Featured News Headlines

Grayscale Predicts Bitcoin May Break 2026 Highs Despite 32% Drop

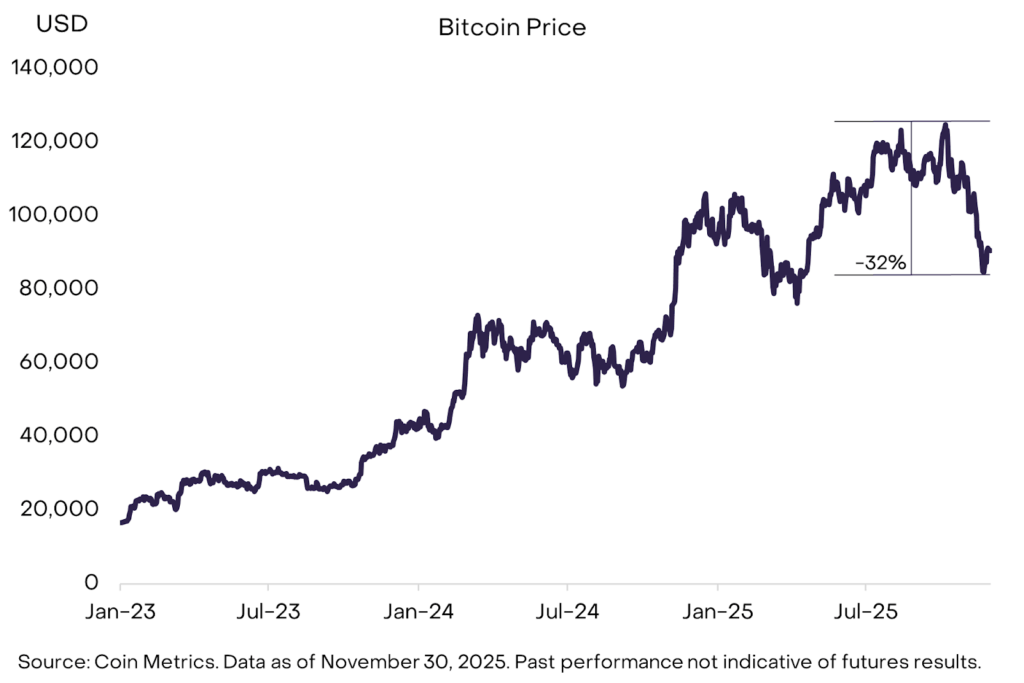

Bitcoin’s recent decline appears to be forming a bottom, with multiple indicators suggesting the cryptocurrency could break its traditional four-year halving cycle and reach new all-time highs in 2026. Despite a 32% pullback, asset manager Grayscale argues that the market downturn may represent a local bottom rather than an extended bear phase.

Option Markets Signal Extensive Downside Hedging

Bitcoin’s option skew has climbed above 4, indicating that investors have already positioned themselves heavily against further downside risk. In a research report released Monday, Grayscale challenged the conventional four-year cycle narrative that has historically governed Bitcoin’s price action. The firm stated: “Although the outlook is uncertain, we believe the four-year cycle thesis will prove to be incorrect, and that Bitcoin’s price will potentially make new highs next year.”

However, any near-term recovery remains contingent on reversals in several key flow indicators. Futures open interest, exchange-traded fund inflows, and selling pressure from long-term Bitcoin holders must stabilize before a sustained rally can materialize.

ETF Flows Begin Turning Positive After Brutal November

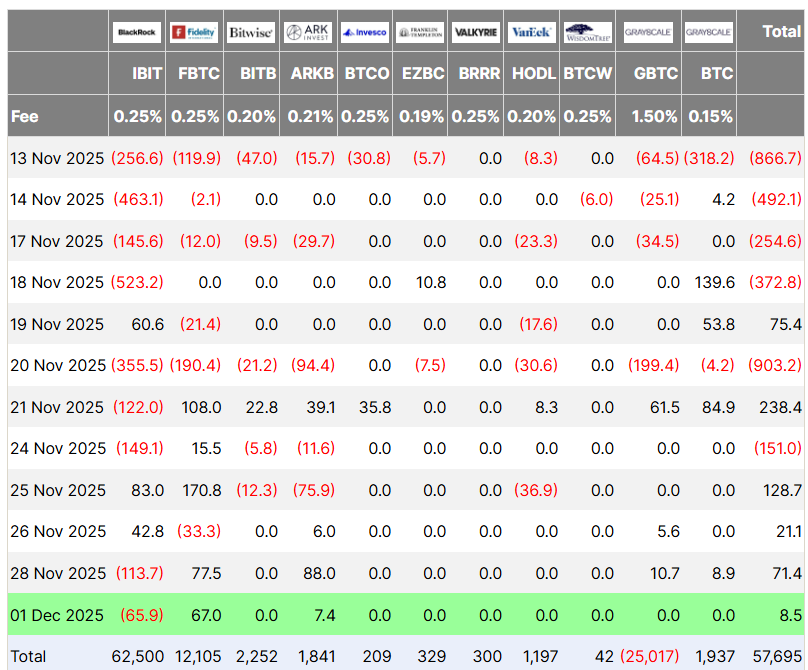

US spot Bitcoin ETFs, which drove much of the cryptocurrency’s momentum in 2025, created significant headwinds in November with $3.48 billion in net outflows—their second-worst month on record, according to Farside Investors data. Yet the tide appears to be shifting in recent sessions.

The funds have now logged four consecutive days of inflows, including a modest $8.5 million on Monday. While these numbers remain relatively small, they suggest buyer appetite is gradually returning after the selloff subsided.

Iliya Kalchev, dispatch analyst at digital asset platform Nexo, notes that current market positioning indicates a “leverage reset rather than a sentiment break.” The critical question, according to Kalchev, is whether Bitcoin can reclaim the low-$90,000s to avoid sliding toward mid-to-low-$80,000 support levels.

Federal Reserve Decision Looms as Major Catalyst

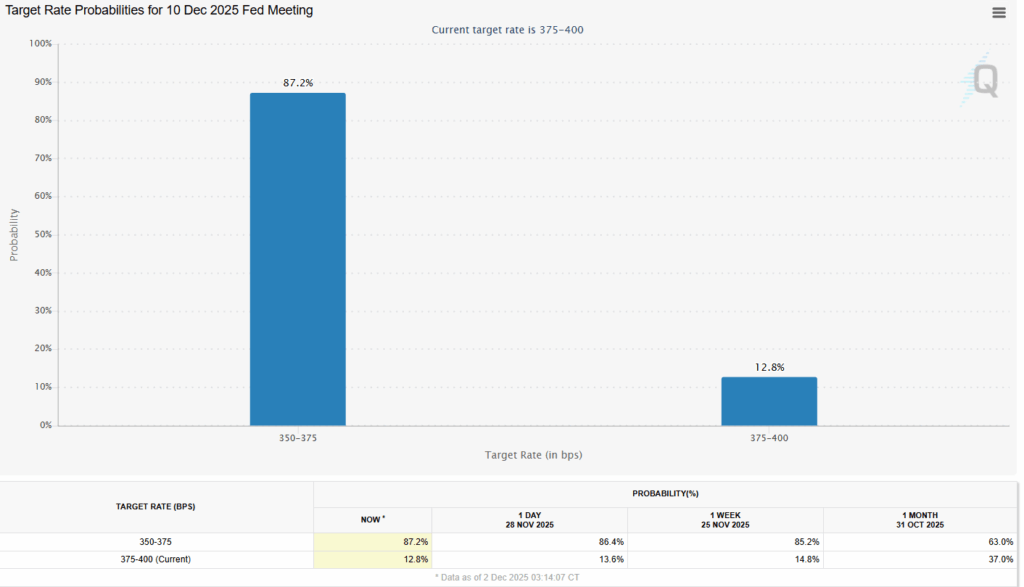

Market participants are now focused on what many consider the largest swing factor: the US Federal Reserve’s interest rate decision scheduled for December 10. The Fed’s policy guidance will serve as a significant catalyst for 2026 market performance, according to Grayscale’s analysis.

According to the CME Group’s FedWatch tool, markets are pricing in an 87% probability of a 25 basis point rate cut, up substantially from 63% a month earlier. Beyond monetary policy, Grayscale identifies potential progress on the Digital Asset Market Structure bill as another catalyst that could drive institutional investment into the crypto sector later in 2026.

Crypto Legislation Advances Through Congress

The legislative process effectively began with the CLARITY Act’s passage through the House of Representatives in July as part of Republicans’ “crypto week” agenda. Senate leaders have indicated plans to build on the House bill under the Responsible Financial Innovation Act framework, aiming to establish comprehensive regulatory guidelines for digital asset markets.

The bill currently sits under consideration in the Republican-led Senate Agriculture Committee and the Senate Banking Committee. Senate Banking Chair Tim Scott announced in November that the committee plans to have legislation ready for presidential signature by early 2026. However, Grayscale emphasizes that continued progress requires crypto to remain a bipartisan issue rather than becoming a partisan talking point during the midterm election cycle.

The convergence of accommodative monetary policy and clearer regulatory frameworks could create favorable conditions for Bitcoin’s next major move, though near-term price action will depend heavily on whether current support levels hold.

Comments are closed.