integrity that Americans deserve,

Acting CFTC Chairman Caroline Pham

Regulated Leverage Arrives: Spot Crypto Trading Enters a New Era

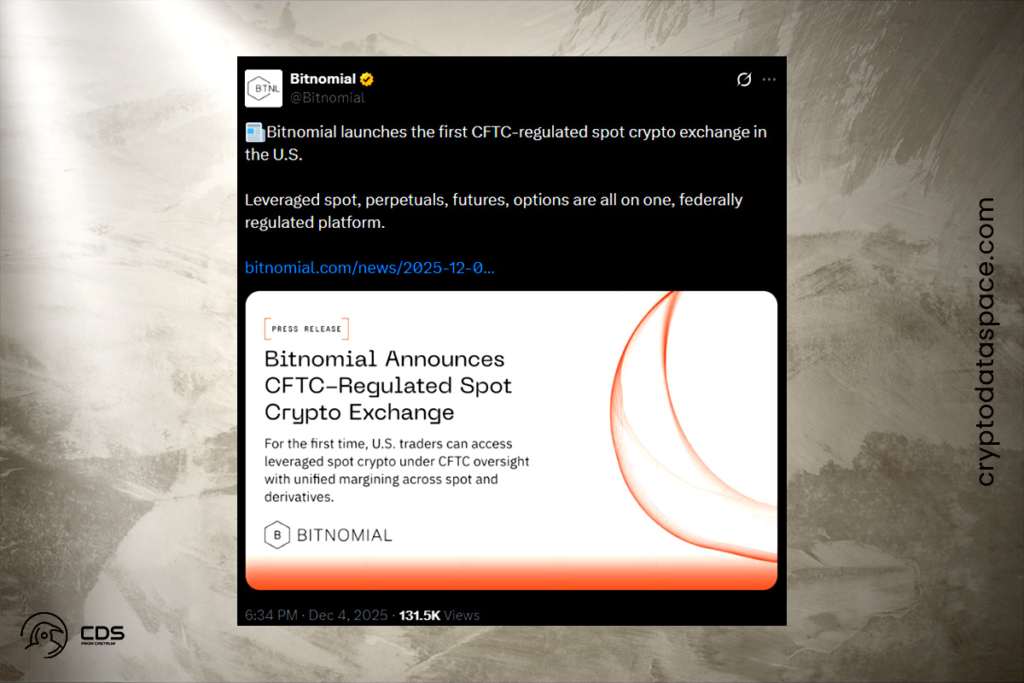

Spot cryptocurrency trading has long been available on sites like Coinbase, but those services don’t use leverage. They operate under money transmitter licenses issued at the state level. By permitting margin-based trading within the same federal framework that oversees the futures and options markets, the CFTC‘s action alters the rules of the game. It strengthens the regulatory framework for spot cryptocurrency trading. Additionally, clearinghouse settlement removes counterparty risk. Bitnomial Inc., a US derivatives exchange, declared its intention to open a leveraged retail spot cryptocurrency exchange supervised by the CFTC. On December 8, the platform is expected to launch.

Leveraged spot crypto trading is now available under the same regulatory framework as U.S. perpetuals, futures, and options. Broker intermediation and clearinghouse net settlement eliminate counterparty risks while providing the capital efficiency traders need.

Bitnomial founder Luke Hoersten

New U.S. Crypto Reforms Aim to Replace Offshore Trading Risks

The significance of providing domestic venues as alternatives to offshore venues was underlined by Pham. This move closes a long-standing loophole in US cryptocurrency regulation.

Recent events on offshore exchanges have shown us how essential it is for Americans to have more choice and access to safe, regulated U.S. markets,

Pham

Legislative initiatives to define regulations for digital assets correspond with this regulatory advancement. To create specific rules for digital assets, the Trump administration supported the GENIUS Act and CLARITY Act. The first federal framework for stablecoins was created by the GENIUS Act, which was passed in July 2025 and mandated monthly public reports and 100% reserve backing. These measures represent a definite departure from the Biden administration’s emphasis on crypto-related fraud and money-laundering regulations. Regulators now seek to safeguard consumers while promoting innovation rather than driving the business in a different direction. This strategy establishes the US as a leader in digital assets worldwide.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.