Featured News Headlines

Post-Quantum Bitcoin: Developers Say Network Upgrades Won’t Happen Overnight

Post-Quantum Bitcoin – The debate over quantum computing and its potential impact on Bitcoin (BTC) is intensifying, but leading figures in the Bitcoin ecosystem say there is no immediate cause for alarm. According to Jameson Lopp, Bitcoin Core developer and co-founder of crypto custody firm Casa, migrating Bitcoin to post-quantum standards could take five to ten years, even though quantum computers do not pose a near-term threat.

No Immediate Threat, But Long-Term Planning Needed

Lopp echoed the views of Adam Back, CEO of Blockstream, stating that quantum computers are unlikely to break Bitcoin anytime soon. However, he emphasized that preparing for future risks is essential. In a post on X, Lopp explained that while the industry can continue monitoring quantum advancements, making careful protocol changes — along with a large-scale migration of funds — would be a slow and complex process.

He also noted that upgrading Bitcoin is far more difficult than updating centralized software. Bitcoin’s distributed consensus model means that any major change requires broad agreement across a global network of participants.

A Divided Bitcoin Community

The quantum debate has revealed a growing divide within the Bitcoin community. Bitcoin maximalists argue for caution, while venture capitalists (VCs) warn that the quantum threat is more urgent than many believe.

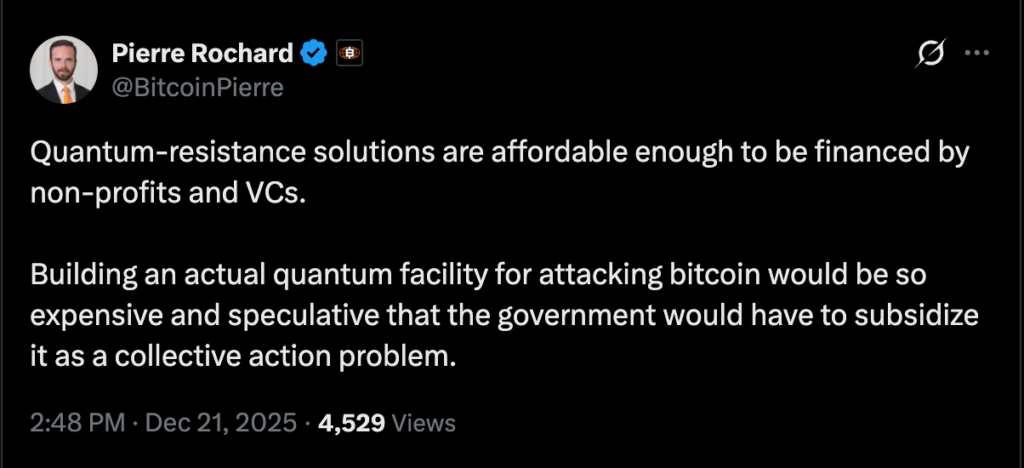

Bitcoin maximalist Pierre Rochard said that quantum-resistant solutions are financially feasible and could be supported by non-profits and VCs. He added that launching a quantum-based attack on Bitcoin would be so expensive that governments would likely need to subsidize it.

Skepticism and Market Concerns

Other industry leaders remain unconvinced about the practical capabilities of quantum machines. Samson Mow, CEO of JAN3, questioned whether quantum computers are even capable of factoring small numbers without major algorithmic customization.

Despite this skepticism, some investors believe market sentiment could be affected. Charles Edwards, founder of Capriole, warned that Bitcoin’s price could fall sharply if the network is not quantum-ready by 2028. He has urged node operators to consider enforcing Bitcoin Improvement Proposal (BIP) 360, which introduces a quantum-ready signature scheme.

As the discussion continues, Bitcoin’s approach appears focused on vigilance, preparation, and consensus — rather than rushed change.

Comments are closed.