BTC Price Dips, But Market Confidence Remains Firm

Bitcoin (BTC) has faced significant downward pressure since reaching $124,000 nearly three weeks ago. The asset recently bottomed at $107,270 before slightly recovering to $109,540, marking a 0.56% gain in the last 24 hours. However, it remains in a monthly downtrend of 3.74%.

Short-Term Holders Exit in Panic

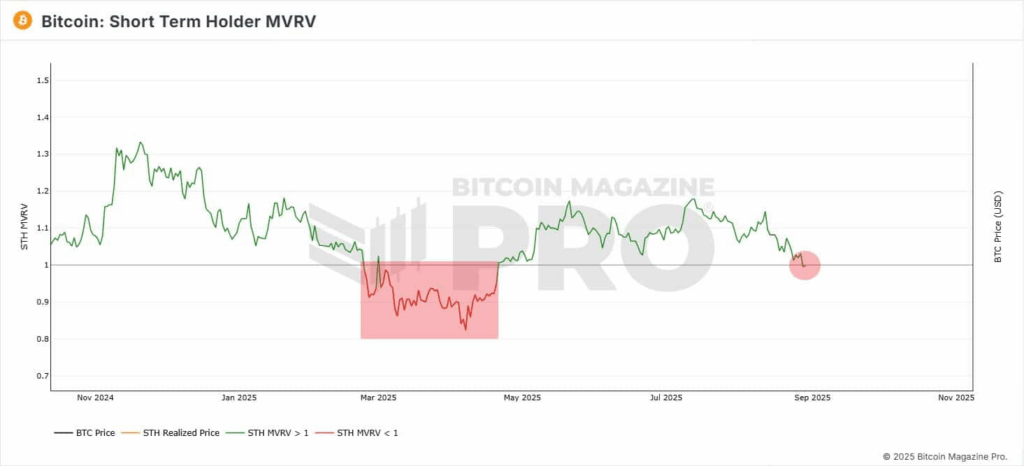

The recent dip triggered panic among short-term holders (STHs). According to analyst Burak Kesmeci, the STH MVRV ratio fell below 1 after staying profitable for 132 days — the first such drop since February, when BTC later plunged to $79K.

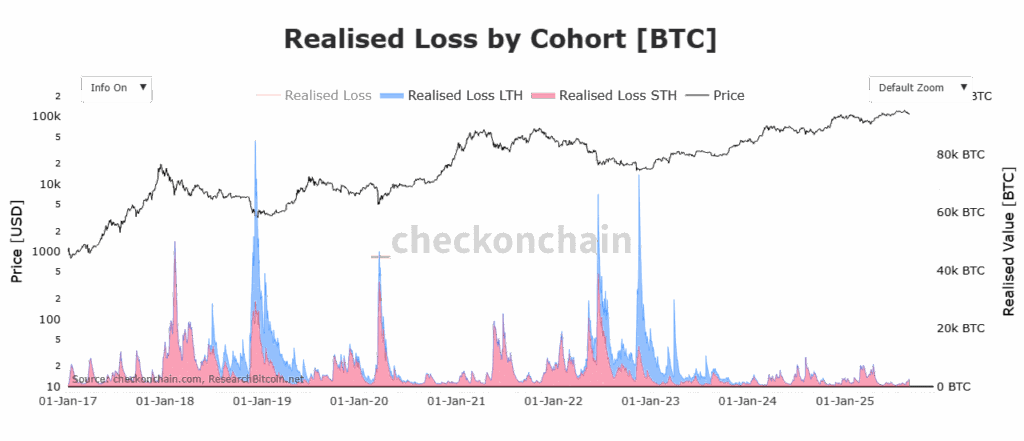

At the same time, STH Realized Losses surged, jumping from 623 BTC to over 2,600 BTC within two weeks. This kind of capitulation reflects fear-based selling and short-term pressure on the market.

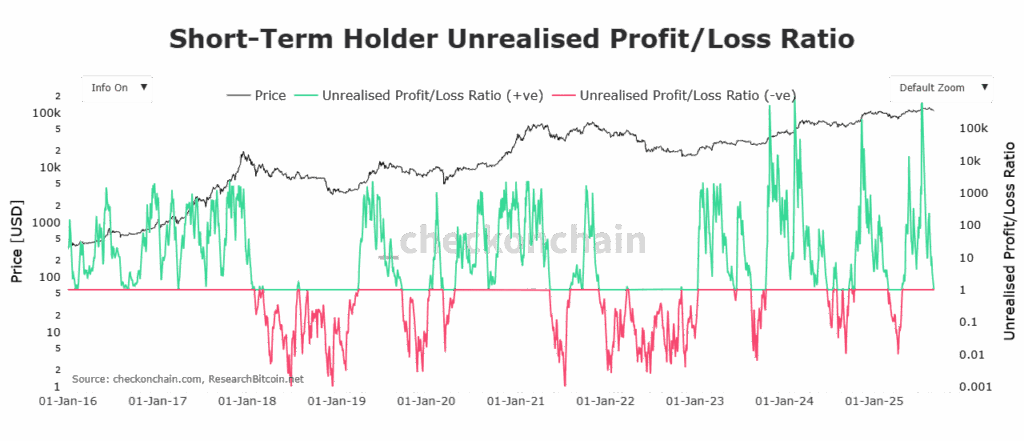

Interestingly, historical data suggests that large STH losses often occur near market bottoms, where “weak hands” exit and long-term players begin accumulating.

“High STH Realized Loss has historically preceded major rebounds,” analysts noted.

Long-Term Holders Remain Unshaken

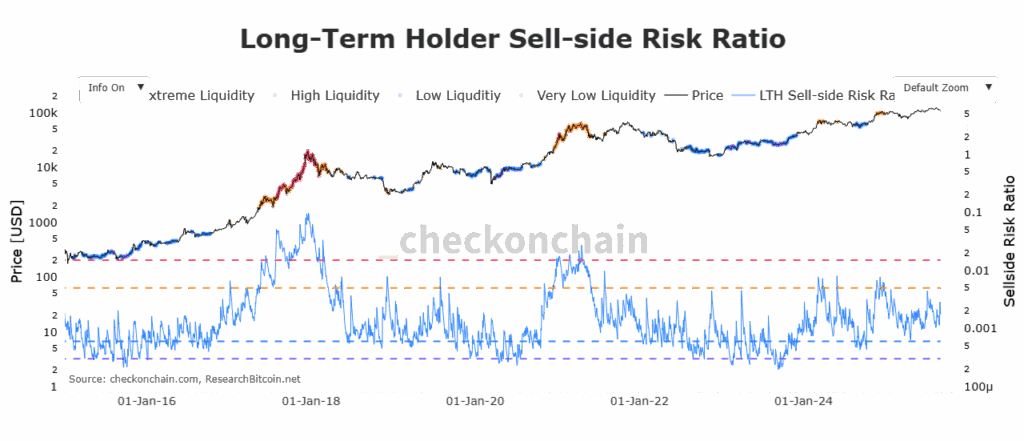

While short-term investors rushed to sell, Long-Term Holders (LTHs) remained steady. According to Checkonchain, LTH Sell-Side Risk has dropped significantly, currently sitting around 0.0017. This indicates strong market conviction, as LTHs are choosing to hold despite falling profit margins.

Data from AMBCrypto shows that the Seller Exhaustion Constant, which had dipped through August, is now beginning to rise — hinting that selling pressure from STHs may be fading.

Comments are closed.