Featured News Headlines

Charles Schwab Reports Growing Crypto ETP Demand

Despite heavy outflows from U.S. spot Bitcoin exchange-traded funds (ETFs) this week, investment giant Charles Schwab says investor engagement with crypto products is growing. The contradiction underscores a split in sentiment between short-term market movements and longer-term institutional interest.

Over $360M Pulled on Friday Alone

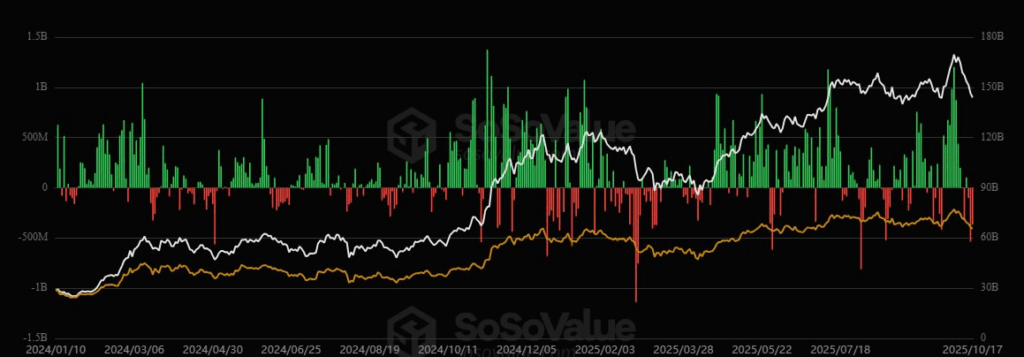

The eleven spot Bitcoin ETFs in the U.S. experienced a combined outflow of $366.6 million on Friday, closing out a red week for the sector. Data from SoSoValue shows that BlackRock’s iShares Bitcoin Trust suffered the largest single-day outflow, losing $268.6 million. Other notable withdrawals included Fidelity with $67.2 million, and Grayscale’s GBTC, which saw $25 million exit.

Only minor movement was seen in Valkyrie’s ETF, while the remaining funds reported no activity on Friday. The total net outflow for the week reached approximately $1.22 billion, with just one day of net inflows—Tuesday.

Bitcoin Tumbles to Four-Month Low

The ETF outflows were mirrored in spot markets as Bitcoin itself dropped by over $10,000, falling from above $115,000 on Monday to a four-month low just below $104,000 by Friday. The sharp downturn erased recent gains and rattled short-term investor sentiment, especially among ETF participants.

Schwab CEO Highlights Strong Crypto Demand

In contrast to the week’s bearish activity, Charles Schwab CEO Rick Wurster offered a more optimistic outlook for crypto-related investment products. Speaking to CNBC on Friday, he revealed that Schwab clients currently hold 20% of all crypto exchange-traded products (ETPs) in the U.S.

“Crypto ETPs have been very active,” Wurster said.

“It’s a topic that’s of high engagement.”

He also noted a 90% increase in visits to Schwab’s crypto site over the past year, highlighting rising retail and institutional curiosity. Industry analyst Nate Geraci added on X (formerly Twitter):

“Schwab operates one of the largest brokerages in the U.S. Hope you’re paying attention.”

Currently, Schwab offers both crypto-themed ETFs and Bitcoin futures products. The firm also plans to launch spot crypto trading by 2026, further signaling its long-term commitment to the sector.

October Breaks Tradition—But Analysts Stay Bullish

Historically, October has been a strong month for Bitcoin, with gains recorded in 10 of the past 12 years. However, October 2025 has so far broken that trend, with Bitcoin down 6% month-to-date, according to CoinGlass.

Still, some market watchers believe the month could recover in its second half. Analysts point to the potential for Federal Reserve interest rate cuts as a catalyst that could reignite bullish momentum and continue the so-called “Uptober” narrative.

Comments are closed.