BNB Price Rally Cools as RSI Flashes Overbought Warning

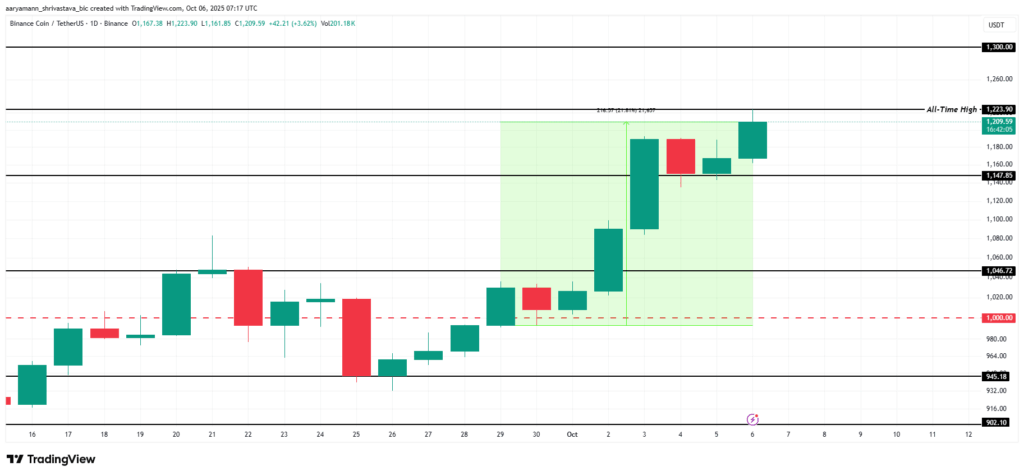

Binance Coin (BNB) has continued its upward trajectory, hitting a new all-time high of $1,223 following a 21% weekly surge. This rally reflects strong investor demand and the token’s underlying resilience, pushing the price closer to the $1,300 milestone. However, on-chain metrics hint at a potential cooling phase ahead.

Investor Selling Pressure Emerges

Despite bullish price action, early signs of profit-taking have begun to surface. According to on-chain data, nearly 4 million BNB—valued at over $4.8 billion—have been transferred to exchanges within just 48 hours. This increase in exchange inflows often signals that short-term holders may be securing profits, potentially putting downward pressure on price momentum.

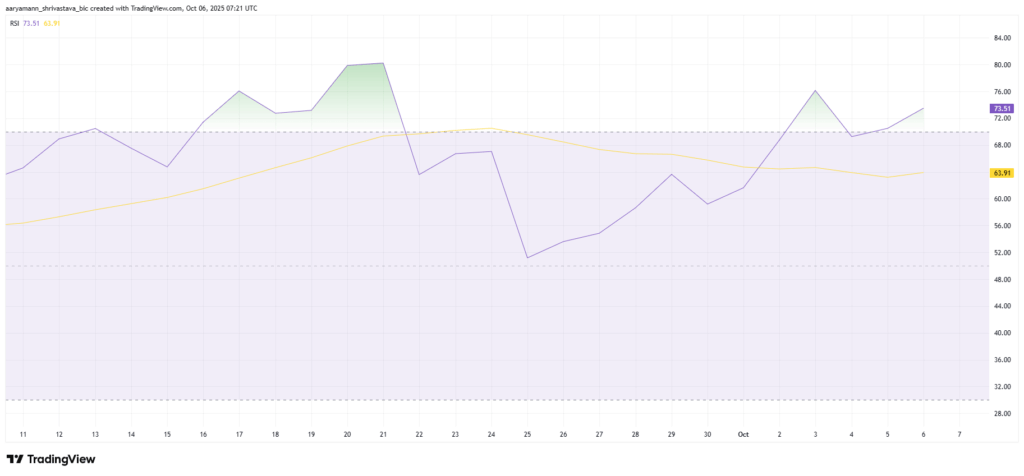

Technical indicators support this caution. The Relative Strength Index (RSI) recently crossed the 70.0 threshold, traditionally interpreted as an overbought zone. Historically, such levels precede short-term pullbacks or market consolidation phases.

Short-Term Correction Possible, Long-Term Trend Still Intact

While fundamentals surrounding BNB remain strong, these signals suggest a potential pause in bullish momentum. Should selling pressure intensify, BNB could revisit key support levels near $1,147, or in more extreme cases, dip to $1,046. That said, investor sentiment remains largely positive, especially given the token’s rapid recovery from previous dips.

At the time of writing, BNB trades around $1,209. A sustained move above the $1,223 resistance could open the door to a fresh leg up toward $1,300. As long as macro conditions and user demand stay favorable, BNB’s long-term uptrend remains structurally intact.

Comments are closed.