Bitcoin’s Q4 Breakdown: Hidden Forces Behind the Latest Decline

With a 2.03% decline over the previous day, Bitcoin (BTC) maintained its erratic trend today. Traders are worried about the asset’s decline. Nevertheless, other analysts contend that possible price manipulation is to blame for Bitcoin’s success. They point to institutional engagement and a recurrent pattern of reductions around the entry of the US market.

In Q4, which has historically been a great time for the asset, BTC has defied all bullish expectations. Although it initially accounted for a large portion of the decrease, the October 10 market crisis was a significant contributor to Bitcoin’s decline at the beginning of the quarter. However, observers of the market are now wondering if this vulnerability will continue.

BTC Drops to $90K as Market Ignores Positive News: What’s Going On?

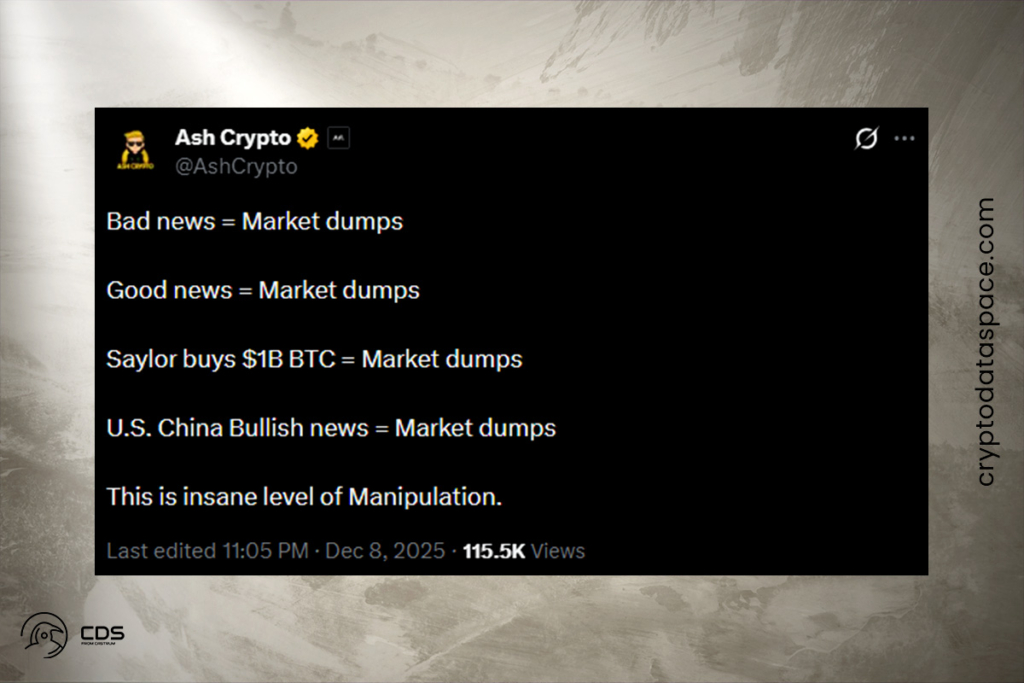

Bitcoin’s slow market response has disappointed traders. Yesterday, Strategy bought 10,624 BTC for $962.7 million. Despite this encouraging news, Bitcoin is down again today at $90,200. Conversely, negative events cause the same sell tendency. Analyst Ash Crypto noted that the market is acting erratically and not responding to positive events. Ash argued in another post that Bitcoin’s drop from $126,000 to $80,000 was not a market correction. US equities rose 8%, with many stocks setting new records. However, Bitcoin is 29% below its pre-crash level, and short-term rallies have been heavily sold. Forced selling is indicated by $500 million liquidations every other day.

If it was just a leverage it should have been a very short term and the market should have bounced pretty fast but instead we kept dumping without any major bounce. This is not normal. This looks like a few big institutions are playing with the market and liquidating both longs and shorts. Another rumor in town is that many big funds blew up on October 10th and they are selling BTC to cover their losses,

Ash

Is One Major Player Manipulating Bitcoin? Analysts Point to Jane Street

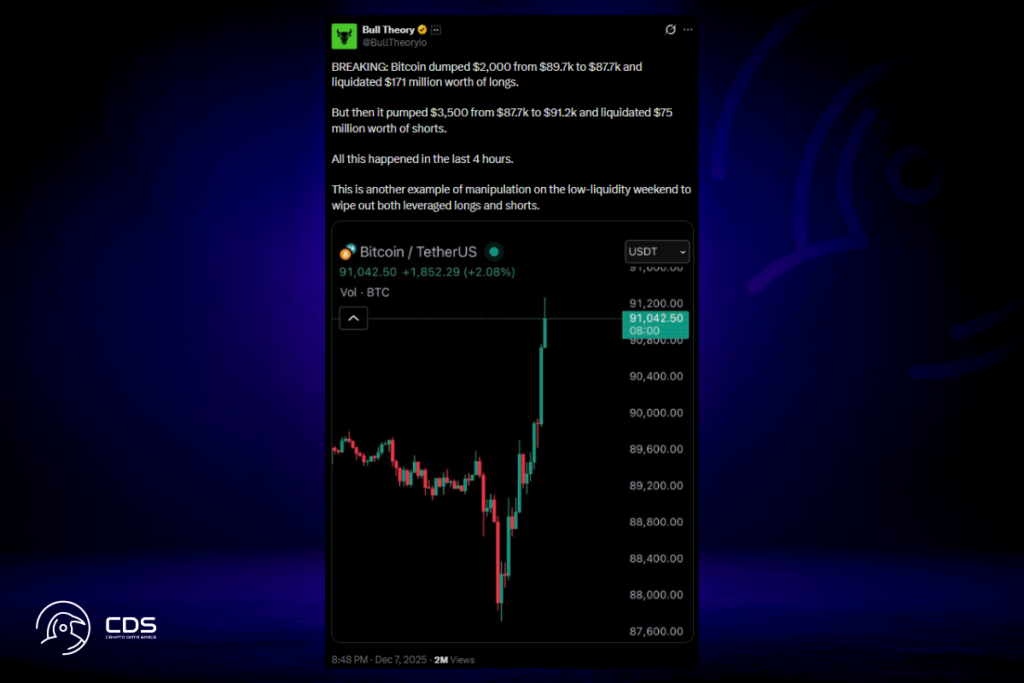

Additionally, Bitcoin‘s price movement over the weekend was cited by another analyst as proof of the most recent manipulation. According to the report, the cryptocurrency momentarily dropped from roughly $89,700 to $87,700. This led to lengthy liquidations totaling roughly $171 million. The move abruptly reversed within hours, wiping away a further $75 million in short positions as Bitcoin surged to about $91,200.

This is another example of manipulation on the low-liquidity weekend to wipe out both leveraged longs and shorts,

Bull Theory

Interestingly, a distinct trend was also seen by the market analyst. After the US market starts at 10 a.m., Bitcoin frequently sees steep drops. Since early November, this trend has been apparent, and it reflects comparable activity seen earlier in the year. Instead of a haphazard reaction, the regularity points to a planned strategy. Jane Street, a significant high-frequency trading company, is suggested as a potential source by Bull Theory. According to reports, Jane Street has the fifth-largest stake in BlackRock’s IBIT ETF, with $2.5 billion.

When you look at the chart, the pattern is too consistent to ignore: a clean wipeout within an hour of the market opening followed by slow recovery. That’s classic high-frequency execution. This means most of the dump in BTC isn’t due to macro weakness but due to manipulation by one major entity,

the analysis

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.