Featured News Headlines

Bitcoin Under Pressure: Will $110K Hold Strong?

The price of bitcoin is still above $110,000. But in the latter week of September, it started to exhibit selling pressure. According to historical records, September has a “curse” that lasts for more than ten years. It has continuously been the year’s weakest month. This trend is threatening to recur as negative signals intensify with little over a week remaining.

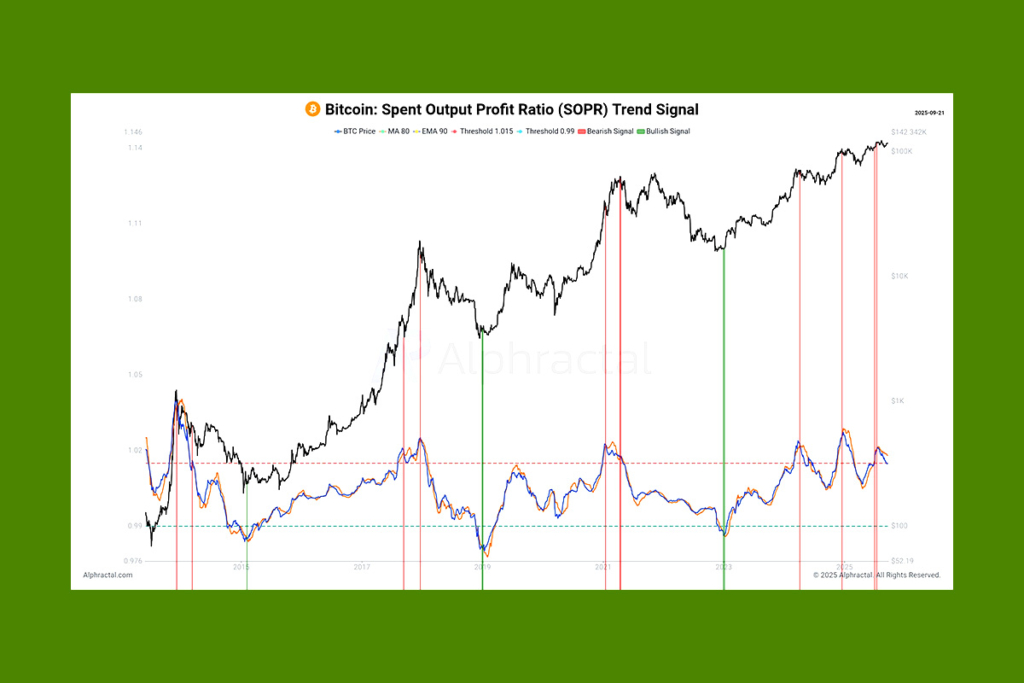

SOPR Trend Suggests Bitcoin Profitability Is Drying Up

Alphractal founder and analyst Joao Wedson noticed the negative flashing Spent Output Profit Ratio (SOPR) Trend Signal. The SOPR calculates the profitability or loss of Bitcoin transactions on the chain. Sellers are making money if the reading is greater than 1. Sellers are at a loss if the reading is less than 1. The SOPR is now moving lower, but is still over 1. This implies that on-chain transactions are becoming less profitable.

The SOPR Trend Signal is excellent at signaling when blockchain profitability is drying up. Never in Bitcoin’s history have investors accumulated BTC so late and at such high prices,

Wedson

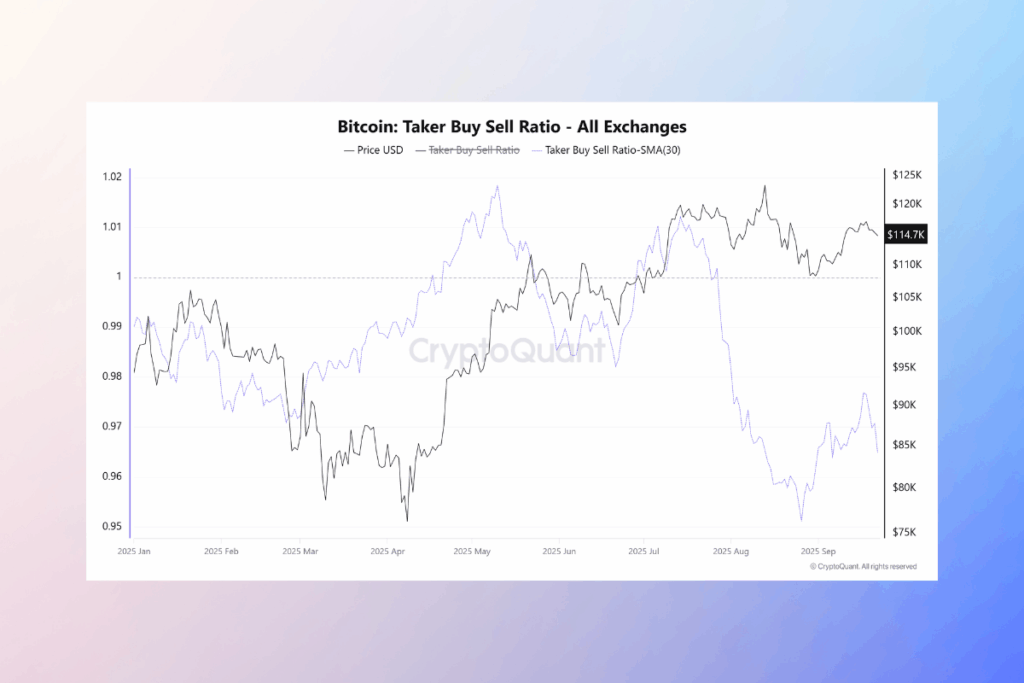

Bitcoin Faces Pressure as Taker Sell Volume Surpasses Buying Activity

According to data from CryptoQuant, in recent weeks, the taker buy/sell ratio on all exchanges has dropped below 1. This declining trend is likewise followed by the 30-day simple moving average (SMA30). This suggests that the volume of active selling (taker sell) is now greater than the volume of buying, indicating a pessimistic attitude among traders. In the past, Bitcoin has frequently experienced negative pressure when this ratio stays below 1, particularly when prices are already close to all-time highs. This indicates a clear waning of bullish momentum.

Bitcoin Taker Buy/Sell Ratio Falls Below 1, Hinting at Bearish Momentum

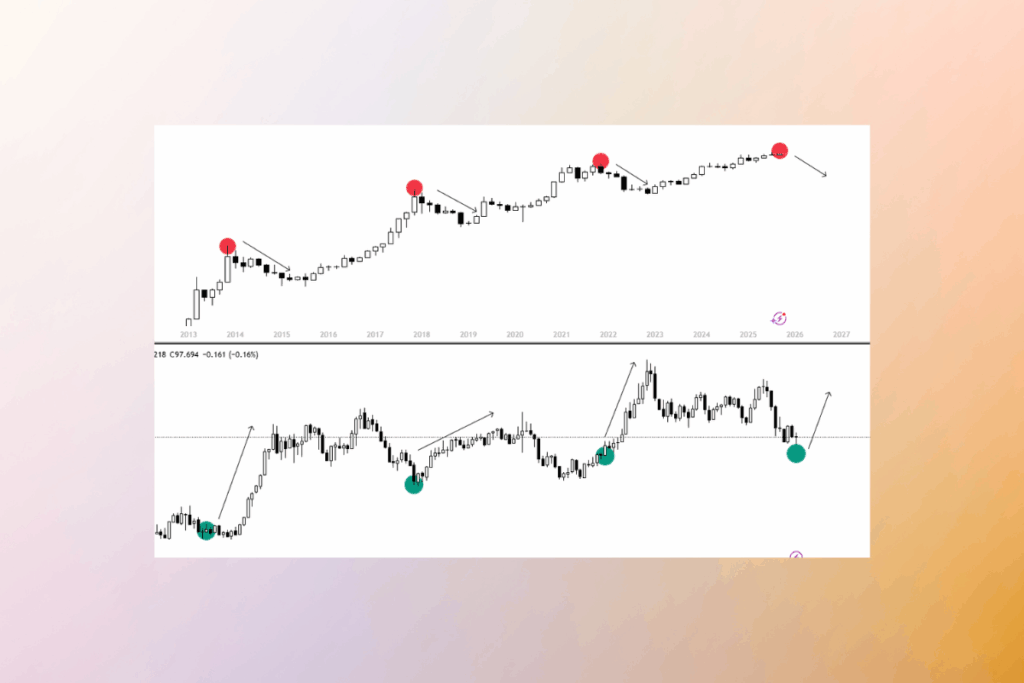

The US Dollar Index (DXY) has increased since the Federal Reserve recently lowered interest rates. From 96.2 to 97.8 points, it increased. There are downside risks to the price of Bitcoin, according to some analysts, as the inverse correlation between DXY and BTC can reappear. Bitcoin might revert, as it did in 2014, 2018, and 2021, if DXY keeps rising.

To sum up, the September curse of Bitcoin is strengthened by these three signals: on-chain, exchange-based, and macro. The last few days of the month might prove it if history is any indication.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.