BTC Dominance Rising Again — What It Means for Altcoins

BTC Dominance– Bitcoin has officially smashed through the $121,000 mark, and top crypto analyst Benjamin Cowen sees this as more than just a milestone — it’s a validation. Cowen emphasizes the importance of viewing Bitcoin as the base unit of account, not USD, and suggests a BTC-heavy portfolio remains the smart play. His models indicate that Bitcoin dominance will likely rebound by October 2025, in line with cycles seen in 2017, 2019, and 2023.

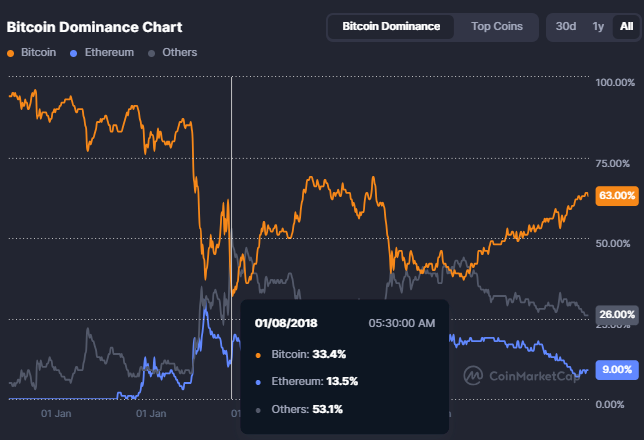

Bitcoin Dominance Rising Again

Currently, Bitcoin holds 63.9% of total market share, growing 0.13% daily. Ethereum trails with 9.6%, and other altcoins make up the remaining 26.5% (a slight drop of 0.36%). Historical data shows Bitcoin once reached 87.4% dominance back in 2013 — a time before Ethereum and the altcoin boom. The landscape has since evolved, but Bitcoin’s strength is clearly resurging.

What’s Fueling the Bitcoin Supercycle?

According to analyst Merlijn The Trader, Bitcoin is now entering Stage 8 of the Livermore Accumulation Cylinder— a phase of explosive growth, where nation-states and institutions rush in. Unlike past retail-driven cycles, this one is being powered by sovereign wealth funds and corporate treasuries, creating relentless buying pressure.

El Salvador paved the way, but other countries and jurisdictions are now planning strategic BTC reserves. This type of adoption is setting a floor for Bitcoin, less reliant on market hype and more on structural, global demand.

Meanwhile, corporations are loading up on Bitcoin to hedge against inflation and currency devaluation, further cementing its role as a financial safe haven.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.