Grayscale Pushes for Avalanche Spot ETF: What’s Next for AVAX?

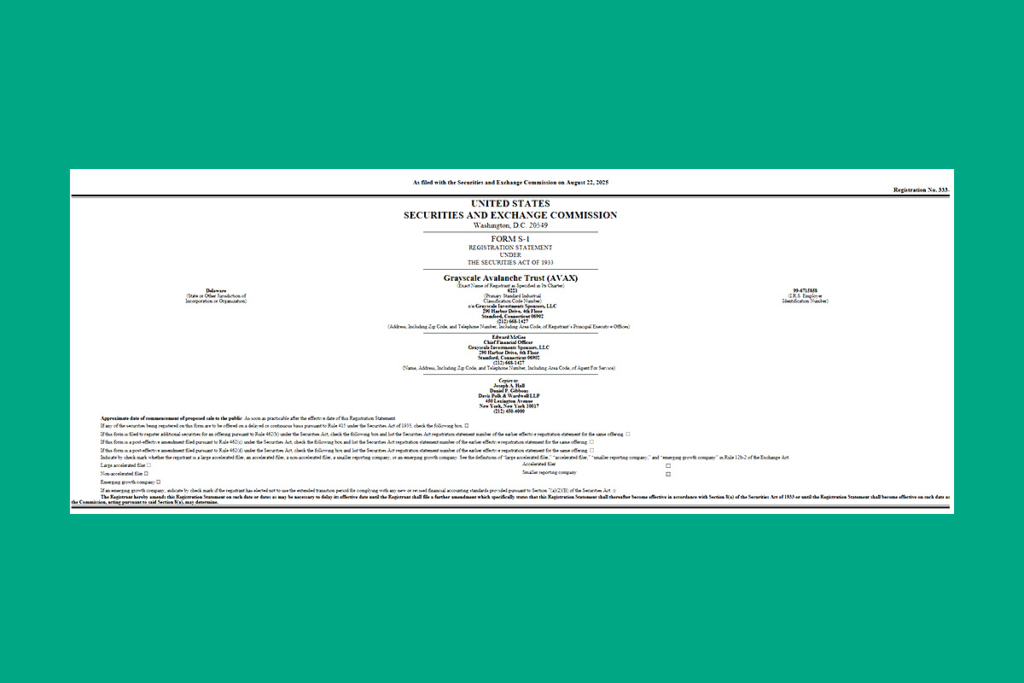

In order to turn its current Avalanche Trust into a publicly traded spot ETF on the Nasdaq, Grayscale Investments has submitted a registration statement to the U.S. Securities and Exchange Commission. The move is intended to give regulated exposure to AVAX, the native token of the Avalanche blockchain, according to the S-1 filed on August 22. Creations and redemptions would take place through authorized participants in cash under the S-1, with Coinbase offering first-rate brokerage services related to spot AVAX execution and custody. The administrator and transfer agent will be BNY Mellon.

No Leverage, No Derivatives: Grayscale Details AVAX Trust Structure

According to Grayscale, if specific requirements are fulfilled and staking is put into place, the Avalanche trust will continue to function as a passive vehicle intended to reflect both the price of AVAX and any AVAX obtained from staking. The trust does not seek to produce profits beyond tracking AVAX and any qualified staking rewards, nor will it employ leverage, derivatives, or comparable tactics. Subject to the staking condition, the issuer anticipates maintaining up to 85% of the trust’s AVAX staked at all times if staking moves forward. The document states that the provider is not permitted to move unstaked AVAX or any staking consideration to another Avalanche address while staking is taking place.

Grayscale’s Crypto Empire Grows: Bitcoin, Ether, and the Road to IPO

Grayscale‘s efforts to diversify beyond Bitcoin and Ether vehicles are strengthened by the product. With a total asset value of $25 billion, the company now oversees two of the biggest spot Bitcoin ETFs. The Block’s data dashboard reveals that it also issues the second-largest ether fund on Wall Street, with assets exceeding $5 billion. Moreover, Grayscale’s corporate plan has progressed this year, with founder Barry Silbert rejoining as chairman and the business getting ready for a possible IPO through private SEC filings.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.