Canary Litecoin ETF Struggles Since Launch

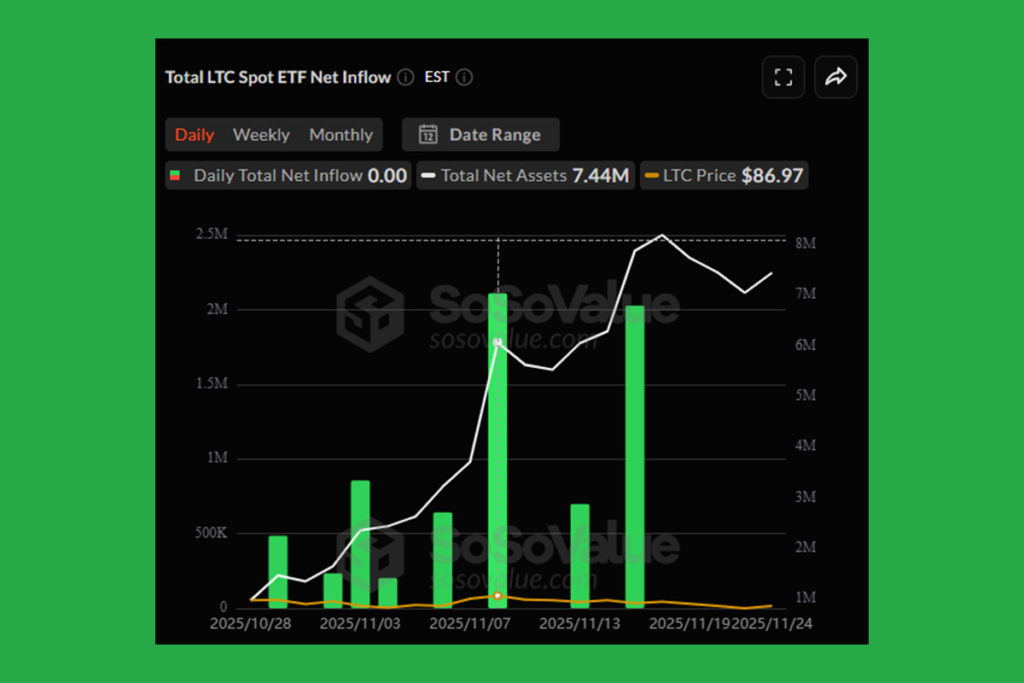

Among the recently authorized cryptocurrency ETFs, the Canary Litecoin ETF (LTCC) has performed poorly. It is well behind funds that are concentrated on Solana and XRP. This indicates that since its October 2025 introduction, investor interest has been quite modest. The LTCC has seen $0.00 in daily net inflows over the previous five trading days, according to statistics from SoSoValue. There are now only $7.44 million in net assets. Only $7.26 million in net inflows have been made since its debut on October 28, 2025. With a total traded value of $747,600, the ETF continues to exhibit very little market activity. With Litecoin trading at $83.73, a significant decline from earlier in the year, this stagnation takes place.

Litecoin ETF Overlooked While Other Crypto Funds Attract Millions

Other cryptocurrency ETFs, however, have garnered a lot more interest. SoSoValue reported $164 million in net inflows into XRP ETFs in a single day. Since their launch, Solana ETFs have seen net inflows of about $570 million. Additionally, XRP ETFs have amassed $586 million. Remarkably, since its launch, neither fund has had any outflows. This discrepancy indicates a widening sentiment difference among investors about digital asset products. Although there is a lot of institutional demand for new ETFs, the Litecoin ETF is still mostly disregarded. The biggest public corporate owner of Litecoin is likewise suffering significant unrealized losses, notwithstanding the ETF’s poor performance.

Lite Strategy Faces $20M Loss on Litecoin Holdings

Previously known as MEI Pharma, Lite Strategy (LITS) has 929,548 LTC worth $79.33 million. This sum amounts to 1.214% of the whole supply of Litecoin. At an average price of $108 each, the business paid $100 million for these tokens. A $20.67 million, or 20.7%, unrealized loss has resulted from this. Lite Strategy turned its attention from pharmaceuticals to cryptocurrencies, with Litecoin serving as its main reserve asset. Despite this well-known affiliation, Lite Strategy’s diminishing holdings are indicative of continued difficulties in the wider acceptance of Litecoin.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.