Featured News Headlines

BTC Price Turbulence: Why Bitcoin Can’t Break the Volatility Loop

The crypto market appears to be locked in a persistent volatility feedback cycle, with Bitcoin (BTC) at the center of the turbulence. Price action has remained unusually erratic, amplifying concerns that another sharp correction could emerge if conditions worsen.

As one analyst put it, “The crypto market is stuck in a volatility feedback loop.”

Sharp Swings Highlight Fragile Market Structure

BTC’s recent movements underscore just how unstable the market has become. In a single four-hour candle, Bitcoin plunged from $89,000 to $87,000 before quickly reversing to $91,000. Such extreme swings in short timeframes have fueled speculation about an impending flush-out, especially given the lack of any convincing bottom formation.

Despite trading nearly 30% below its all-time high, Bitcoin’s bid-side liquidity has thinned considerably — a development that fits the current risk-off sentiment.

Net Losses Signal Renewed Capitulation Pressure

On-chain data reflects the market’s uneasy mood. Bitcoin’s Net Realized Profit/Loss metric has once again turned negative, showing that coins moving to exchanges are being sold at a loss. This dynamic typically emerges during periods of capitulation, when holders retreat in response to rising uncertainty.

Muted ETF inflows further reinforce the cautious stance. Even with the Coinbase Premium Index turning positive, investors remain hesitant, suggesting that BTC’s heightened volatility continues to keep the $90,000 level in jeopardy.

Lower Highs Keep Market Questioning Whale Intentions

Nearly two months after the October sell-off, Bitcoin still hasn’t reclaimed the six-figure threshold. On the daily timeframe, BTC has formed a sequence of lower highs — $80k, $83k, and $88k — each followed by brief rebounds. This pattern has strained leveraged traders the most.

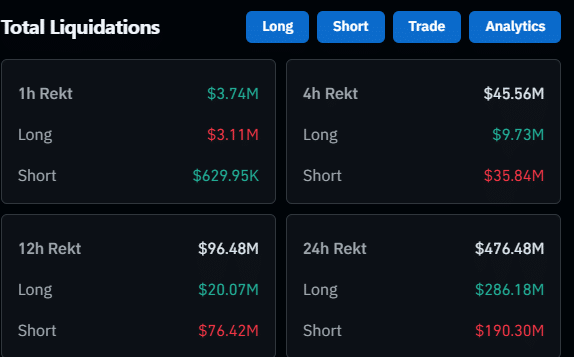

In one four-hour period, analysts observed $171 million in long liquidations and $71 million in short liquidations, prompting renewed discussion about whether large players are intentionally steering the market. The 24-hour liquidation total approached $500 million, a figure that highlights how brutal the recent swings have been.

Open Interest Drop Strengthens Deleveraging Narrative

BTC’s Open Interest (OI) supports the notion that the market is undergoing a deliberate deleveraging phase. OI has dropped by $30 billion since its October peak at $94 billion, aligning with the idea that “smart money” may be keeping price action trapped in a loop to flush out excessive leverage.

As one observation noted, “whale activity looks deliberate, turning the current Bitcoin price loop into a bear trap.”

Comments are closed.