Whale Holdings Dip, But Price Surges

Large Bitcoin holders — those with between 100 and 10,000 BTC — are quietly reshaping market dynamics. According to Santiment, this group now controls approximately 9.29 million BTC, or 47% of the circulating supply, valued at over $1.1 trillion across around 2,066 addresses.

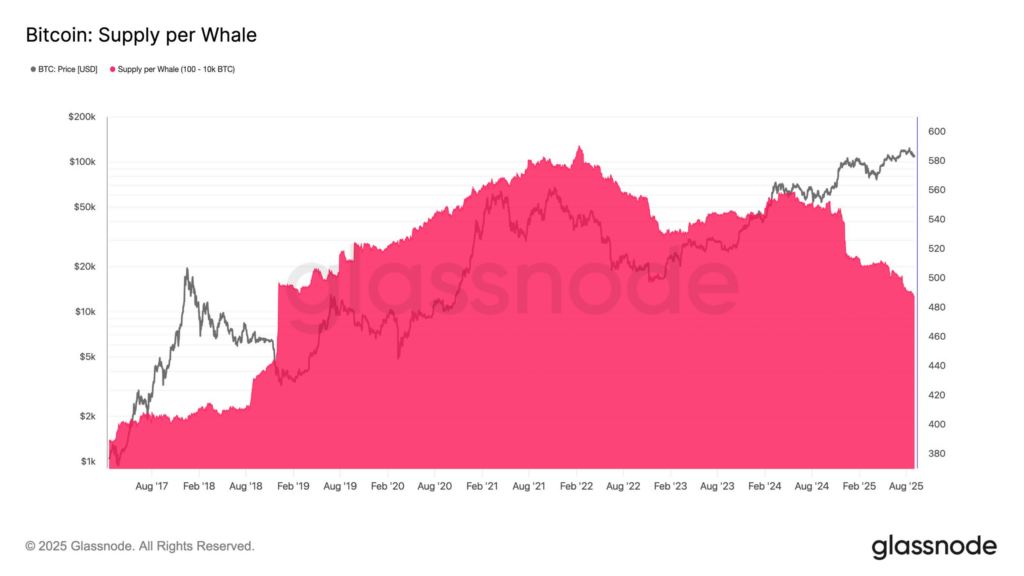

However, a key trend is emerging: the average balance per whale address is declining. As of September 2025, the supply per whale has dropped to 480 BTC, down from 560 BTC in 2024 and 590 in 2022 — levels not seen since 2018.

Unlike 2022, when the declining whale supply mirrored Bitcoin’s drop to $17K, the 2024-2025 period paints a contrasting picture. This time, the decline comes alongside aggressive price growth, suggesting an evolving market structure.

Declining Whale Supply Fuels Resilience

Bitcoin’s price peaked at $73,000 in March 2024, coinciding with a brief rise in whale holdings. Since then, whale balances dropped by about 12%, yet BTC surged 70%, reaching a new all-time high of $124,000 in 2025.

This inverse relationship — falling whale supply during a price rally — highlights increasing market absorption by smaller participants and a more distributed liquidity profile.

“This divergence could signal Bitcoin’s growing structural resilience,” analysts noted, emphasizing that sell-offs by large holders are no longer triggering extended bearish phases.

The drop in per-whale supply is increasingly viewed not as weakness but as a key liquidity event. It suggests greater decentralization and a market less reliant on a small number of large players — a structural evolution from earlier cycles like 2022.

Comments are closed.