BTC Correction Sparks Debate: Traders Split on Market’s Next Move

Since its record high of almost $124,500, Bitcoin has fallen more than 12.09%, dividing traders into two groups. While some warn that a new bear cycle has begun, others regard it as a normal correction of the bull market.

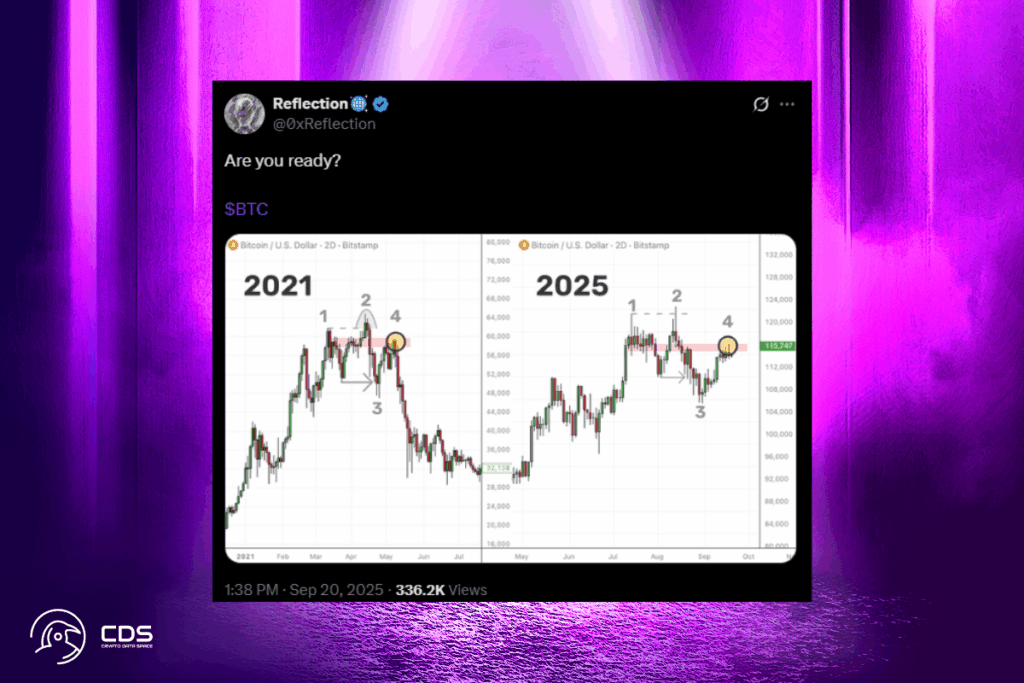

Bitcoin Shows Fractal Pattern Similar to 2021 Peak

Numerous assessments suggest that Bitcoin may replicate the price trajectory that predicted the market peak in 2021. According to cryptocurrency expert Reflection, Bitcoin saw a strong surge to all-time highs in 2021, which was followed by a blow-off top and a decline into mid-range support. A failed retest of resistance marked the end of the surge. In a matter of weeks, the series of actions caused Bitcoin to plummet by more than 50%, from close to $69,000 to about $32,000.

With Bitcoin sitting just below a similar distribution zone that signaled the bearish turnaround in 2021, the 2025 structure of the cryptocurrency is now mirroring that same four-step process. If the fractal holds, Bitcoin could face a similar rejection.

Rising Wedge Collapse Could Push BTC Toward $50K

A rising wedge, a bearish pattern of higher highs and lows inside narrowing trendlines, has been broken by Bitcoin on the weekly chart. A drop to the $60,000–$62,000 range, which coincides with the 200-week exponential moving average (200-week EMA; blue wave), is more likely as a result of the breakdown. The price of Bitcoin is even expected to fall toward $50,000, according to some analysts. Interestingly, a 55% decline to the same 200-week EMA support was caused by a similar wedge collapse in 2021.

But not everyone expects the Bitcoin market to fall more broadly. The 200-day simple and exponential moving averages of Bitcoin create a cluster that Trader Jesse points out is providing support during bull market declines. At that level, he claims, the cryptocurrency might make a mid-term bottom.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.